Platinum rallied strongly in the first two weeks of 2013 on bullish fundamental reasons, but the true catalyst for this week’s move up came on news of supply disruptions from Anglo American Platinum Ltd. (AMS.JO), the world's largest platinum producer which announced that it will suspend production at several mines in South Africa.

Closing the mines will cut platinum production by 400,000 ounces annually, according to some news reports. The company produces about 40% of the world's mined platinum. The troubles for platinum don’t stop there. The cutbacks will result in 14,000 job losses, or 3% of the country’s mineworkers, and a 20% drop in annual production.

Union leaders are already threatening new strikes, which brings to mind the violent strikes of last summer which resulted in about 50 deaths. On Thursday miners returned to work after an illegal walkout, but it’s difficult to predict how this will play out.

There are several fundamental factors influencing the platinum market. Analysts say that global platinum production as a whole is in a deficit; with some citing a supply deficit of 400,000 ounces in 2012, versus a 430,000 ounce surplus in 2011. This news comes in tandem with a forecast of a rebound in automotive sales. Platinum’s greatest industrial use is in auto catalysts, so the simple equation of tight supplies and higher demand underpins a strong fundamental outlook.

Platinum prices began to fall around a year ago in when demand dropped due to the poor economy. Then in August, prices picked up again due to the labor strikes in South Africa, which produces 75% of world platinum supply. As the labor disputes were resolved, prices drifted lower once more, until recently.

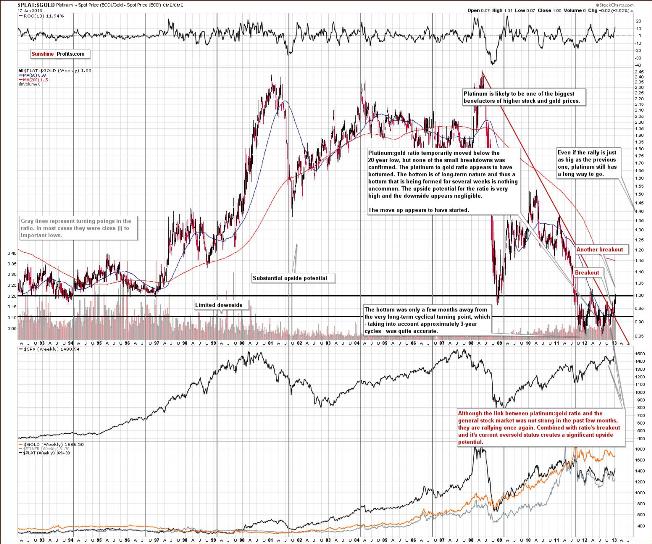

In the platinum to gold ratio chart, recent trading days have seen a post breakout rally triggered by supply issues in South Africa. Fundamental factors and news, however, don’t determine how much prices will rally in the short-term or if the rally should be followed by a correction or a big move to the upside, which seems to be the case today – technicals do.

An important technical development is the breakout above the declining long-term resistance line. This is something we have emphasized previously and will still have bullish implications next month since the price of platinum is still well below the long-term average relative to gold. It seems that platinum is undervalued and we feel it will outperform gold in the months ahead.

Summing up, the long-term outlook for gold remains positive. Long-term analysis shows patterns which are similar to those seen right after major bottoms (and one was just in). This has bullish implications. The platinum market seems poised to outperform gold in the coming months. With the yellow metal’s outlook being bullish for the medium-term, this makes platinum likely to rally strongly in the future. It still does not seem too late to take advantage of this.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Platinum To Outperform Gold In The Coming Months

Published 01/21/2013, 06:28 AM

Updated 05/14/2017, 06:45 AM

Platinum To Outperform Gold In The Coming Months

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.