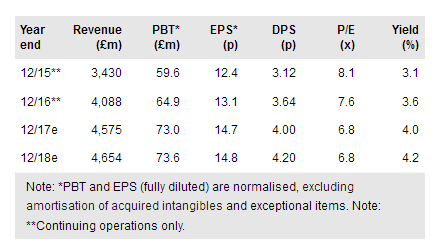

Lookers (LON:LOOK) issued a Q3 trading statement that reaffirmed management expectations for 2017. It also indicated the initiation of a share buyback programme, as in the absence of any immediate M&A opportunities the recent fall in the share price has made the returns compelling from such an allocation of capital. Clearly, new car sales in the UK are persistently lower year-on-year, with confidence declines among consumers and businesses taking their toll. However, the strength of higher-margin used car demand and aftermarket sales continue to deliver a positive mix. Overall, the rating appears undemanding and the yield attractive.

Robust used and after sales development

Unlike some of its peers, Lookers does not appear to be seeing any undue read across from weaker new car sales to its used car activities. In addition, the growth of service operations continues to reflect the growth in the overall UK vehicle parc driven by strong markets in recent years. SMMT figures showed continued sharp declines in new car and van sales in October as confidence continued to wane. However, Lookers continues to outperform the new car market and is still displaying strong growth in its higher-margin used and after sales businesses in H217, which between them account for almost two-thirds of gross profit,

To read the entire report Please click on the pdf File Below: