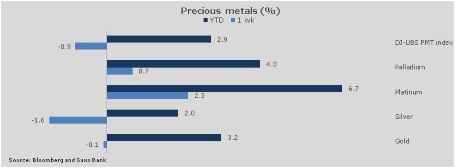

Despite a few wobbles over the past 48 hours, precious metals is still the best performing sector so far this year. This positive performance has come after strong rallies in palladium and platinum with the latter getting an extra boost from supply concerns over strike action by miners in South Africa.

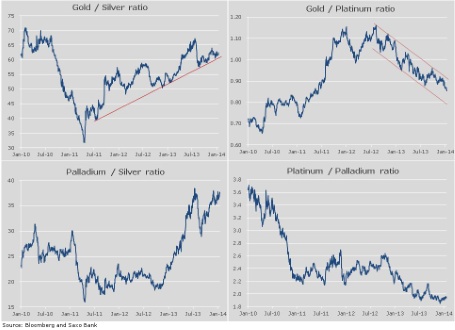

Gold/platinum ratio: Taking a different look at these metals through the ratios we can see how the differences in performance have played out. The much-followed and also traded ratio between gold and platinum has gone from a gold premium of 15 percent in August 2012 to a current discount of the same magnitude. The current momentum on that ratio looks solidly in favour of platinum both from a technical and a fundamental perspective. However, after having rallied by more than 12 percent since December 19, platinum failed to break the double top at USD 1481/oz. This failure came despite the threat of another disruption to supply after the strike notice that was issued to the three main platinum mining companies in South Africa — the world's largest producer. This could indicate some near-term buyer fatigue, not least due to the general retracement in the metals sector over the past couple of days. However, any relative weakness in platinum still looks like a good entry point into the ratio considering the diverging prospect now being expected for the two metals.

Gold/silver ratio: This ratio, which reflects the price of one ounce of gold measured in ounces of silver, has traded in a 60.5 to 64 range for the past three months. This is above the five-year average at 57.25. Despite the expectations of a pick-up in global growth and demand, silver has so far failed to benefit from this, and the uptrend remains intact. Short-term momentum indicators on this ratio currently favours gold over silver, and it will require a break of the uptrend from 2011, which is now at 60.5 to tip the focus back onto silver.