Today's Highlights- U.S.-China trade deadline: 10 days | Days to Brexit: 38

Please note: All data, figures & graphs are valid as of February 19th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Now that a shutdown has been successfully averted...

Sixteen states have already formed a coalition to ask the courts to block the President from proceeding and this battle could play out for some time to come. However, as the amount of money they're squabbling over is relatively small, this partisan bickering probably won't have much impact on the markets, short of any major breakthroughs or escalation.

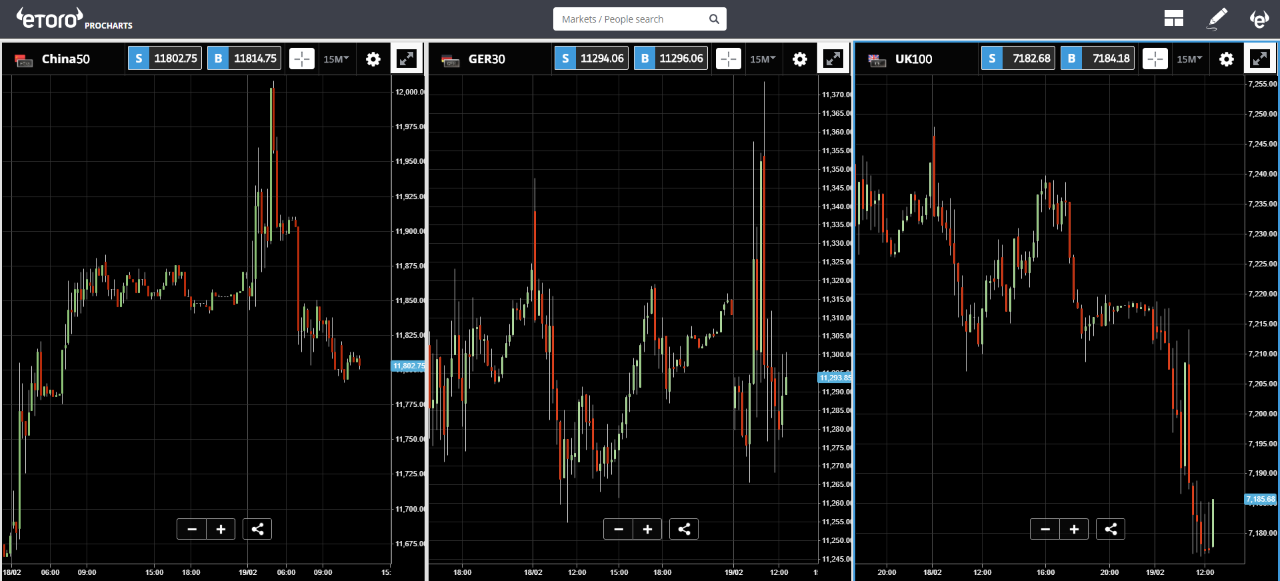

Markets were up earlier during the Asian session but by now they are decidedly down. Brexit concerns, U.S.-China Trade, and an apparent European slowdown are taking their toll, despite pledges from the central banks to prop them up.

The United States will come back from their long weekend today so the first few minutes after Wall Street rings the opening bell will be fairly significant.

Gold Surges

The shiny yellow metal has reached fresh highs this morning and is now at levels not seen since last April.

Precious metals such as Gold, Silver, Copper, and Platinum are increasingly being seen as a viable hedge against all the geopolitical tension mentioned above.

Crypto Optimism Continues

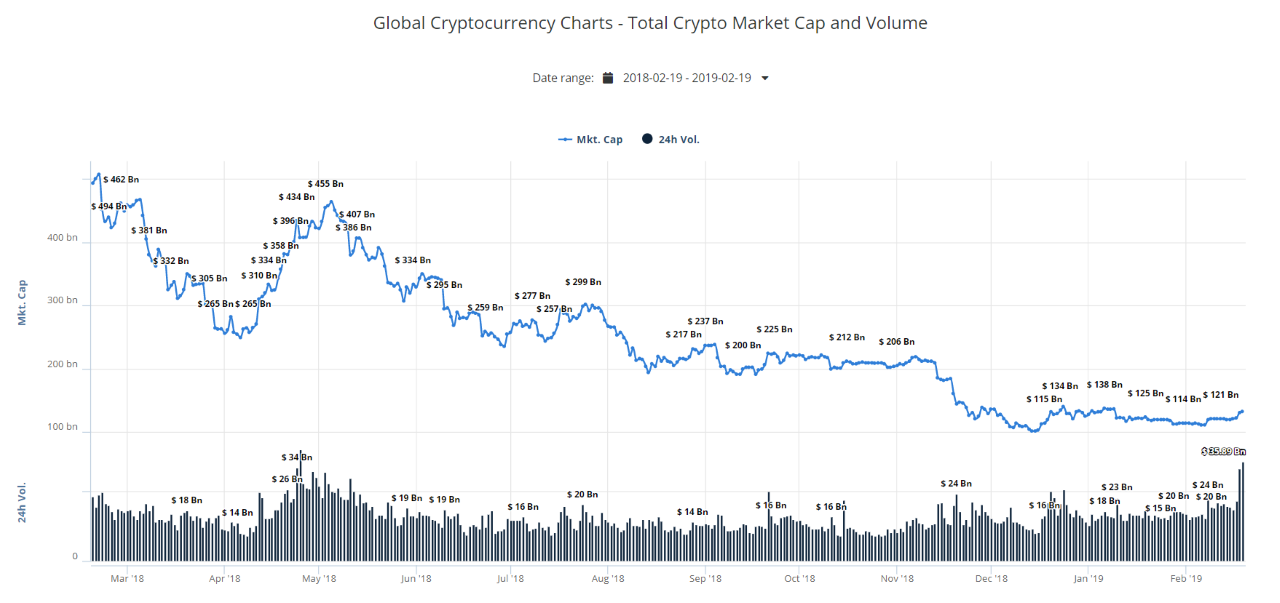

The crypto market is once again capturing the imagination of traders across the globe as volumes have now reached levels not seen since last April.

I had the chance to discuss some of the market drivers in an interview with CoinTelegraph yesterday.

One of the cool things is that the number one gainer over the last 24 hours is EOS. EOS is the number one coin in my portfolio, simply based on the token economics.

Though it's easy to get excited. Please remember that we're still very much in a bear market. So please trade with caution. Always remember to diversify your portfolio with other assets in order to keep your risk to a minimum.