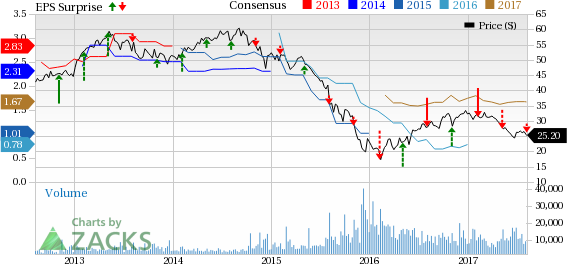

Plains All American Pipeline, L.P. (NYSE:PAA) reported second-quarter 2017 adjusted earnings of 21 cents per unit, missing the Zacks Consensus Estimate of 26 cents by 19.2%. The partnership reported loss of 20 cents per unit in the year-ago quarter.

Total Revenue

In the second quarter, the partnership reported total revenue of $ 6,078 million, which missed the Zacks Consensus Estimate of $6,318 million by 3.8%.

However, quarterly revenues were up 28.8% from $4,950 million in the year-ago quarter.

Operational Update

In the quarter under review, Plains All American’s total cost and expenses were $5,821 million, up 21.2% year over year from $4,804 million primarily due to higher purchases and related costs.

The partnership’s operating income increased 75.3% to $257 million from $146 million a year ago.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) came in at $451 million in the second quarter, down 4.9%. The Supply & Logistics segment was a major drag, dropping 172% year on year. This negative impact was partially offset by the higher contribution from Transportation (up 9%) and Facilities (up 12%).

Interest expenses increased 11.4% to $127 million from $114 million a year ago.

Financial Update

Current assets as of Jun 30 were $3,528 million, compared with $4,272 million as of Dec 31, 2016.

As of Jun 30, Plains All American had long-term debt of $10,040 million, compared with $10,124 million as of Dec 31, 2016. The total long-term debt-to-total book capitalization ratio at the end of the quarter, including short-term debt was 52%, down from 57% at the end of 2016.

Guidance

Plains All American revised 2017 full-year adjusted EBITDA guidance of $2,075 million from a prior adjusted guidance of $2,260 million.

The partnership revised 2017 expansion capital expenditure projection of $950 million from a prior projection of $900 million. Maintenance capital expenditure guidance of $210 million was revised from a prior guidance of $195 million.

Peer Performance

Among other players from the industry that have reported their second-quarter earnings, Archrock Partners, L.P. (NASDAQ:APLP) , Cone Midstream Partners LP (NYSE:CNNX) and Enbridge Energy, L.P. (NYSE:EEP) have surpassed the Zacks Consensus Estimate.

Zacks Rank

Plains All American currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Plains All American Pipeline, L.P. (PAA): Free Stock Analysis Report

Cone Midstream Partners LP (CNNX): Free Stock Analysis Report

Archrock Partners, L.P. (APLP): Free Stock Analysis Report

Enbridge Energy, L.P. (EEP): Free Stock Analysis Report

Original post