The shares of Array BioPharma Inc (NASDAQ:ARRY) have struggled since peaking two months ago. However, ARRY stock has pulled back to a historically supportive trendline, suggesting it could be time to buy the dip. What's more, Array Biopharma is scheduled to report earnings tomorrow morning, and the shares have a history of rallying after quarterly releases.

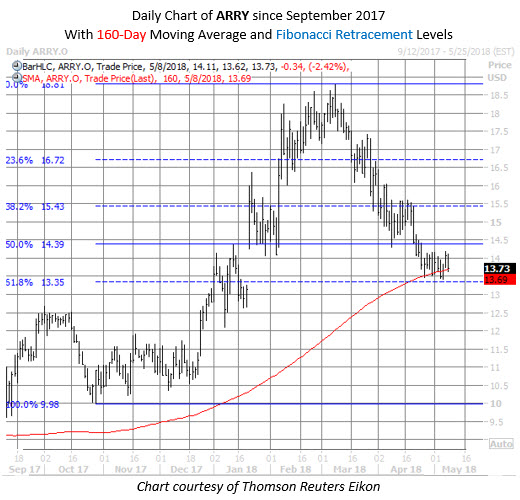

ARRY stock touched a record peak of $18.78 on March 8. Since then, however, it's been a slow slog lower, with the stock last seen down 2.4% at $13.73. But Array shares seem to have found support in the $13.50 area -- a 61.8% Fibonacci retracement of the equity's rally from late October to March.

Further, ARRY is now within one standard deviation of its 160-day moving average, after a lengthy stretch above this trendline. Following similar pullbacks -- of which there have been five -- Array Biopharma stock was higher by an average of 12.56% one month later, according to data from Schaeffer's Senior Quantitative Analyst Rocky White.

As alluded to earlier, the biotech concern is scheduled to report earnings tomorrow morning. Following the company's last earnings report, ARRY stock surged 15.5% in the subsequent session. After the firm's earnings release one year ago, the shares jumped 20.1%. In fact, looking back six quarters, ARRY stock has moved lower after earnings just once.

Looking back eight quarters, the shares have moved 9.5%, on average, the day after earnings, regardless of directions. This time around, the options market is pricing in a smaller-than-usual one-day move of just 6.5% for ARRY, per at-the-money implied volatility data.

Should Array stock once again move higher after earnings, a short squeeze could propel the equity's gains. Short interest represents about a week's worth of pent-up buying demand, at ARRY shares' average trading volume.