Pharmacyclics, Inc. (PCYC) is a clinical-stage biopharmaceutical company focused on developing and commercializing small-molecule drugs for the treatment of cancer and immune mediated diseases. The Company's clinical development and product candidates are small-molecule enzyme inhibitors designed to target biochemical pathways involved in human diseases. As of June 30, 2011, it had three drug candidates under clinical development and a number of preclinical molecules.

This is a stock and vol note for a bio-tech that has hit new highs in stock price and IV30™. Let's start with a quick company overview, and then move into the analysis. Here are some snippets from a Seeking Alpha post:

Presently, PCYC has three product candidates in clinical development and several molecules in pre-clinical lead optimization. To date, nearly all of the company's resources have been dedicated to the research and development of its products, and has yet to generate any commercial revenues from the sale of its products. The company spends significant sums of money on research and development, pre-clinic testing and clinical trials, and is also subject to various regulatory and marketing approvals. The company has been showing losses over the last three financial years with no expectations of profitability until the successful development of its products and subsequent approvals.

Ibrutinib is an orally active selective irreversible inhibitor of Bruton's Tyrosine Kinase (BTK) that the company is developing for the treatment of patients with B-cell malignancies (lymphoma or leukemia). Trial results have confirmed the superiority of ibrutinib in treating B-cell cancers, including chronic lymphocytic leukemia (CLL), small lymphocytic lymphoma (SLL). A Phase I dose escalation study evaluating the safety and tolerability of single-agent ibrutinib has been completed in patients with relapsed B-cell malignancies. Results were impressive, with Ibrutinib demonstrating a favorable safety profile and an evidence of anti-tumor activity.

With Phase II trials ongoing and positive results coming out for ibrutnib, PCYC anticipates starting Phase III registration trials by the end of 2012. It is widely agreed that it is one of the most attractive drugs in development, given the robust clinical activity demonstrated in several hematologic malignancies as well as an equally impressive safety profile.

Source: Seeking Alpha via Yahoo! Finance; Pharmacyclics Inc.: A Stock Up 400% This Year, A $4 Billion Company , written by Qineqt: Team of investment professionals including former hedge fund manager, trader and analyst at top tier $10 billion hedge fund. Members include investment professionals who oversaw research and trading organization of 50+.

I have verified that the company deos indeed carry a nearly $4 billion market cap on revenue of ~$8 million for FY 2011.

Let's turn to the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side, we can see the incredible run over the last seven weeks. On 5-14-2012, the stock closed at $26.94 and, as of this writing, is up more than 113% since that time. A year ago the stock closed at $10.48 and two years ago it was trading at $6.85. In English, the stock is up 448% over the last year and 738% over the last two years, with a large portion of those moves realized since mid May. Wow... The 52 wk range in stock price is [$8.65, $59.29], so the stock reached its annual high yesterday.

On the vol side, we can see how the implied has rocketed up of late, moving from 58.49% to 85.18% since 5-14-2012, or a ~45% rise in the implied. The 52 wk range in IV30™ is [45.47%, 85.78%], so the vol is also at an annual high. In fact, the level of the implied is now at its highest level since 12-2010. I bring this up a lot, but this is another example of a rising stock (abruptly rising, one could say) that also demonstrates rising vol (risk).

What's so interesting about the stock and vol movement is that there has not really been one "big day." Normally we see vol rise and then on some day of reckoning (news), the stock moves abruptly and the vol (risk) finally comes in. The run in PCYC feels like speculation, but not so much on a single impending FDA decision, but more on a momentum and "longish"-term potential. In any case, it's very odd to see vol rise this quickly with stock and have no real "market moving news event" impending. In fact, Capital IQ forecasts the next earnings release in mid Sep (source: Briefing.com (www.briefing.com). Weird... Very weird...

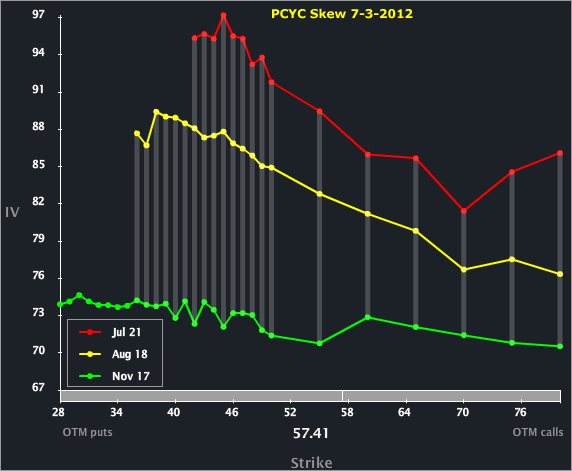

Let's turn to the Skew Tab to examine the line-byline and month-to-month vols.

We can see a monotonic vol increase from the back tot he front, reflecting greater risk in the near-term than the intermediate. Keep in mind that the green curve includes an earnings release. Even more interesting, if there is in fact an upcoming FDA ruling or trial result or "something," it appears that it is due out in the Jul expiry, and thus the elevated vol. I can't imagine what the stock would do if the news was bad... OK, I can imagine it, it's just a colloquialism.

The shape of the skew is also kinda normal -- the OTM puts are more expensive (in terms of vol) than the ATM strikes and the OTM calls. I do note that Nov is rather flat when compared to the front two expiries.

To learn more about skew, you can read this post: Understanding Option Skew -- What it is and Why it Exists .

Finally, let's turn to the Options Tab, for completeness.

Across the top we can see the monthly vols are priced to 87.80%, 82.05% and 71.87%, respectively for Jul, Aug and Nov. Looking further out, we can see that the expiries in 2012 (and later) are all priced in the 60's (in terms of vol). Hmm...

DISCLAIMER: This is trade analysis, not a recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Pharmacyclics Stock And Vol Hit New Highs On "No" News But Big Promise

Published 07/04/2012, 01:44 AM

Updated 07/09/2023, 06:31 AM

Pharmacyclics Stock And Vol Hit New Highs On "No" News But Big Promise

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.