* Reports Q2 2020 results on Thursday, Jan. 23, before the market opens

* Revenue Expectation: $18.42 billion

* EPS Expectation: $1.37

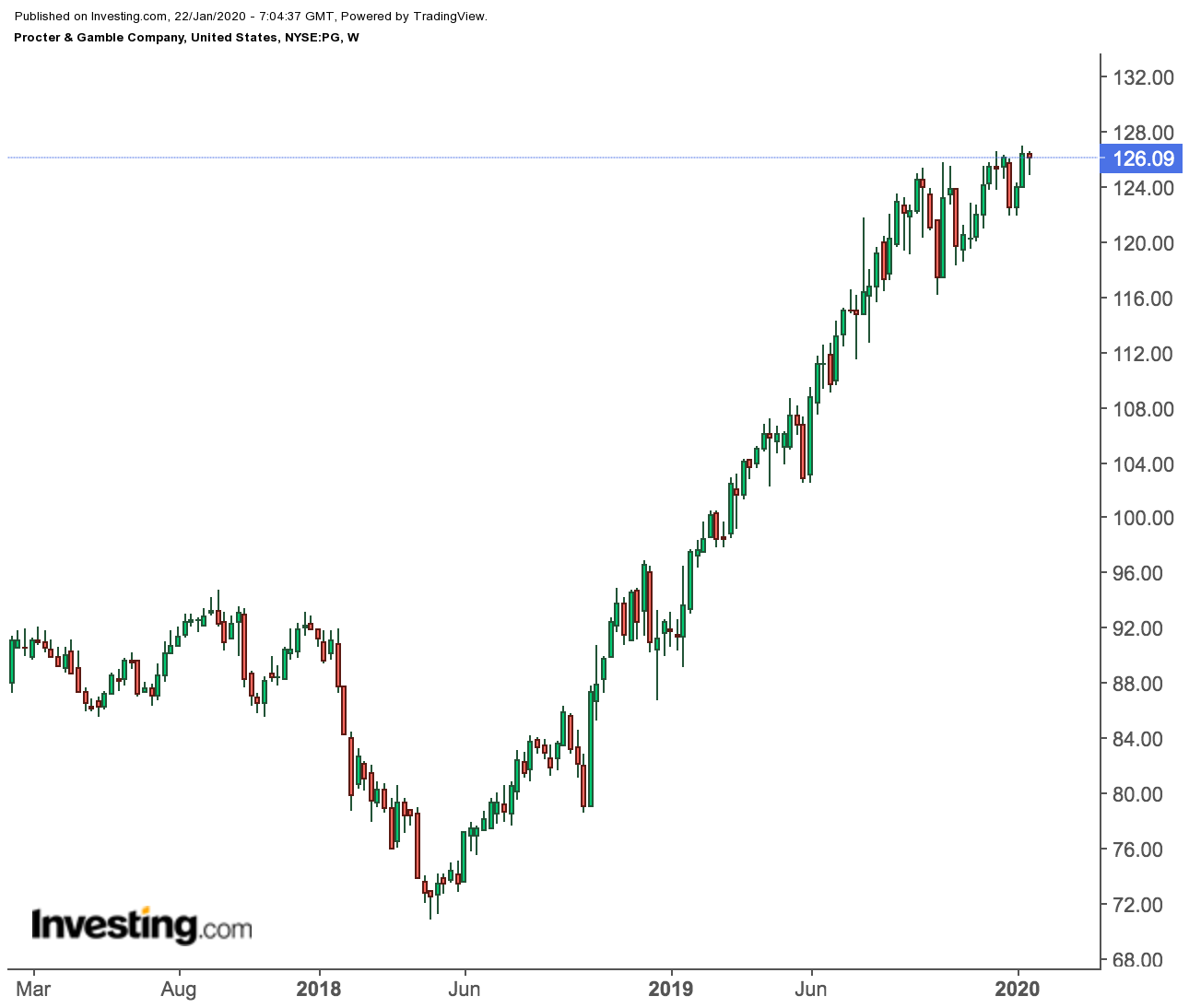

The shares of global consumer staples giant Procter & Gamble (NYSE:PG) have had a great 2019. Investors sent the stock soaring to a record high after seeing five consecutive quarters of explosive growth and the company building in strong expectations for the current year.

That remarkable run of strong sales is likely to continue when the maker of Pampers diapers and Gillette razors reports its 2Q fiscal 2020 earnings tomorrow morning. Analysts, on average are expecting $1.37 a share profit on sales of $18.42 billion.

In expectation of another blowout quarter, the shares of the world’s largest maker of household products touched another record high of $127 on Friday. The stock closed at $126.09 yesterday, up about 38% in the past year.

During the past two years, P&G, whose other brands include many household names such as Dawn dish washing soap, Bounty paper towels and Crest toothpastes, has consistently been growing sales, helped by its innovation, marketing and a simplified organizational structure.

In October, the company reported that organic sales, which exclude things like acquisitions and currency fluctuations, rose 7% in its fiscal first quarter, showing that it is keeping up the momentum after it matched the previous quarter’s fastest organic sales growth in more than a decade.

But the pace of growth that P&G is showing is unusual for a company which produces everyday consumables in categories where the competition is intense and margins are low. From a big consumer staple giant like P&G it wouldn’t be fair to expect a blow-out quarter every time.

During the same period, Kleenex and Huggies maker Kimberly-Clark (NYSE:KMB) reported organic sales growth of 4%, while Reckitt Benckiser (LON:RB) the U.K.-based maker of Lysol disinfectant products and Woolite detergent, reported disappointing organic growth of just 1.6%.

Lofty Valuations?

These concerns have made some investors question P&G’s lofty valuations and its potential to provide further upside after such a fast and powerful rally.

Today, P&G trades at 24 times forward earnings compared to its five-year average of around 20. Over the past decade, the stock has never featured a forward earnings multiple this big.

These concerns could be valid for short-term investors, but we think measuring P&G stock performance on these metrics doesn’t present a true picture of the company’s growth potential. What’s fueling the share price gains is the company’s success in its turnaround strategy to cope with changing consumer needs as well as its ability to put itself way ahead of competitors.

Under Chief Executive Officer David Taylor, Cincinnati-based P&G has cut its roster of brands from 175 to 65, focusing on the 10 product categories where the margin is highest. During the course of that process the company has also eliminated 34,000 jobs through a combination of brand sales and buyouts, as well as plant closures —slashing more than $10 billion in costs.

These measures are clearly helping the company to seek higher prices for its products despite a very benign inflationary environment. P&G started implementing phased price increases last summer after failing to revive growth by doing the opposite. The shift in pricing strategy will be completed by February, which could boost prices between 4%-10% on products including its Pampers, Bounty, Charmin and Puffs brands.

Bottom Line

P&G stock remains our favorite pick from among the packaged consumer goods companies. It's one of the largest dividend payers in the U.S. — distributing $2.98 per share annual dividend for a yield of 2.36% — and a track-record that's hard to match.

The maker of Pampers diapers has raised its payout for 62 consecutive years. Now that growth is back on track, investors should expect more hefty dividend hikes. We see little reason to abandon this consumer powerhouse, even if its stock goes through some weakness.