Picton Property Income's (LON:PCTN) stated ambition is to be consistently one of the best performing diversified property companies on the main market and the H118 performance supports that goal with continued property outperformance versus its benchmark as it has done over one, three, five and 10 years. This property performance translated into a 7.1% NAV total return during the period including dividends that prospectively represent an attractive and well covered 4% dividend yield. Despite Brexit uncertainties, management expects a positive supply and demand balance in regional industrial and office markets to drive further market rental growth. Ongoing active asset management initiatives provide additional opportunities.

Good performance in H118

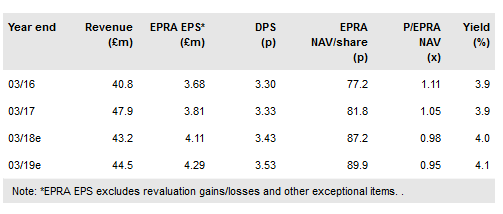

Picton continued to meet its objective of consistent performance during H118.A property return of 6.3% and income return of 2.9% both outperformed the MSCI IPD Quarterly Benchmark (5.0% and 2.2% respectively). IFRS net profit was £30.7m including a net £19.9m of gains on investments with NAV per share increased by 5% on end-FY17 to 86p. Including dividends paid of 1.7p, the NAV total return was 7.1% over the six-month period. The company intends to pay an increased annual dividend of 3.5p (+3%) commencing with a quarterly DPS of 0.875p to be paid in February 2018. Mainly tracking higher rent growth than forecast our EPRA EPS estimates are increased by c 4% for FY18 and 3% for FY19.

To read the entire report Please click on the pdf File Below: