Brazil's state-run energy giant Petroleo Brasileiro S.A. or Petrobras (NYSE:PBR) is reportedly planning to divest nine shallow water oil fields in the northeastern states of Ceará and Sergipe. These fields produce a total of 13,000 barrels of oil and equivalent natural gas a day from multiple wells.

The proposed divestment, however, is not expected to result in a significant reduction in the company’s debt. This is because the nine fields contribute even less than 1% of the total production of the company. Also, the sale is unlikely to draw the same level of interest as the integrated player’s prized deep water, pre-salt oil fields, which will be up for auction in 2017. Notably, the aforesaid sale is in line with the company’s $15 billion divestment program to shed non-core properties.

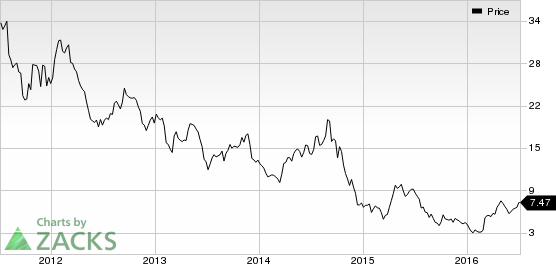

Petrobras remains the most debt-laden company in the oil industry with a total debt of about $126 billion. Also, it has been hard for the company to raise money in the debt as well as the equity markets after its involvement in a money laundering scam. Hence, the company is focusing on massive asset divestitures to reduce debt and strengthen its balance sheet.

To this end, the company is trying to vend a stake in its fuel retailing unit, BR Distribuidora SA, and the network of gas pipelines – Nova Transportadora do Sudeste SA – to address issues such as deteriorating net income, high debt management risk, disappointing return on equity and weak operating cash flow.

Headquartered in Rio de Janeiro, Petrobras is the largest integrated energy firm in Brazil and one of the largest in Latin America. The company’s activities include exploration, exploitation and production of oil from reservoir wells, shale and other rocks, as well as refining, processing, trading and transportation of oil and oil products, natural gas and other fluid hydrocarbons.

Weakness in the commodity markets for the last two years has severely impacted the financials of Petrobras and other energy majors like Chevron Corporation (NYSE:CVX) , BP plc (NYSE:BP) and Royal Dutch Shell (LON:RDSa) plc RDS.A. However, the scenario is now getting better to some extent since oil is walking on the bullish path after recovering from multiyear low marks in February.

PETROBRAS-ADR C (PBR): Free Stock Analysis Report

BP PLC (BP): Free Stock Analysis Report

CHEVRON CORP (CVX): Free Stock Analysis Report

ROYAL DTCH SH-A (RDS.A): Free Stock Analysis Report

Original post