Can Pfizer (NYSE:PFE) Grow with Several Upcoming Revenue Headwinds?

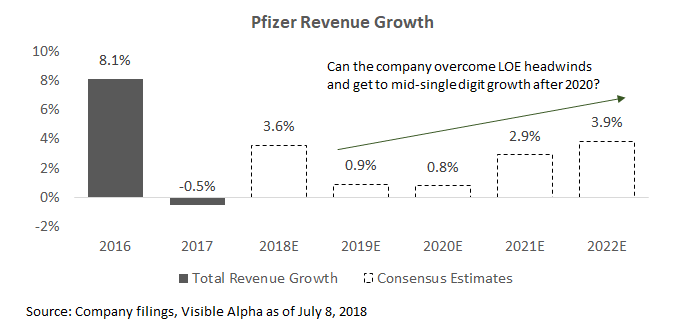

The key topic for Pfizer is whether the company will be able to grow revenue in the mid-single digits going into the early 2020s. The company faces between $7 billion to $9 billion in loss-of-exclusivity (LOE) revenue headwinds from now until 2025. Notable headwinds include LOEs from Enbrel and Lyrica, and recent supply issues in its sterile injectables.

Management believes they can achieve mid-single digit revenue growth (or more) starting in 2020, when the LOE headwinds begin to subside. Given Pfizer's broad portfolio, the company will need a number of existing drugs to outperform, and help from the pipeline. Several key drugs should generate higher-than-average company growth, but will likely need some of its label expansion efforts to work out to provide more upside. Consensus estimates suggests analysts do not expect the company to hit mid-single digit growth rates currently.

Headwinds include Lyrica, Enbrel, and Sterile Injectables

Analysts are skeptical given the sizable headwinds ahead for the company. The company will face LOEs in Lyrica and Enbrel, and is still resolving sterile injectable manufacturing issues.

Lyrica: Lyrica is used to treat several indications, including epilepsy, neuropathic pain, and generalized anxiety disorder. The drug made up roughly 10% of total sales in 2017 despite having lost product exclusivity in European markets in 2014. The company will lose US patent protection at the end of 2018, and management expects a generic to come to market by mid 2019. As a result, analysts model a significant sales erosion in 2019. Lyrica is expected to represent a significant portion of the total LOE headwind, although management is hopeful that they will be able to return to growth once they annualize the Lyrica generic launch in 2020.

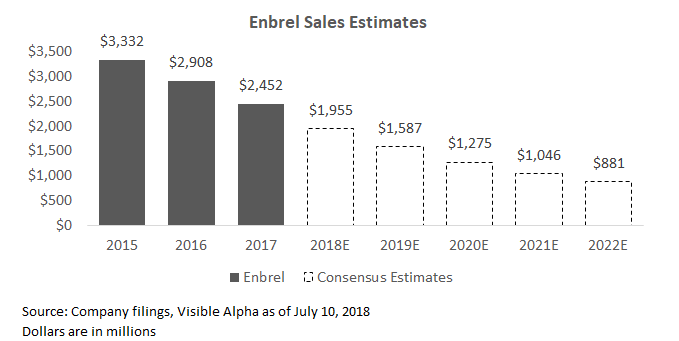

Enbrel: Enbrel is a blockbuster drug that treats a number of indications for arthritis and psoriasis. Drug sales have seen double digit declines outside of the US as biosimilar generics in Europe have grown over time. Analysts expect Enbrel to continue to decline, putting pressure on the Inflammation and Immunology segment (I&I) for several years. Xeljanz, another drug in the I&I segment (detailed later in this article), could potentially offset declines here and turn the segment positive if the drug is able to achieve management's expectations.

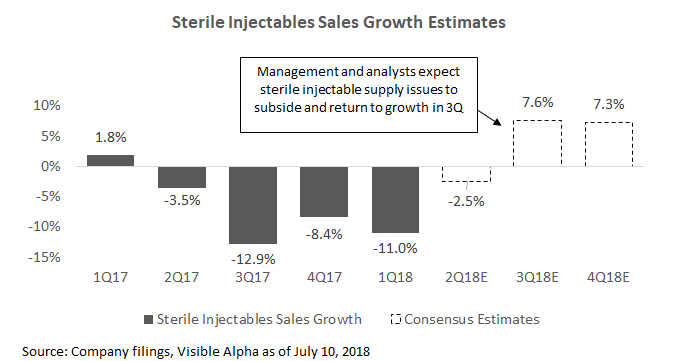

Sterile Injectables: Pfizer's sterile injectables have been another source of revenue headwind for the company. Hospira faced manufacturing issues and lost roughly $500 million in sales in 2017. In 2018, these issues have persisted, and the segment declined a further 11% in 1Q18. Management has a remediation plan in place to upgrade its facilities and to bring on additional supply in 2019. They expect further declines in 2Q18 before turning to growth in the second half of the year, bringing the full year to flattish growth. If management is able to completely resolve these issues, the sterile injectables business could turn to growth beyond 2018.

Ibrance, Xtandi, Xeljanz, and Biosimilars Could Drive Upside to Estimates

Given the revenue headwinds, Pfizer will likely need to execute on a number of label expansions for key drugs to hit targets. Biosimilar success and the pipeline also represent areas of upside.

Ibrance: Ibrance is a oral combination treatment for women with a specific kind of metastatic breast cancer. There are about 150,000 women in the US with metastatic breast cancer. Within that group, about 60% have the subtype that Ibrance works with (HR+, HER2-). Ibrance is used in combination with hormone therapy to treat metastatic breast cancer.

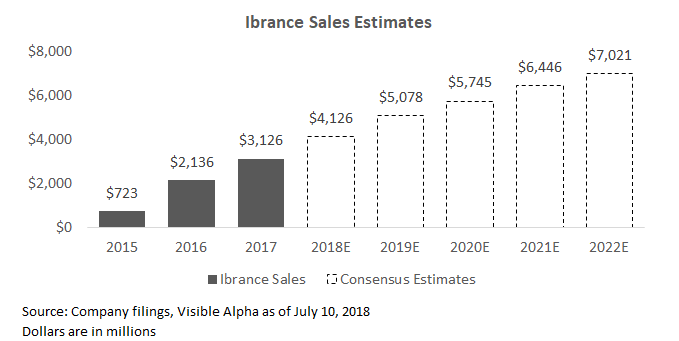

Ibrance should continue to see strong growth in the coming years, with analysts expecting growth of up to $7 billion in sales by 2022 (from 2017 sales of $3 billion).

One of the primary drivers of growth (and potential sources of upside) is the expansion of the market for CDK4/6 inhibitor treatment on metastatic breast cancer. The CDK4/6 inhibitor market is roughly $10 billion in size, and is expected to grow significantly. Ibrance was the first CDK4/6 inhibitor with its approval in 2015. There are two other CDK4/6 inhibitors on the market - Eli Lilly's (NYSE:LLY) Verzenio and Novartis' (NYSE:NVS) Kisqali, both approved in 2017. CDK4/6 inhibitor treatment is still in its early-to-mid stages of adoption. Currently, only about 60% of newly diagnosed HR+, HER2- patients will receive a CDK inhibitor agent for first-line usage. Given the strength of data, oncologists believe penetration will continue to grow as physicians become more aware of the drugs.

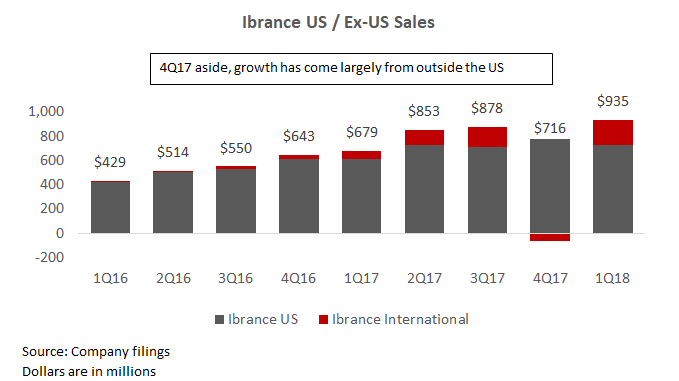

International expansion should also drive near-term growth. Ibrance sales in the US has tapered over the last several quarters, and management believes that new launches in the EU and Japan should fuel growth moving forward.

A significant longer-term driver (and potential source of upside) is the potential expansion into earlier stage breast cancer. The company currently has several trials (PALLAS and PENELOPE-B) that are expected to produce readouts some time in 2020. The patient population size here is significantly larger than in late stage breast cancer and therefore could meaningfully expand Ibrance sales. Furthermore, the company has several other trials looking into other areas of expansion, including neoadjuvant breast cancer (readout expected in the fall of 2018) and HER2+. Note that Pfizer recently announced that Ibrance "narrowly" missed its secondary overall survival (OS) endpoint in its PALOMA-3 trial. However, investors do not view this as a significant setback.

Xtandi: Xtandi is used to treat advanced prostrate cancer. While the drug has done well for Pfizer, there are some concerns around upcoming sales for several reasons. First, Xtandi sales recently missed consensus estimates in the last quarter. Second, investors now see increased competition on the horizon with a potential Zytiga generic launch in 4Q18 and Johnson and Johnson's Erleada launch (as the drug was approved earlier this year).

However, management expects the drug to continue to grow in the face of these headwinds. Management cites Xtandi's competitive advantage over the competition - its ability to be dosed without steroids.

Additionally, the company is pursuing a number of line extensions. In February, Pfizer released PROSPER trial results for non-metastatic castration resistant prostate cancer (nmCRPC) in February that showed strong results - Pfizer noted that the median metastasis-free survival was 36.6 months compared to 14.7 months for ADT alone. The company has a PDUFA date coming up in July, and investors now widely expect Xtandi to receive approval for nmCRPC and launch in 2H18.

Longer-term, Pfizer is also pursuing the hormone sensitive prostrate cancer indications. Pfizer expects metastatic hormone sensitive results in early 2020 and non-metastatic hormone sensitive results in early 2021. Receiving approval for these adjacent indications will be key to driving upside to Xtandi consensus estimates, and investors will therefore be on the lookout for positive progress.

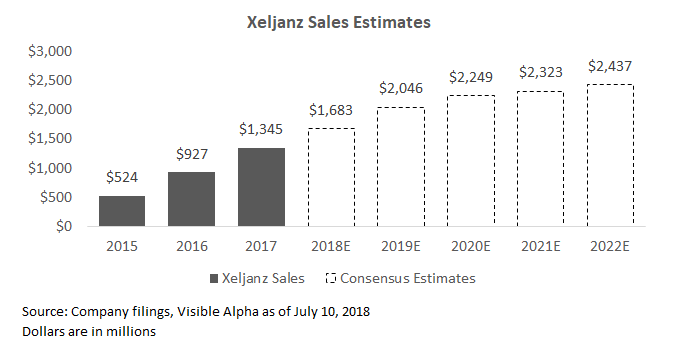

Xeljanz: Xeljanz is used for the treatment of rheumatoid arthritis and psoriatic arthritis. Xeljanz sales has ramped at a slower-than-expected rate, but has eventually grown to a sizable $1.3 billion in 2017. Like Xtandi and Ibrance, sales were recently slowed in 1Q18 due to supply issues.

Looking ahead, management believes the company is still on track to hit its full year targets. The drug recently won approval for ulcerative colitis, a chronic inflammatory bowel disease, and management believes this can add an additional $1 billion in sales. Investors will be watching for signs of outperformance within this indication.

Biosimilars: While biosimilars represent a smaller portion of Pfizer sales, the area represents a potential longer-term growth opportunity for the company. Key biosimilars include Inflectra, Nivestim, and Retacrit. Inflectra in particular has been slow to gain share from Johnson & Johnson's (NYSE:JNJ) Remicade since its launch, as share still sits in the single digits. However, the estimated price discount is now much higher since launch, and analysts believe share gains could accelerate.

Beyond Inflectra, management plans to launch an additional five biosimilars within the next two years. Of note, Pfizer received a CRL on Herceptin in April due to technical issues, and believes the issues can be resolved in time to meet its original launch expectations.

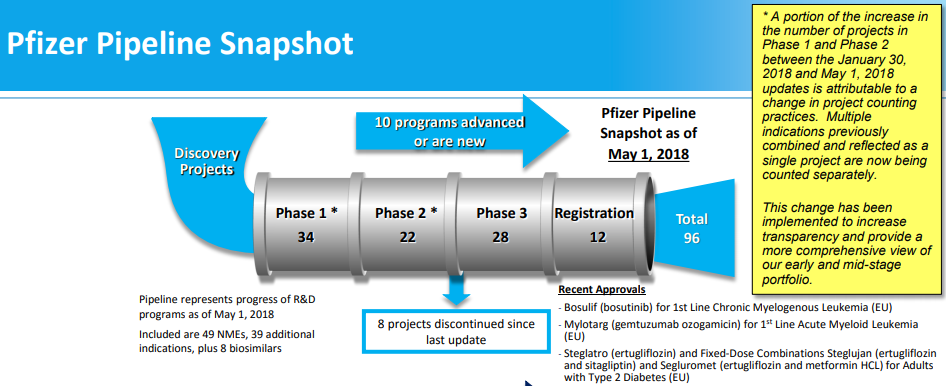

Pipeline: While this article focused primarily on existing drugs, the pipeline represents an obvious additional area of potential upside. In May, the company noted that they had 96 projects in the pipeline, with 28 in phase 3 and 12 in registration. Of the 96 projects, management believes that potentially 25-30 of these could receive approvals through 2022, with up to 15 having blockbuster potential. One key drug to watch is Tafamidis, which management highlighted as the most risky asset. The company will need to execute on this front in order to increase the odds that sales grow in the mid single digits after 2020.

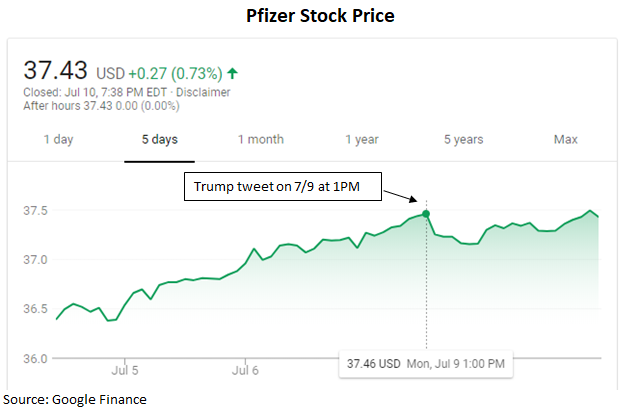

A Quick Note on Pricing

Trump recently threatened to stop pharmaceutical companies from pursuing price increases, and has even singled out Pfizer for its recent pricing actions. While his call-out received media attention and a Pfizer response to not raise pricing, investors were already discounting the back and forth as an optical PR move. The weighted average pricing net of rebates (because rebates also grow each year) grew by 3% last year and was flat in 1Q18, according to Pfizer. Pfizer stock is largely flattish since Trump's tweet on July 9th.