Plains All American Pipeline, L.P. (NYSE:PAA) provided its EBITDA guidance for full-year 2016 and distribution guidance for the third quarter, apart from disclosing a simplification of its capital structure.

Details of the Simplification

Plains All American and Plains AAP, L.P. have entered into an agreement, under which the former will let go its 2% general partner stake in the latter in exchange of the issuance of 245.5 million common shares by Plains All American and the assumption of all of Plain AAP’s liability. The deal is valued at $7.2 billion. Upon closing of the transaction, Plains AAP is entitled to a 34.8% ownership interest in Plains All American.

Plains AAP is an affiliate of Plains GP Holdings, L.P. (PAGP), a holding company of the master limited partnership, Plains All American Pipeline, which through its subsidiaries, is involved in the transportation, storage and marketing of crude oil and refined products.

Distribution Guidance

Subsequent to the cancellation of its distribution and incentive rights in Plains AAP, Plains All American announced a distribution of 55 cents per share for the third quarter of 2016, down 21% from the second-quarter distribution of 70 cents.

The step was taken to improve the partnership’s overall credit profile and better align its interests with those of its shareholders, including Plains GP Holdings.

EBITDA Outlook

Plains All American Pipeline also reaffirmed its 2016 adjusted EBITDA projection of $2.175 billion.

The partnership has been pursuing a non-core divestment strategy in order to generate proceeds that will help it focus better on its core operations. The partnership anticipates divestment proceeds in the range of $500–$600 million for 2016 and has closed asset sales worth $350 million year to date.

Zacks Rank

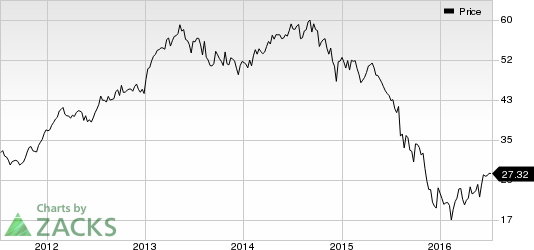

Plains All American currently carries a Zacks Rank #2 (Buy). Other favorably placed stocks in the Oil & Gas Production Pipeline space include CONE Midstream Partners LP (NYSE:CNNX) and Rose Rock Midstream, L.P. (NYSE:RRMS) , both sporting a Zacks Rank #1 (Strong Buy), and Enable Midstream Partners, LP (NYSE:ENBL) , with a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report >>

PLAINS ALL AMER (PAA): Free Stock Analysis Report

CONE MIDSTREAM (CNNX): Free Stock Analysis Report

ENABLE MIDSTRM (ENBL): Free Stock Analysis Report

ROSE ROCK MIDST (RRMS): Free Stock Analysis Report

Original post

Zacks Investment Research