Seventeen months after the Shpirag-2 well started drilling in Southern Albania, Petromanas Energy (PMI) and joint venture partner Royal Dutch Shell A, (RDSa) have finally released testing results from the $75 million exploration well on Albania’s Blocks 2-3.

PMI and Shell announced a discovery at Shpirag-2 today, with flow rates of 1,500 to 2,200 barrels per day of oil equivalent (800 to 1,300 barrels per day of 35 to 37 degree API oil and 2 to 5 mmcfd of gas) observed during the test period. PMI and Shell also believe they have identified an 800 meter oil column in fractured carbonate reservoirs at the Shpiragu structure, but were only able to test 400 metres due to drilling setbacks.

“These are compelling results from a well that, due to difficulties encountered while drilling, is not the optimal wellbore into the reservoir,” said Mr. Glenn McNamara, CEO of Petromanas. “These test results initially confirm the well’s ability to flow light oil and provide early validation of the potential of Block 2-3 and our considerable investment to date in this asset. Given carbonate reservoirs are dependent on fracture porosity, and well rates can vary significantly across the reservoir, we are very encouraged to have flowing oil at these rates from our first well.”

Blocks 2-3 cover a mountainous region of Southern Albania believed to host multiple, deep oil formations, analogous to the Val’d Agri oil field in Italy, on the other side of the Adriatic Sea. Val’d Agri has been a producer for a consortium which includes Royal Dutch Shell since 1996. Petromanas was able to attract Shell as a joint venture partner on Albania’s Blocks 2-3 in February, 2012.

Frank Giustra, a director and large shareholder of Petromanas Energy, said that most wells at Val’d Agri produce with rates similar to that of Shpirag-2, with a few wells flowing at much more substantial rates, effectively carrying that field’s heavy drilling costs. Mr. Giustra said he was “very happy” with the results from Shpirag-2 via email Monday afternoon, adding that Shell is financing 2 more exploration wells in Albania with Petromanas, including Molisht-1, which is currently drilling. Additionally, results from a 450km seismic survey are to be concluded by year end.

Jamie Summerville, an analyst with TD Securities, said today’s news is a potential long term positive for Albanian neighbour, Bankers Petroleum (TSX:BNK) [Editor's note: Frank Giustra financed the original Bankers Petroleum ten years ago]. If and when the Shpirag structure starts producing, PMI and Shell’s light oil would be a cheaper diluent for Bankers’ heavy oil production at the Patos Marinza field, 50KM west of Shpirag. In a Monday afternoon alert to TD clients, Mr. Summerville added that the joint venture will require “Significant additional testing and appraisal drilling… but we assume both companies are right to be encouraged by the initial rates announced today from Shpirag-2.”

Petromanas and Shell continue drilling the Molisht-1 prospect to the Southeast of Shpirag-2. The Molisht-1 well was spud August 20, 2013 and is currently at a depth of approximately 1,400 hundred meters on its way to a targeted approximate depth of 5,500 metres. Drilling operations are scheduled to take 9 months from the initial spud (Roughly May 20, 2014), to be followed by testing.

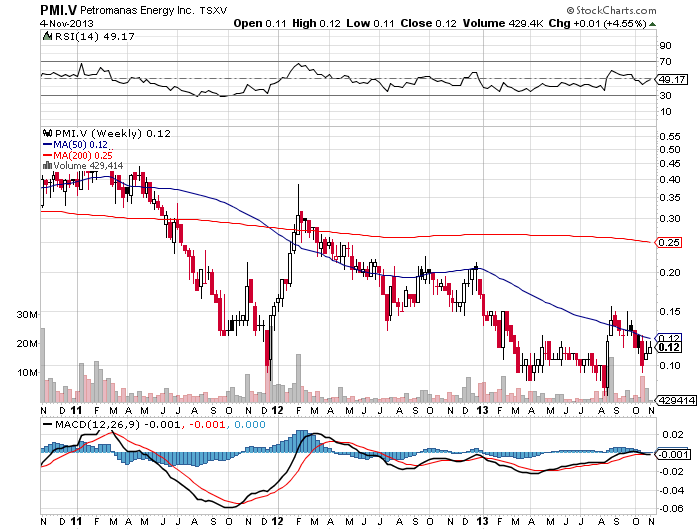

Shell is the 75% owner of Blocks 2-3, with Petromanas holding the remaining 25%, as well as operatorship. Shares in PMI last traded at $.115 Monday, valuing the company at approximately $80 million.

Disclaimer: Exploration stocks such as Petromanas Energy (PMI) are extremely risky. This is not advice or a recommendation to buy shares in any company. We own a position in PMI and are biased. Always do your own due diligence.

Original post