Over the past few weeks, a vast majority of stocks and ETFs have been selling off alongside of the broad market. Exceptions in the realm of ETFs have been mostly limited to select commodity ETFs, such as precious metals and oil/gas.

We remain long and bullish on ProShares Ultra Silver ETF (AGQ), as well as US Oil Fund (USO), which is breaking out of a long base. Although both ETFs have pulled back over the past several days (quite normal after breaking out), their weekly chart patterns still look good and we anticipate further gains in the near to intermediate-term.

Another ETF that has been bucking the near-term bearish trend of the main stock market indexes recently is PowerShares China ETF (PGJ), one of the few non-commodity ETFs that has been outperforming the benchmark S&P 500 Index over the past few weeks. Take a look:

On the daily chart above, the recent relative strength of $PGJ versus $SPY (S&P 500 SPDR ETF) is quite clear. Notice, for example, that $SPY failed its breakout attempt to new highs in August, but $PGJ held its breakout and pushed significantly higher.

When a stock or ETF is so strong that it continues to trend higher while the main stock market indexes are trending lower, it typically surges much higher as soon as the broad market bounces. This is the basis of relative strength trading, the main aspect of the ETF swing trading system detailed in my book, Trading ETFs: Gaining An Edge With Technical Analysis.

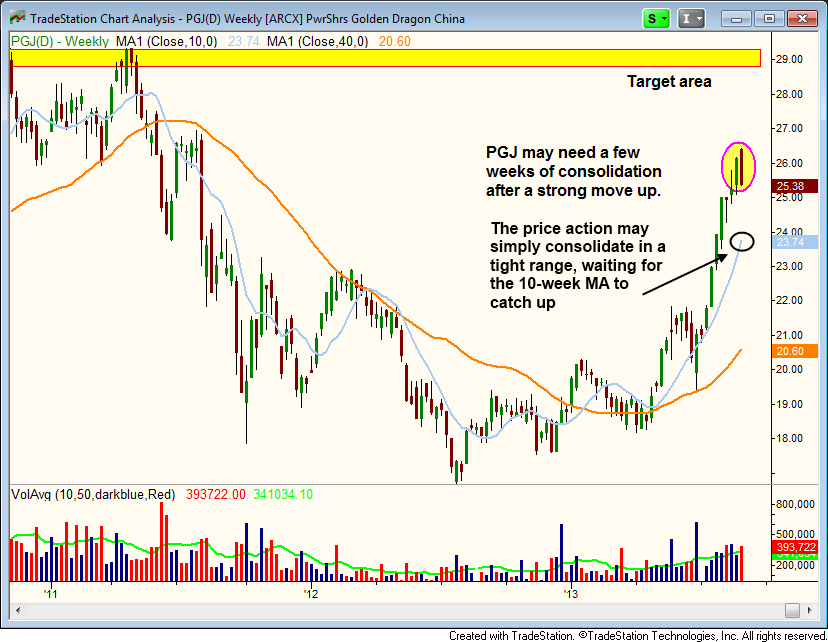

Now, let’s take a look at the longer-term weekly chart pattern of PGJ below:

The weekly chart shows that PGJ has been surging steadily higher for several months, and at a very steep angle of attack. However, after a strong 10-week advance from the touch of the 40-week moving average (orange line) in late June, $PGJ may now be due for a healthy 4-5 week correction.

Given its convincing bullish momentum, it’s probable that PGJ will eventually rally at least to its prior highs of 2011 (about 15% higher), but the ETF is likely in need of a short rest before doing so.

Because the reward-risk ratio for this trade setup is not very positive at the moment, $PGJ is not yet an actionable trade setup. Nevertheless, put this ETF on your watchlist because it could soon be in play and present a profitable momentum trading opportunity.

As for a specific buy entry point, look for the 10-week moving average (same as the 50-day moving average) to catch up while PGJ consolidates in a tight range. If that happens, a breakout above the high of that new base would be buyable, with a protective stop just below the low of the range.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

PGJ: A China ETF That Should Be On Your Trading Watchlist

Published 09/03/2013, 07:49 AM

Updated 07/09/2023, 06:31 AM

PGJ: A China ETF That Should Be On Your Trading Watchlist

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.