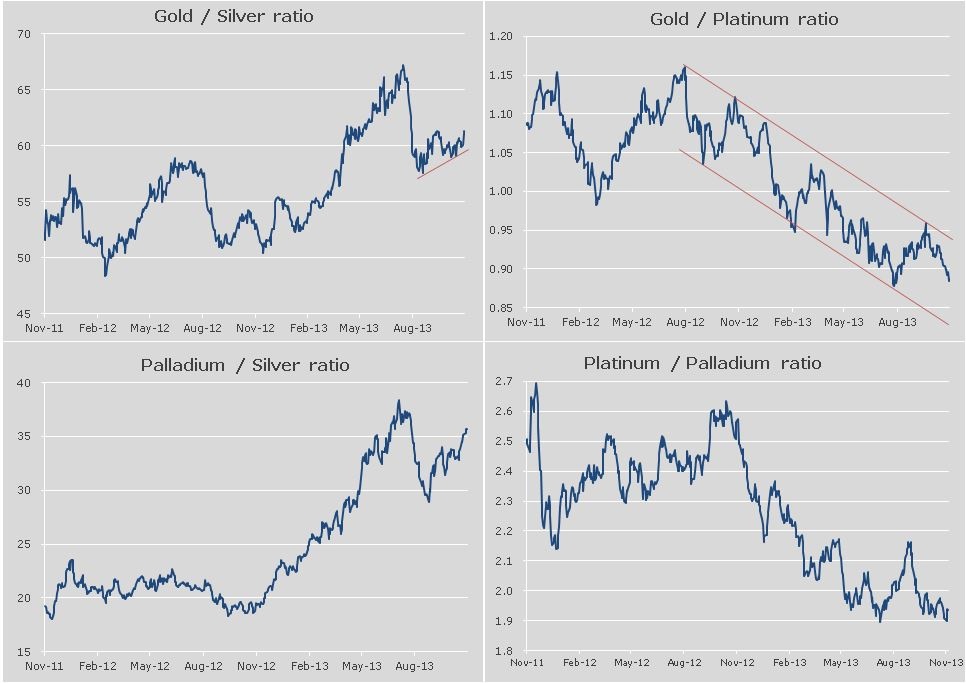

Precious metals are back on taper-watch which has put prices under pressure once again, while platinum group metals (PGMs) have done better, both in relative but also absolute terms. Over the past month we have seen platinum at +4.8 percent and palladium at +4 percent, placing them amongst the top three performing commodities overall. Meanwhile, gold is unchanged and silver is down by almost 3 percent.

Gold still under pressure

Gold has been under pressure since the stronger-than-expected US GDP and job reports last week. Meanwhile, silver has done even worse, resultingd in a return to the October low at USD 20.50/oz. A break through this level could signal a potential move down to the 19.25 to 19.50 area of support and would further support the current outperformance of gold over silver, as seen above. The sell-off in gold has up until now not shown any signs of accelerating despite the headwind that rising bond yields and taper talk creates for the attractiveness of metals as an alternative investment. It gives a clear indication that most, if not all, of the distressed selling - triggered by the need to reduce exposure earlier this year - is now over.

So while there are no clear triggers at the moment to support the upside potential, selling seems to have been relatively subdued with flows into Exchange Traded Products actually showing a small uptick during the past week. For now though momentum is negative with no clear signs of changing just yet. So on that basis, new established shorts have so far no reason to worry too much unless we start to break the previous day's high which is USD 1,286/oz for gold and USD 21.40/oz for silver.

Platinum - best performing metal

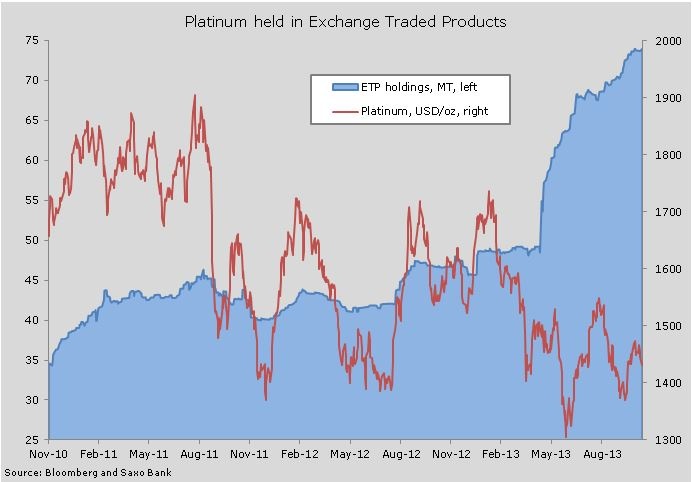

Platinum has been the best performing metal over the past month but on a wider scale palladium is trading close to the most expensive price ratio level in a decade. Strong investment demand as seen through holdings in exchange traded products ETPs), together with increased industrial demand, has lead to the biggest deficit for platinum since 1999, according to a report by Johnson Matthey, the specialty chemicals company and a leading specialist in PGMs. In this report another deficit for palladium is seen, but that would shrink as consumption is expected to fall faster than supply.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Platinum Heads Metals Leaderboard

Published 11/13/2013, 06:57 AM

Updated 03/19/2019, 04:00 AM

Platinum Heads Metals Leaderboard

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.