Here’s What Happened

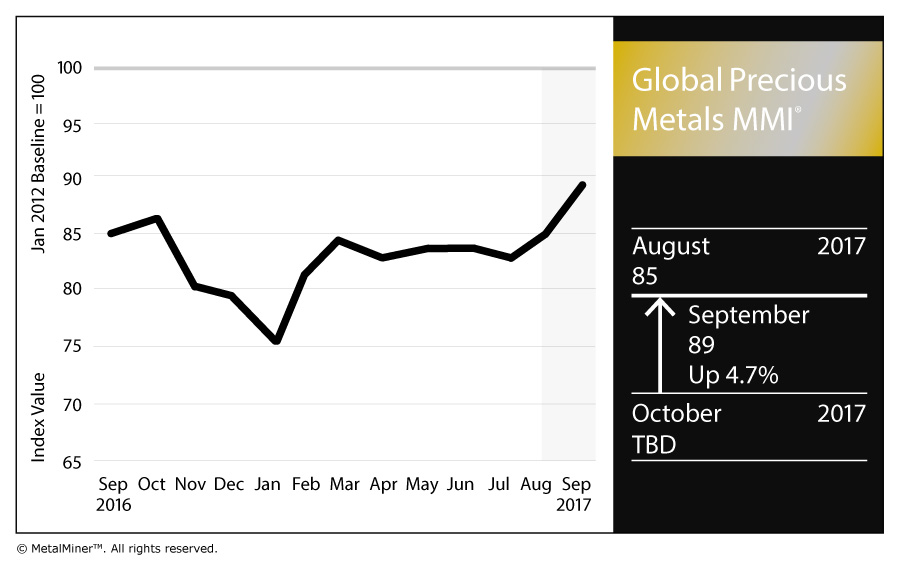

- MetalMiner’s Global Precious MMI, tracking a basket of precious metals from across the globe, tore itself away from a one-month downward trend to rise 4.7% for a reading of 89. That value was up from 85 at the beginning of August.

- Palladium continues its steady yet undeniable march upward. The platinum-group metal (PGM) crushed it with yet another recent high, ending up above the $900 per ounce level as of Sept. 1. As of this writing, palladium is holding on to that increase, still hovering near that level.

- Platinum is no slouch either, creeping upward even closer to its recent high of March 2017, when it landed above $1,000 per ounce.

- The U.S. gold price broke and held above the $1,300 per ounce threshold at the beginning of the month for the first time since October 2016.

Two-Month Trial: Metal Buying Outlook

What’s Going On in the Background?

- Unless you’ve been living in a cave, you would’ve been hard-pressed to miss the hurricane and tropical storm news of the past couple weeks. No sooner did Hurricane Harvey slam into the Texas Gulf Coast region, Hurricane Irma made her way up into the center of Florida soon after.

- Aside from natural disasters, other price drivers, such as political uncertainty surrounding North Korea and the U.S. Congress’ tussle over how to deal with the debt ceiling and potential government shutdown, certainly have taken their toll on investor sentiment.

What Metal Buyers Should Look Out For

- How will the recent storm disasters affect precious metals prices? It could hit gold and silver refiners especially hard, as South Florida is home to one of the biggest precious refiners in the country and is also a hub for “assaying, refining, logistics and financing operations,” according to this article citing, ultimately, reporting done by the Miami Herald. If you’re in the market for those two metals, keeping an eye on the short-to-medium term aftermath of Hurricane Irma looks to be crucial.

- As for the PGMs, platinum prices may turn around to the downside soon, if the recent outlook of the World Platinum Investment Council (WPIC) is to be believed. The WPIC foresees a stalling of supply out of South Africa for the balance of 2017, while demand will equally stall, according to the council. In terms of palladium’s future, analysts at Commerzbank (DE:CBKG) told DigitalLook:

The metal used by the auto industry in emissions-controlling catalytic converters was benefiting from strong Chinese car sales data but that sales there are likely to weaken.

- Of course, vehicle replacement in Texas and Florida post-hurricanes could do their part to support platinum and palladium prices.

by Taras Berezowsky