Picton Property Income's (LON:PCTN) 25 July NAV update showed that asset management initiatives have continued to add value through a series of new and renewed leases, as well as two asset disposals at 37% above their March 2017 valuations. Like-for-like valuations in the office and industrial sectors, representing 75% of the portfolio, rose over 2% and earnings of £5.3m gave 1.16x dividend cover, also contributing to NAV gains. Management continues to execute the strategy of investing in and actively managing a regional property portfolio to provide rising income and increasing capital value.

NAV update

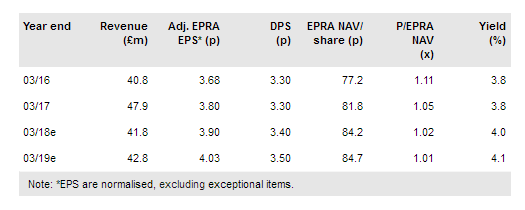

Picton’s announcement showed that NAV rose to £452.5m or 83.8p per share in the quarter to 30 June 2017 (31 March 2017: £441.9m and 81.8p), in part due to a 1.8% like-for-like revaluation gain on the portfolio, but also with increased dividend cover (116% from 106% at 31 March 2017) from higher earnings (£5.3m vs £4.9m). A 0.85p quarterly dividend was paid and another declared, equivalent to an annual dividend of 3.4p, a 4% yield on the current share price; the quarterly total NAV return was 3.4%. The rise in NAV helped reduce net LTV to 27.0% (March 2017: 27.4%) and £51m of funds remain undrawn from the two revolving credit facilities. Combined with proceeds from two recent disposals, these provide capital for meaningful further portfolio and earnings growth.

To read the entire report Please click on the pdf File Below: