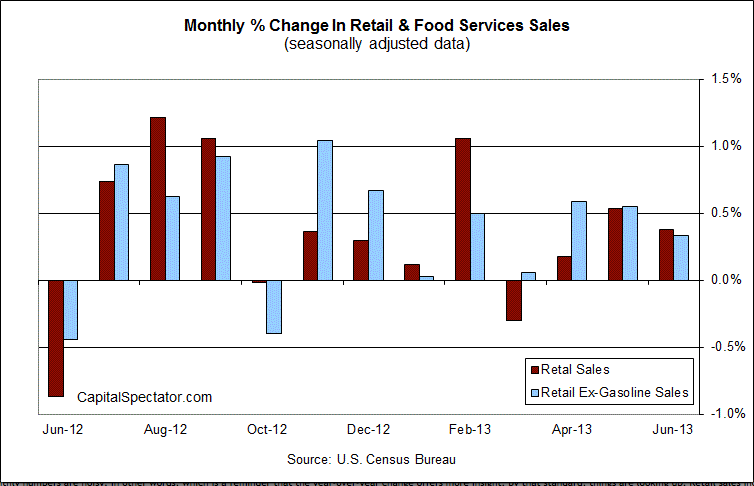

Retail sales increased 0.4% in June, which is below the consensus forecast, but that shortfall is less about a weaker pace of spending vs. overly optimistic expectations among economists for this morning’s number. In any case, don't pay too much attention to one number, particularly one that has little relevance for assessing the broader macro picture. On the other hand, take note that the year-over-year trend in retail spending inched higher for the third month in a row, offering another clue for thinking that business cycle risk remains low.

As for last month, consumption slowed a bit. The 0.4% gain in June compares with a monthly rise of nearly 0.5% over the past year. The main headwind last month was the sharp slowdown in the motor vehicles and parts category, which posted a relatively sluggish 1.8% advance. Then again, auto consumption surged more than 11% in May and so it’s not entirely surprising that consumers retreated in this corner of big-ticket spending.

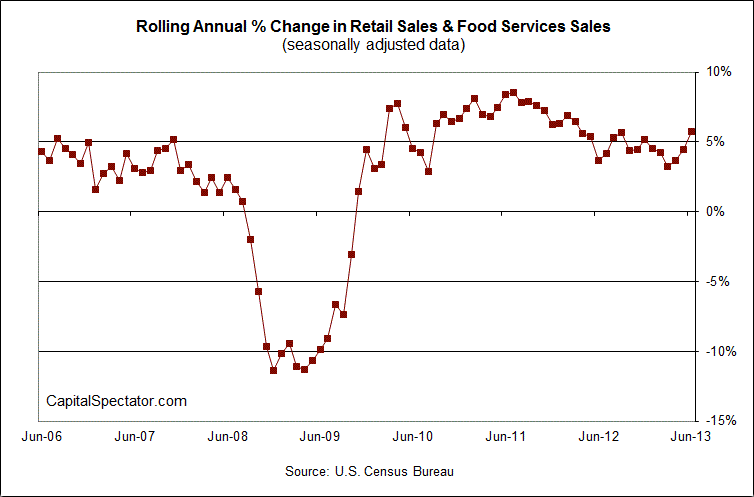

Monthly numbers are noisy, in other words, which is a reminder that the year-over-year change offers more insight. By that standard, things are looking up. Retail sales increased 5.7% for the year through June -- the most in more than a year.

It may be premature to say that retail sales are headed for more than modest growth, but it’s certainly overbaked to argue that consumers are unable or unwilling to spend. Indeed, a 5.7% annual rate of increase for this series falls comfortably into the category of "robust."

Yes, there are still many reasons to err on the side of caution for projecting the economy’s path for the near term. But if retail spending means anything (and it does), it’s fair to say that modest growth remains a reasonable assumption.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Picerno On U.S. Retails Sales growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.