Bayer (OTC:BAYRY) announced last Friday that it is set to invest approximately 5 billion euros, or around $5.6 billion, in order to further research "additional methods to combat weeds." The company also aims to reduce its environmental impact by 30% by 2030.

Litigious Problems

Bayer’s focus on researching weed killers comes after recent lawsuits, including one it settled in which it has to payout $2 billion. The plaintiffs in that lawsuit claimed that the glyphosate in Monsanto’s Round-Up, now sold under the Bayer name, cause cancer. Bayer was found liable for the plaintiffs contracting non-Hodgkin’s lymphoma.

In a statement released in May after the verdict, Bayer maintained that glyphosate, an herbicide used in Round-Up, and Round-Up itself, were both safe when used correctly. Additionally, Bayer pointed out that the verdict is a "stark" contrast from the EPA’s determination that there are "no risks to public health from the current registered uses of glyphosate." Bayer was optimistic in this press release, although it’s important to realize that a company wants its outlook to be positive. The firm said that this verdict has no impact on future verdicts.

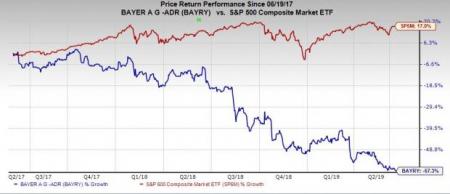

Bayer acquired Monsanto (NYSE:MON) in 2018 for about $62 billion. Since the acquisition, Bayer stock has tumbled 50%. The falling stock price has brought Bayer’s market cap to around $56 billion, 9% less than it paid for Monsanto last year. Currently, there are more than 13,000 lawsuits against the company over the use of glyphosate, claiming that it causes cancer.

Lawsuits can cause fluctuations in the stock, as a ruling for the company is likely to boost the stock and a ruling against the company is likely to hurt the stock. Having so many lawsuits ongoing, many investors may not want to deal with these fluctuations and uncertainty.

Going Forward

Bayer, in its press release, noted that "glyphosate will continue to play an important role in agriculture and in Bayer’s portfolio." While Bayer is confident in Round-Up, it will use the investment in research to provide farmers with multiple weed killer options. Since the lawsuits against the company primarily deal with the potentially harmful effects of glyphosate, the EU and EPA may do more research into the chemical. If the EU and EPA were to ban the use of glyphosate, Bayer is setting itself up for the future by doing the research for a new, glyphosate-free product now.

Bayer did not acknowledge any wrong doing, but did commit itself to improving the company. On top of the aforementioned plans to reduce its environmental impact, Bayer is "raising the bar in transparency… and engagement." With these goals in mind, Bayer looks to improve its perception in the public eye. If Bayer is able to produce a glyphosate-free weed killer, its stock price could benefit.

Bayer does boast an "A" grade for Value in our Style Scores system. The stock’s P/E of 7.76 represents a discount compared to its industry average of 15.10. It is important to point out that while Bayer’s low P/E may give it some appeal as an investment option, the low P/E may also just be a result of the stock’s falling price over the past few months. While Bayer may be in potential ongoing legal trouble, its outlook in terms of earnings is positive. Zacks Consensus Estimates call for 9.14% earnings growth in fiscal 2019, followed by an additional 14.66% earnings growth in fiscal 2020.

Bottom Line

The growth of Bayer’s earnings in the next couple of fiscal years does look good, but it may still be a risky investment with all the pending lawsuits. More billion-dollar settlements could negatively impact the company. But, if these lawsuits are resolved and Bayer comes out relatively unscathed, the stock could bounce back.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft (NASDAQ:MSFT) stock in the early days of personal computers… or Motorola (NYSE:MSI) after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this "4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Bayer Aktiengesellschaft (BAYRY): Free Stock Analysis Report

Original post

Zacks Investment Research