It has been more than a month since the last earnings report for Pilgrim's Pride Corporation (NASDAQ:PPC) . Shares have added about 17.9% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Second-Quarter 2017 Results

Pilgrim's Pride reported mixed second-quarter 2017 results.

Earnings: The company’s quarterly adjusted earnings of 93 cents per share surpassed the Zacks Consensus Estimate of 85 cents. The bottom line also came in higher than the year-ago tally of 58 cents per share.

Revenues: In the reported quarter, Pilgrim's Pride generated net revenue of $2251.6 million, up 11% year over year. However, the top line fell short of the Zacks Consensus Estimate of $2,271 million.

Revenues from the company's U.S. operations, which account for nearly 83.6% of the total revenue, climbed 12.2% year over year. Revenues from the Mexican business – 16.4% of the total revenue – were up 5.3% year over year.

Costs/Margins: Pilgrim's Pride's cost of sales in the reported quarter increased 4.8% year over year to $1,826.2 million. Gross margin contracted 480 basis points (bps) year over year to 18.9%.

Selling, general and administrative expenses advanced 24.5% year over year to $61.6 million. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) margin came in at 18.68%, expanding 473 bps year over year.

Balance Sheet/Cash Flow: Pilgrim's Pride exited the quarter with cash and cash equivalents of approximately $303.9 million, up from $120.3 million at the end of 2016. Long-term debt (net of current portion) was $1,404.3 million, as against $1,011.9 million as of Dec 25, 2016.

In the reported quarter, the company generated $316.1 million of cash from its operating activities, up 9.4% year over year. Capital spending totaled $174.2 million compared to $94 million incurred in the year-ago quarter.

Outlook: Pilgrim's Pride is well poised to boost its near-term profitability on the back of a well-balanced product portfolio. The company also believes that the advanced product offerings under the GNP Company’s brands would increase its market demand in the quarters ahead. Also, the capital investments programs are anticipated to generate benefits, moving ahead.

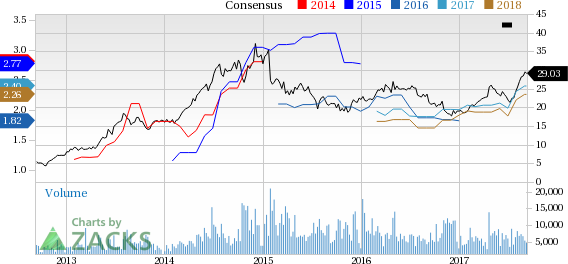

How Have Estimates Been Moving Since Then?

Analysts were quiet during the past month as none of them issued any earnings estimate revisions.

VGM Scores

At this time, Pilgrim's Pride's stock has an average Growth Score of C, though it is doing a lot better on the momentum front with a A. The stock was allocated a grade of A on the value side, putting it in the top 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for value and momentum investors than growth investors.

Outlook

The stock has a Zacks Rank #1 (Strong Buy). We are expecting an above average return from the stock in the next few months.

Pilgrim's Pride Corporation (PPC): Free Stock Analysis Report

Original post