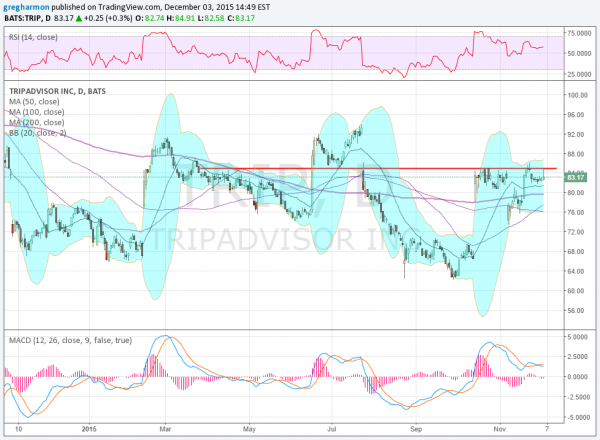

TripAdvisor Inc (O:TRIP), has had a rather uneventful 2015. The stock has basically moved in a broad channel from 64 to 92 all year with a good portion of the time between 80 and 85. The broad market was like this as well. Boring right? Maybe not so.

If you get deep into the weeds the stock has held up tremendously well over the last two days with the broad market selling off. This got me interested in looking at the chart more closely. As the market has lost 3%, TripAdvisor is actually up.

The stock is holding under resistance at 85 with momentum in the bullish range. The RSI is making higher lows and turning up, while the MACD is flat after a pullback. A move over 85 would look for continuation to the top of the range at 92. Failure here and a push below 81 looks like a drop to 73 or even into the gap. That is $10 to the upside from here, and $9 to the downside.

If there were just some potential catalyst to start it one way or the other. Oh yeah, the Non farm payroll report tomorrow and the FOMC meeting the 16th could be that move. The at the money December 83 calls are going for about $2 as a good defined risk trade to the upside. The puts are similar for that downside trade. If you think either of these could move the stock to the ends of the range but don’t know which way then a December 83 Straddle (about $4.00) allows you to participate either way.

DISLCAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.