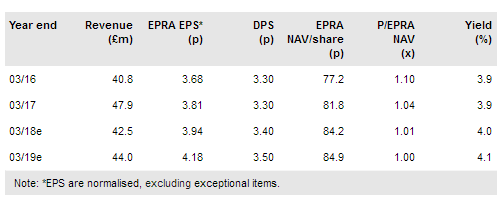

Picton Property Income’s (LON:PCTN) strategic objective is to grow both its asset base and income stream. It actively manages its portfolio and during FY17 and the early months of the current year completed the sale of £62m of non-core assets at prices above book value, reducing central London office exposure and reducing debt. The £23.15m acquisition of a Grade A office building in Bristol with significant potential from the letting of recently refurbished vacant space and rent reversion, meets the company’s strategic objectives and further rebalances the portfolio geographically. We have increased our EPRA EPS estimates by c 1% for FY18 and c 4% for FY19.

Diversified asset and income growth

Picton has acquired a Grade A office building located in Bristol’s city centre for £23.15m. Known as Tower Wharf, the building provides 70,664 sqft of office accommodation, 64% occupied by four tenants with an average lease length of 5.2 years (2.8 years to first break). The remaining vacant space is fully refurbished and available to let into an improving occupational market. With continuing high take-up and limited new supply the market for Grade A office space in Bristol city centre has continued to tighten and Picton sees significant reversionary potential in addition to letting vacant space.

To read the entire report Please click on the pdf File Below: