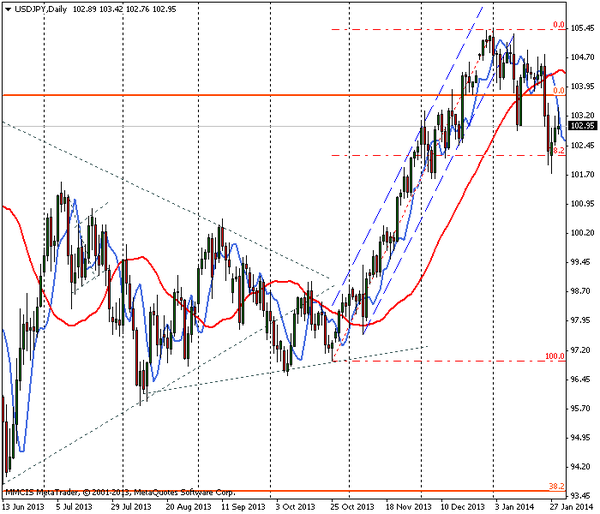

"The Asian session for the pair USD/JPY was held on Tuesday rather calmly started with the 102.55 mark, the pair consolidated near this level until the opening of the European session", said Forex Broker FOREX MMCIS group. The main events unfurled in the middle of the day when the U.S. dollar received support amid unrest in emerging markets and let USD/JPY pair to reach the level of intraday high - 103.12, specify analysts.

Publication of mixed U.S. data had a negative pressure on the dollar.

Nevertheless, the opening of trading on the American market cooled the ardor of the bulls, since the publication of mixed U.S. data had a negative pressure on the dollar across the board, including against the Japanese yen. So, experts say Forex orders for durable goods in December fell by 4.3% to 229.3 billion dollars, with an expected growth of 1.8%. Were weak and figures on orders excluding transportation, which decreased by 1.6% with a projected growth of 0.6%. Forex analysts also note that the data on the level of consumer confidence in January rose to 80.7 points against 77.5 in December, with growth forecast to 78 points. Thus, the pair USD/JPY, closed Tuesday trading at 102.90 position, at the end of the day showed an increase of 0.42%.

Forex analytics company FOREX MMCIS group note that today, January 29, 2014, investors' attention will be focused on information from the U.S., especially the results of the two-day meeting of the open market operations of the Fed. Surprises at this meeting is quite possible, despite the fact that the Fed, according to recent statements by some members of the FOMC, determined to continue the reduction to stimulate the economy. It is expected that this time, the monthly repayment of assets will be reduced by another 10 billion to $65 billion, experts say Forex. Another reason for the immutability of the current monetary exchange rate is likely to be a change of power at the Fed and Bernanke at the last meeting for himself as chairman, likely will not change the chosen vector.

USD/JPY" title="USD/JPY" align="bottom" border="0" height="242" width="474">

USD/JPY" title="USD/JPY" align="bottom" border="0" height="242" width="474">