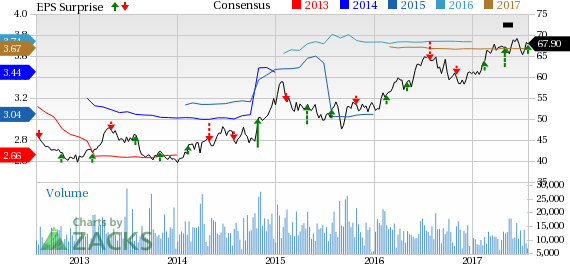

PG&E Corporation’s (NYSE:PCG) adjusted operating earnings per share (EPS) of 86 cents in the second quarter of 2017 surpassed the Zacks Consensus Estimate of 79 cents by 8.9%. Earnings were also up 30.3% from 66 cents reported in the year-ago quarter.

GAAP earnings during the quarter were 79 cents per share, compared with 41 cents a year ago.

Revenue Update

In the second quarter, the company reported revenues of $4,250 million, up 1.9% from $4,169 million in the year-ago period. The figure, however, missed the Zacks Consensus Estimate of $4,319.8 million by 1.6%.

Electric revenues were down 4.1% from the year-ago levels, while natural gas revenues rose 31.7%.

Operational Highlights

Total operating expenses in the second quarter were $3,502 million, down 7.1% from $3,768 million in the year-ago period. Costs declined due to lower cost of electricity, and operation and maintenance expenses.

Operating income came in at $748 million, up from $401 million in the second quarter of 2016.

Interest expenses in the quarter were $225 million, compared with $207 million in the year-ago quarter.

Guidance

The company has reiterated its guidance for 2017 adjusted earnings from operations in the range of $3.55−$3.75 per share.

Zacks Rank

PG&E Corporation currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Peer Releases

DTE Energy Company (NYSE:DTE) reported second-quarter 2017 operating earnings per share (EPS) of $1.07, which surpassed the Zacks Consensus Estimate of 97 cents by 10.3%. Operating earnings also grew 9.2% from the year-ago figure of 98 cents.

NextEra Energy, Inc. (NYSE:NEE) reported second-quarter 2017 adjusted earnings of $1.86 per share, beating the Zacks Consensus Estimate of $1.76 by 5.7%. Reported earnings were also up by 11.4% year over year.

WEC Energy Group (NYSE:WEC) reported second-quarter 2017 adjusted earnings of 63 cents per share, beating the Zacks Consensus Estimate of 59 cents by 6.8% and the year-ago figure of 57 cents by 10.5%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Pacific Gas & Electric Co. (PCG): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Original post

Zacks Investment Research