PIMCO published a report on Spain ahead of the ECB's much-anticipated meeting this week. The analysts at the famed bond-management company expect a lackluster response that is more of a band-aid than the proverbial nuclear option. The first point the analysts make is that the firepower to buy bonds is limited if it comes through the bailout fund. The European Stability Mechanism (ESM), the permanent bailout fund, has lots of firepower, though it still does not officially exist. Until the German parliament approves the fund, which won't happen until mid-September, the 500 billion euros of capital it has will not be deployed.

The temporary bailout fund, the European Financial Stability Facility (EFSF), only has about 250 million euros remaining, according to the analysts. So, this amount of capital could be deployed to support ailing sovereign-debt markets by buying bonds on the secondary market, but it is not a large amount of money compared to the size of sovereign bond markets.

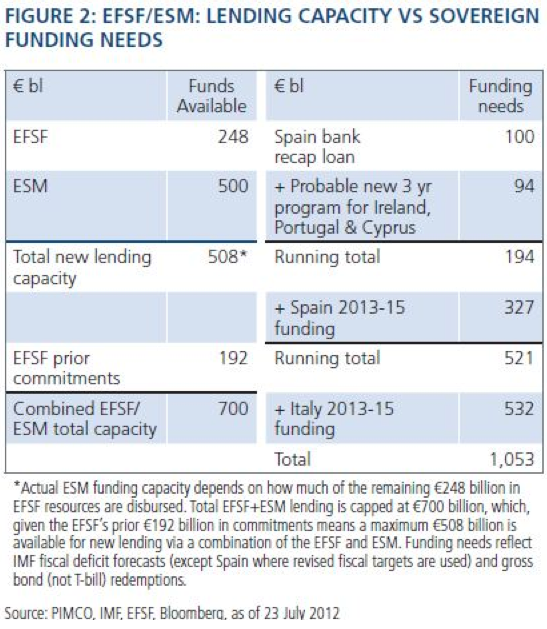

As the graph above details, it is a simple matter of math that the joint bailout funds are not big enough. Through 2015, the funds would need more than 1 trillion euros to support of markets and governments, much more than its current capacity of 700 billion euros. Thus, the thesis is that the ECB has to step up and assume a larger role, which has been discussed widely at Benzinga.

The belief is that an ideal strategy to preserve the currency union would be for the ECB to step in and use its balance sheet to purchase bonds, something it has opposed throughout the crisis. The ECB does have the Securities Market Program (SMP), which it uses to buy bonds to cap yields, however it's been inactive, now, for 20 weeks. PIMCO believes that the EFSF and the ESM should combine their bond-buying efforts in a move that could backstop losses on bonds purchased by the ECB, which would lessen fears of outright purchases at the ECB. Such a step would be a large one and would surely restore confidence to markets.

Sadly, this is not PIMCO's base case for the upcoming announcements. They write, "unfortunately, the political environment does not appear conducive to such a decisive policy response this summer. Key eurozone governments, such as Germany, want greater ceding of fiscal sovereignty first, a very difficult political task for the countries involved, and the ECB remains reluctant to provide direct funding to the EFSF/ESM." They note that rate cuts and further LTRO's are likely and potentially a small restart of the SMP, but nothing that is the so-called game-changer.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

PIMCO On Spain: It's Too Late To Act

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.