Platinum is an essential metal for the automotive industry and is therefore seen as strongly correlating with the global demand for luxury goods and automobiles. However, platinum is not falling in value counterintuitively as demand for cars decreases. In this article, we will examine the correlation between demand for cars and platinum prices and propose some answers.

Industry Outlook

The automotive industry is one of the chief consumers of platinum, comprising around 40% of the market worldwide. The production of new vehicles, global economic conditions, and consumer preferences all heavily influence the demand for platinum in that industry.

Source: CME Group (NASDAQ:CME)

According to World Platinum Investment Council data, platinum demand in the automotive industry will grow over the coming years. In 2020, despite the impact of the COVID-19 pandemic on the industry, demand for platinum rose by 5%, to 2.72 million ounces (Moz).

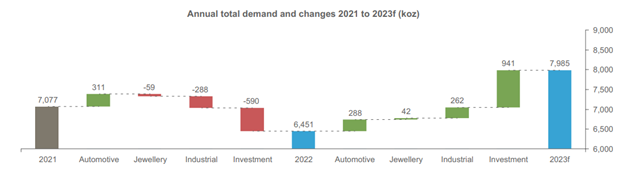

Having seen two years of significant surpluses, the platinum market is expected to move to a material deficit in 2023. The transition from the 776 thousand ounce (Koz) surplus in 2022 to the forecast 556 Koz deficit in 2023 will represent a 1300 Koz drop in supply. This reflects the fact that mining and recycling supply remains close to the weak levels of 2022, with only a 3% (201 Koz) increase, while demand will grow by 24% (1534 Koz).

Supply and demand analysis

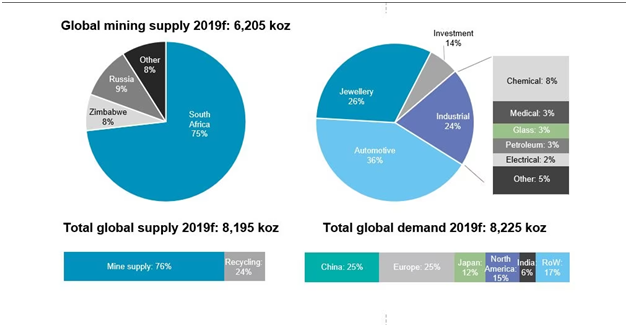

Three countries account for 90% of the world’s platinum production: South Africa, Russia, and Zimbabwe. Of these three, South Africa is by far the world’s largest producer, supplying 75% of the world’s platinum.

Source: WPIC, SFA (Oxford)

Supply pressures

South Africa is in the midst of an energy crisis, and power cuts are certain to affect mining operations, thereby disrupting the global supply of platinum.

The ongoing war in Ukraine and the implied sanctions on Russia have put some pressure on the supply side.

Demand pressures

Increased production of hybrid vehicles, which require less platinum in their catalytic converters than traditional gasoline vehicles do, has impacted demand for platinum in cars. Demand growth for the metal in the automotive industry has increased less in 2022 than the previous year, despite the economy reopening. As more hybrid cars enter the automobile market, this tendency will continue. It may be counteracted by creating hybrid cars that run on diesel, which would require the same amount of platinum as traditional gasoline cars do to keep CO2 emissions low.

China, Japan, and the US are the world’s largest platinum consumers, as well as the world’s largest automobile buyers. This fact alone indicates a strong correlation between demand for automobiles and platinum, and hence their prices. As the US enters a recession, demand for cars and platinum will continue to sink.

Commodity and technical price analysis

Demand for platinum as an investment metal increased by 12% in 2022 amid possible US and EU recessions and global economic uncertainty. Investment demand became the most significant reason to buy the metal.

Source: Metals Focus

FBS does not expect this demand to last through 2023. As economies contract, leading industrial and car demand to decrease, investors will stop perceiving platinum as a safer haven than gold or silver. A negative supply/demand balance is bullish for the price, but this momentum won’t last long. Interest in the metal will drop through 2023 and 2024.

On a smaller timeframe, we see a fake breakout and a liquidity collection near $1100. The price may slide lower as it breaks below the trendline.

Looking up close, we see an enormous flag that would normally be a bullish pattern. Here, it’s not finished. The worst for the metal is yet to come, with the $830 price point as a conservative target. Any further decisions should be made based on reactions at this level.

Summary

Platinum demand is under heavy pressure due to falling demand for cars and increased production of hybrid vehicles. The only thing that can keep platinum alive is investment demand. Demand is expected to slow further amid the recession and the energy crisis in South Africa. If the metal fails to rise in times of higher demand, we expect a further price decline will be more probable.

***

FBS is an international brand present in over 150 countries. Independent companies united by the FBS brand are devoted to their clients and offer them opportunities to trade Margin FX and CFDs.

FBS Markets Inc. – license IFSC/000102/310

Tradestone Ltd. – CySEC license number 331/17, FCA temporary permit 808276

Intelligent Financial Markets Pty Ltd – ASIC Licence number 426359