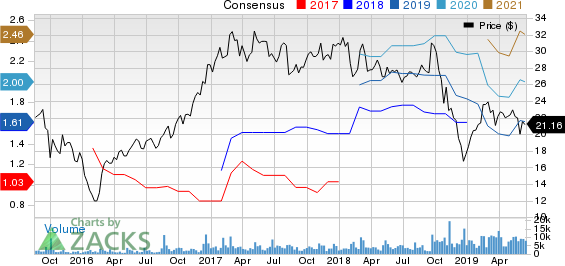

Shares of Univar Inc. (NYSE:UNVR) have popped around 18% over the past six months. The company has also significantly outperformed its industry’s decline of roughly 17% over the same time frame.

Univar, a Zacks Rank #3 (Hold) stock, has a market cap of roughly $3.6 billion. Average volume of shares traded in the last three months was around 1,761.2K. The company has an expected long-term earnings per share growth rate of 9.5%.

Let’s take a look into the factors that are driving this chemical company.

Driving Factors

Better-than-expected earnings performance in the first quarter, upbeat outlook and buoyant prospects from the Nexeo acquisition have contributed to the gain in Univar’s shares.

Univar’s adjusted earnings of 33 cents per share for the first quarter topped the Zacks Consensus Estimate of 23 cents. The company, in May, said that it expects adjusted EBITDA of between $195 million and $200 million for the second quarter of 2019, up from $173.1 million it earned a year ago.

For 2019, Univar continues to expect adjusted EBITDA of between $740 million and $760 million, reflecting an increase from $640 million a year ago. The projected figure reflects 10-months earnings from the Nexeo Chemicals business and net realized synergies worth roughly $10 million. The company also expects to generate $300-$350 million in free cash flow in 2019.

Univar remains focused on cost-cutting, expense management and productivity actions, which is helping it to minimize operational costs and boost margins. The company is also gaining from its strategic initiatives, efficiency gains and prudent investments to drive growth.

The company also remains committed to grow its core business and improve sales force execution to deliver sustained growth in gross profit margins. Improved sales force execution contributed to an expansion in gross margin in the first quarter.

Univar is also poised to gain from synergies of the Nexeo buyout. The combination is expected to drive growth and boost shareholders’ value with the largest sales force in North America along with extended product offering and most efficient supply chain network in the industry. The acquisition is expected to deliver $100 million of annual run rate cost savings by the third year following its closure. The company expects around $10 million net realized synergies in 2019.

Stocks to Consider

A few better-ranked stocks worth considering in the basic materials space are Materion Corporation (NYSE:MTRN) , Israel Chemicals Ltd. (NYSE:ICL) and Innospec Inc. (NASDAQ:IOSP) .

Materion has an expected earnings growth rate of 27.3% for the current year and carries a Zacks Rank #1 (Strong Buy). The company’s shares have gained around 11% over the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Israel Chemicals has an expected earnings growth rate of 13.5% for the current fiscal year and carries a Zacks Rank #2 (Buy). Its shares have gained around 10% in the past year.

Innospec has an expected earnings growth rate of 6.6% for the current year and carries a Zacks Rank #2. Its shares are up roughly 7% in the past year.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft (NASDAQ:MSFT) stock in the early days of personal computers… or Motorola (NYSE:MSI) after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Innospec Inc. (IOSP): Free Stock Analysis Report

Univar Inc. (UNVR): Free Stock Analysis Report

Israel Chemicals Shs (ICL): Free Stock Analysis Report

Materion Corporation (MTRN): Free Stock Analysis Report

Original post

Zacks Investment Research