After posting weaker-than-expected first-quarter 2017 results, Philip Morris International Inc. (NYSE:PM) reported yet another dismal quarter. Both earnings and revenues lagged the Zacks Consensus Estimate in second-quarter 2017. Moreover, the company lowered its earnings guidance for 2017 due to higher impact of unfavorable currency.

Quarter in Detail

Adjusted earnings per share of $1.14 per share missed the Zacks Consensus Estimate of $1.23 by 7.3% in the second quarter. It also dipped 0.9% from the year-ago quarter. While the company benefited from strong pricing, lower cigarette volumes led to the decline.

Net revenue, excluding excise taxes, was $6.917 billion, which was up 4.0% (up 7.0% excluding unfavorable currency of $195 million) in the second quarter. Favorable pricing and volume/mix in the quarter drove revenues. Revenue increased across Eastern Europe, the Middle East & Africa (EEMA), Latin America & Canada and Asia regions but were partly offset by regions of European Union (EU).

Revenues from combustible products declined 3.4% (down 0.5% excluding negative currency) to $6.3 billion. On the contrary, Reduced Risk Products (RRPs) reported a whooping increase from last-year quarter, stemming from the shift of customer preference away from tobacco products. However, revenues were way behind the Zacks Consensus Estimate of $7.058 billion by 2.0%.

Total cigarette and heated tobacco unit shipment volume fell 5.0% to 199.9 billion units. The volumes were unfavorable in Asia, particularly in Indonesia as well as in Pakistan and in Philippines. The ongoing declines of primarily low-margin cigarette volumes and EEMA regions were responsible for the same. While cigarette shipment volume declined 7.5% in the quarter, heated tobacco unit shipment volume of 6.4 billion units increased significantly from 1.2 billion units recorded in second-quarter 2016.

During the quarter, Philip Morris’ market share dipped by 0.2 points to 38.2%, with declines, mainly in Germany, Italy and Spain, partly offset by gains, notably in France and Poland.

Adjusted operating companies income was down 1.1% year over year to $2.8 billion due to lower revenues. Excluding currency impact of $199 million, adjusted operating income increased 5.9%. Adjusted operating margin was also down 210 basis points to 40.6%.

Financial Update

During the quarter, Philip Morris announced a regular quarterly dividend of $1.04 per share.

Guidance

Philip Morris lowered its earnings guidance for 2017, including currency. The company now expects its 2017 diluted earnings per share in the band of $4.78–$4.93 as compared with $4.84–$4.99, expected earlier. Excluding adverse effect of currency of 14 cents (8 cents expected earlier) in 2017 and favorable tax item of 4 cents reported in the first quarter, this guidance reflects growth of nearly 9–12% over the adjusted earnings of $4.48 delivered in 2016. The Zacks Consensus Estimate for 2017 is currently pegged at $4.90, which is within the company’s guidance range.

Further, the company expects revenues growth, excluding excise taxes, of over 7% excluding currency impact and acquisitions.

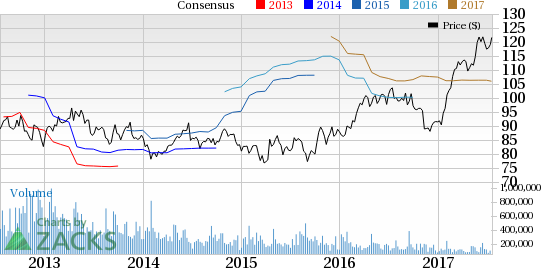

Share Price Movement

If we look into last six months’ performance, Philip Morris’ shares have outperformed the Zacks categorized Tobacco industry and the broader Consumer Staples sector. The stock has rallied 28.4% in comparison to the industry’s gain of 15.1%. The company has also outpaced the broader Consumer Staples sector, which gained 8.3% over the said time frame.

Zacks Rank & Other Stocks to Consider

Philip Morris currently carries a Zacks Rank #2 (Buy).

Investors interested in the consumer staple space can also consider Post Holdings, Inc. (NYSE:POST) , Kellogg Company (NYSE:K) and Lamb Weston Holdings Inc. (NYSE:LW) . While Post Holdings sports a Zacks Rank #1 (Strong Buy), both Kellogg and Lamb Weston carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Post Holdings and Kellogg Company have long-term earnings growth rate14.00% and 5.96% respectively. Lamb Weston has an average positive earnings surprise of 11.9% in the trailing four quarters.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Kellogg Company (K): Free Stock Analysis Report

Post Holdings, Inc. (POST): Free Stock Analysis Report

Lamb Weston Holdings Inc. (LW): Free Stock Analysis Report

Philip Morris International Inc (PM): Free Stock Analysis Report

Original post

Zacks Investment Research