With the Lyft (NASDAQ:LYFT) and Levi Strauss (NYSE:LEVI) initial public offerings behind us, 2019 is shaping up as the year of the big name IPO. Next up, social media player Pinterest whose S-1 filing was made public a week ago Friday. The company is expected to start trading in late April or early May. Here's what we learned from our first peek at the financials.

Based in San Francisco, Pinterest, a website and application dedicated to the sharing and discovery of ideas on creativity and aesthetics, launched in 2010. Unlike other image-sharing sites such as Facebook's (NASDAQ:FB) Instagram, users come to Pinterest to inspire themselves and others. As one of the company's founders has said, they utilize Pinterest as a "catalogue of ideas."

External reports suggest about 80% of users are women and approximately a third of the platform's U.S. users are millennials. In our view, Pinterest exists in enough of a niche to not be perceived as threatening to one of Facebook’s businesses. This is key. We’ve already seen what happens when companies like Snap (NYSE:SNAP) aim to compete directly with the juggernaut social media platform—they flounder helplessly or get completely crushed.

Though Pinterest's valuation and number of shares on offer are still unclear, it's expected the company will be valued at around $12 billion dollars. We’ll accept that figure for the purposes of this analysis. The pending ticker is PINS.

Users: Commendable Growth, But Slowing

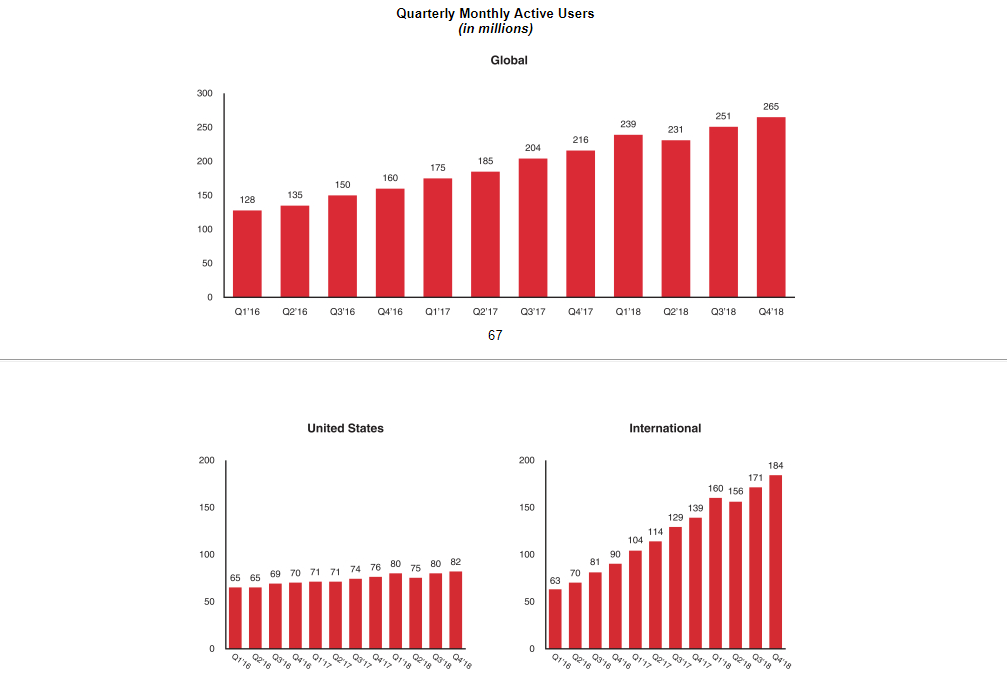

Every analysis of a high-growth, social media business must start with user growth. This is, after all, the metric that dictates the company's valuation.

Pinterest’s user growth over the past three years has been commendable, expanding from 128 million monthly users (MAUs) in Q1 2016 to 265 million MAUs in Q4 2018. However, over the past year, the trajectory seems to have slowed. Year-over-year, user growth fell from 36.5% in Q1 2018 to 22% in Q4 2018. Still, global growth remains strong. Nonetheless any pressure on this critical metric is always a major point of concern.

Another cause for concern: virtually all Pinterest’s user growth has come from outside the U.S. User growth in its home country has been less than stellar, growing only 7.9% last year, from 76 million MAUs in Q4 2017 to 82 million in Q4 2018. This is no small matter, monetizing an international user base is more difficult.

Business: Ideal Targeted Ad Environment; Limited U.S. Expansion

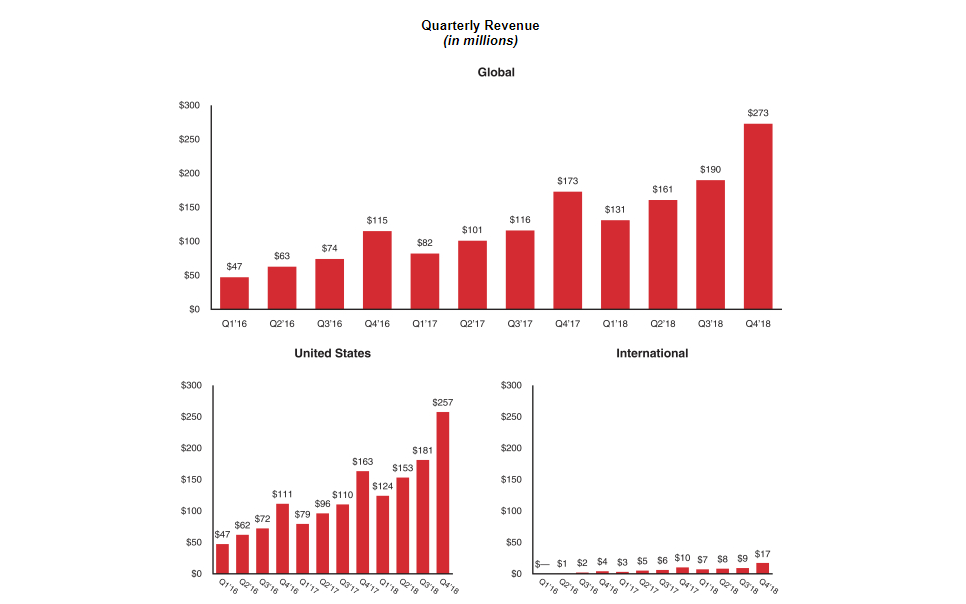

Like all other social media companies, Pinterest's revenues come from advertising. Since users pin interesting products on their inspiration boards, targeting is relatively simple for advertisers.

In 2018, revenues were $755 million, compared to $472 million in 2017, an impressive 60% jump. This was made possible by focused efforts on monetizing U.S. users. Indeed, a whopping 95% of Pinterest's 2018 revenues—or $715 million— came from the U.S.

To its credit, Pinterest has excelled at monetizing U.S. users. Over the past three years it has more than quadrupled its average revenue per user (ARPU), moving from $0.74 to $3.16. Unfortunately, as mentioned earlier, U.S. growth is slowing, limiting Pinterest's earnings potential going forward.

The limited revenue Pinterest brings in from its international segment ($40 million last year) isn't surprising. ARPU per international user is a low $0.25. In part, That's because Pinterest hasn’t prioritized monetizing its international user base, but also because garnering revenue from European, Asian, and African users is more difficult and less profitable.

For comparison: Facebook sees approximately $35 in revenue from a U.S. user versus just $10 from those in Europe, $3 from Asia and only $2 from users in Africa. As well, the road to international monetization will be even more difficult for a smaller company such as Pinterest which means any user growth from these regions will likely not make any significant contributions to Pinterest’s bottom line, at least in the short-term.

Still, for a tech company heading toward an IPO, Pinterest’s bottom line isn't bad at all. The company lost $62 million last year, down from losses of $129 million and $181 million in 2017 and 2016, respectively. Lyft, the newest tech IPO, went public with an annual loss of $911 million. Indeed, Wall Street is known to be patient towards companies with red ink but growth potential.

Bottom Line

This is a tricky IPO to evaluate. Pinterest's current fundamentals are relatively good aside from user and revenue metrics. It will go public with a good chance of reaching $1 billion in revenue and turning profitable in 2019, its first year of trade, quite a rare thing for tech IPOs. For that reason, a $12 billion valuation seems appropriate.

However, based on its fundamentals Pinterest isn't a steal. Nevertheless, it's certainly not as overpriced as many tech IPOs are.

Still, its growth prospects are problematic. Though it's progressing well outside the U.S., domestic expansion will continue to be one of the critical earnings drivers in coming years. Pinterest's biggest challenge going forward will like finding a way to effectively monetize its international user base.