Petro Matad (LON:MATD) is now drilling Gazelle-1, the final well of its 2019 three-well exploration and appraisal campaign in Block XX, in Mongolia. Results are expected during October, alongside test results from the successful Heron-1 well. In the south-west of the block, the riskiest well in the programme, Red Deer-1, did not encounter hydrocarbons. We update our valuation on the back of results from the two first wells of the campaign. Red Deer, previously valued at 2.8p/share has been removed from our sum of the parts. We have de-risked Heron to a 68% chance of commercial success vs 45% in our last note. We now value the asset at 4.9p/share and will update the probability of success once the well test results are announced. Our risked valuation, post assumed farm-out value dilution, is updated to 20.1p/share (down 7%) at $70/bbl long-term Brent, which we expect to revisit after drilling Gazelle-1 and well testing Heron-1.

Gazelle-1 looks to build on Heron-1 success

Gazelle-1 sits to the west of Heron-1 in a region on trend with existing Block XIX production, targeting 13mmbbls. Meanwhile, testing on Heron-1, which established a 77m gross oil-bearing interval in a structure proven productive in adjacent Block XIX, is due to commence in October. Sections of better than typical Lower Tsagaantsav reservoir identified in the well could point to improved deliverability.

Low threshold for commerciality

The low well costs and attractive fiscal terms that enable cost recovery provide an attractive risk/reward in Mongolia. Petro China’s current production from Blocks XIX and XXI demonstrates commercial oil production and the presence of spare capacity at the existing nearby infrastructure should allow for rapid commercialisation in the case of success. Based on our analysis, the threshold for commerciality at Block XX is low, with development of small discoveries (c 10mmbbl) generating an IRR in excess of 10%.

Valuation: Base case risked at 20.1p/share

Our updated base case risked valuation assumes a 50% value dilution through farm-down. We have removed Red Deer from our sum of the parts and de-risked Heron to a 68% chance of commercial success. Our risked valuation post assumed farm-out value dilution is updated to 20.1p/share (-7%) at $70/bbl long-term Brent, which we expect to revisit post-drill of Gazelle-1 and Heron-1 well test. Petro Matad is fully funded for 2019 and we assume a farm-down to fund future development. However, further issues of equity at the current share price could be significantly dilutive to our per-share valuation.

Business description

Petro Matad is a pure-play Mongolian exploration company with a 100% equity interest in Blocks IV, V and XX. Management is drilling three exploration and appraisal wells in 2019, targeting low-risk prospects in Block XX.

Oil encountered in Heron-1

Petro Matad is currently drilling Gazelle-1, the third and final well in its 2019 exploration and appraisal campaign focused on Block XX in eastern Mongolia. The first well, Heron-1, encountered a 77m gross potential oil reservoir and is due to be tested during October. This was followed by Red Deer-1, in the south of the block, which did not encounter hydrocarbons and is being plugged and abandoned. The company is returning to the north of the block and on trend with existing production in Block XIX with the drilling of Gazelle-1. Results from this well are also expected during October.

Heron-1: Testing during October

Heron-1 was an appraisal of the Petro China-operated T19-46-3 well, located immediately to the north in Block XIX and identified to be sitting in the same structure. Petro Matad believes that the bulk of the 13km2 structure extends into Block XX and the well was targeting mean prospective resources of 25mmbbls in the Lower Tsagaantsav reservoir.

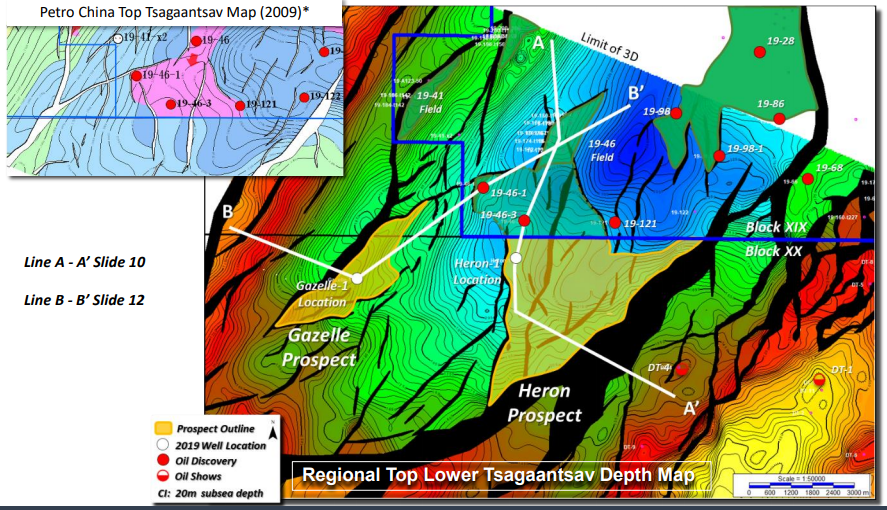

Exhibit 1: Regional depth map with Heron-1 and Gazelle-1 locations

The well encountered a 77m gross interval of potential oil reservoir, based on log interpretation, within which three zones, totalling 22m (gross), exhibited better porosity and permeability characteristics than typically seen in the Lower Tsagaantsav. Testing is due to commence in early October and to be completed within the month. In the case of success, there is potential to bring the well onstream soon via Petro China’s central processing facility, located 20km to the north.

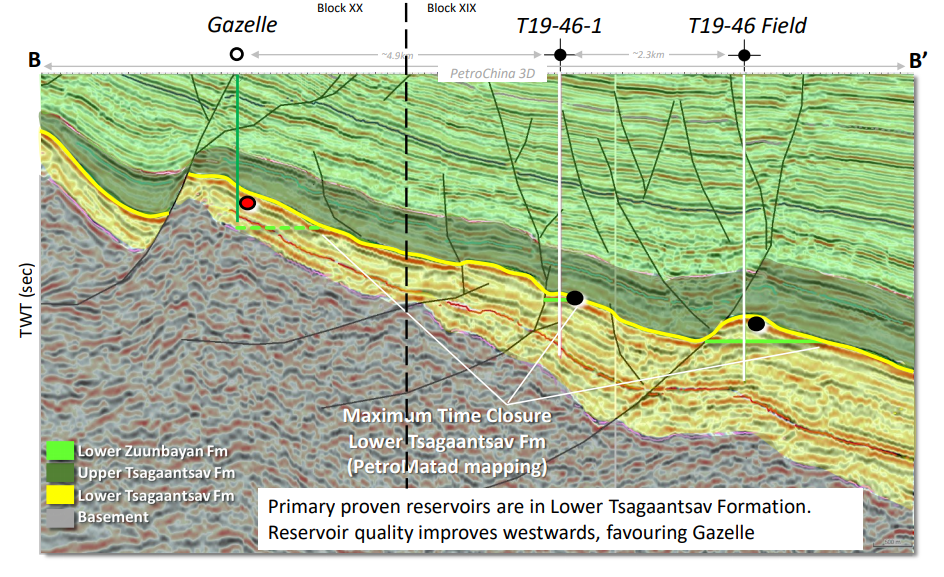

Gazelle-1: Updip of proven oil

Gazelle-1 was spudded on 19 September and is expected to take around 35 days to reach a TD of around 2,500m (including logging). The exploration well is located 4.5km south-west of Petro China’s T19-46-1 oil well and to the west of Heron-1. Gazelle-1 sits updip of T19-46-1 on the western flank of the Tamsag Basin and is on trend with the best producing wells in Block XIX. Reservoir quality has been observed to improve westwards in Block XIX, and should therefore be favourable for Gazelle-1.

Exhibit 2: Gazelle-1 schematic

The well is targeting mean prospective recoverable resources of 13mmbbls. However, this is based on the structural trap and there is potential for further upside in the stratigraphically trapped part of the accumulation. In the event of success, the company expects to be able to complete well testing operations before the winter shutdown of operations in late November.

Red Deer-1

Red Deer-1 was drilled in an undrilled basin in the southern part of Block XX, around 100km to the south-west of existing Petro China production. The well encountered a thick interval of good-quality sandstones, but no hydrocarbons were present. Preliminary analysis suggests that source rocks could be present shallower in the drilled section, but that they are not fully mature for hydrocarbon generation. The well was drilled on budget at less than $4m and has been plugged and abandoned.

Valuation

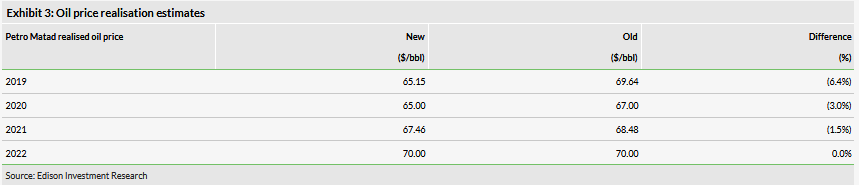

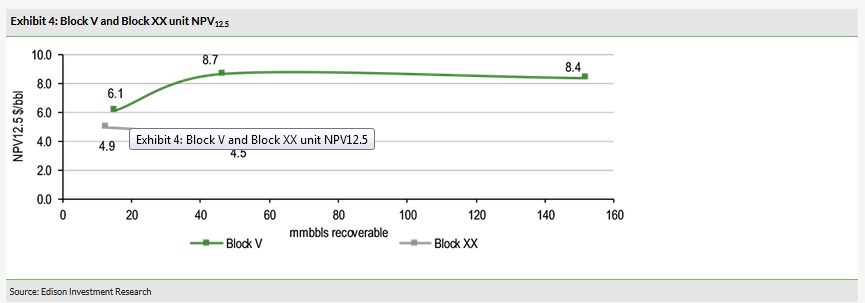

Our valuation of Petro Matad is based on risked value for the company’s drill-ready and committed prospects in Block XX and Block V. Details of the prospects are provided above. We calculate economics per unit volume ($/boe) using modelled company development plans for Block XX and Block V. Changes in economics per unit volume since our last note are driven by an updated near-term price deck.

Our unit values are shown below and are driven by discovery size (for more details, see our outlook note published on 28 January 2019).

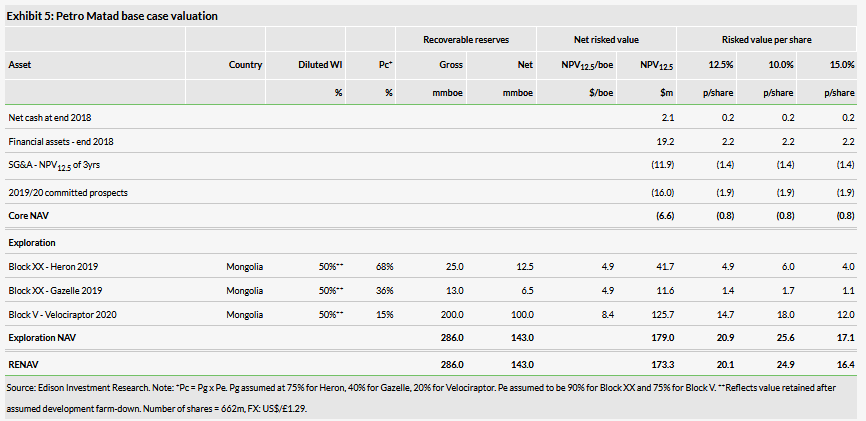

In our base case valuation, shown below, we typically include elements of dilution, of which investors need to be mindful of when investing in the small-cap E&P sector:

While we do not currently include equity dilution through a future fund-raise, this has the potential to be significantly dilutive to our per-share NAV valuation.

We include asset-level working interest dilution through the farm-down of discoveries made during the exploration phase.

Apart from the already mentioned price deck update, we have updated our capex assumption for the 2019/20 well programme to $16m from $15m to account for Red Deer-1 costs of $4m, previously estimated at $3m. We have also removed the value estimated for Red Deer and updated our valuation for Heron by de-risking the chance of commercial success. We will update our risking assumptions for the asset, post-well test. Reserves estimates remain in line with our previous note (there has been no subsequent update from the company).

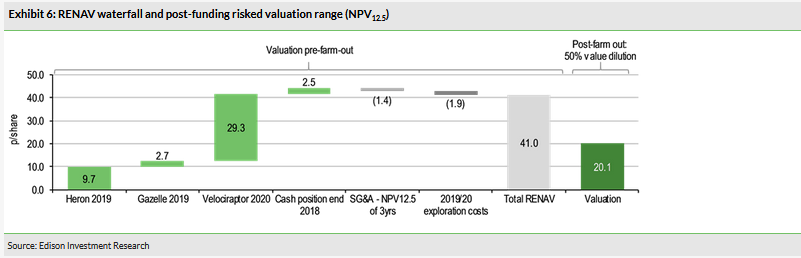

The waterfall chart below provides a breakdown of our risked valuation prior to farm-down at 41.0p/share, followed by what it could look like post farm-down. Our updated base case valuation of 20.1p/share (-7%) is on the basis of a $70/bbl Brent long-term (2022) oil price and 50% asset-level value dilution through farm-down (see Appendix A for further details of our farm-down framework).

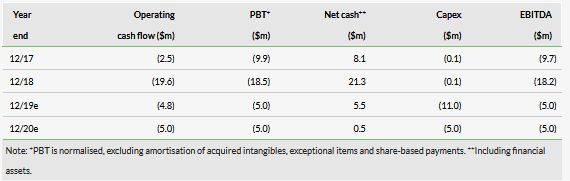

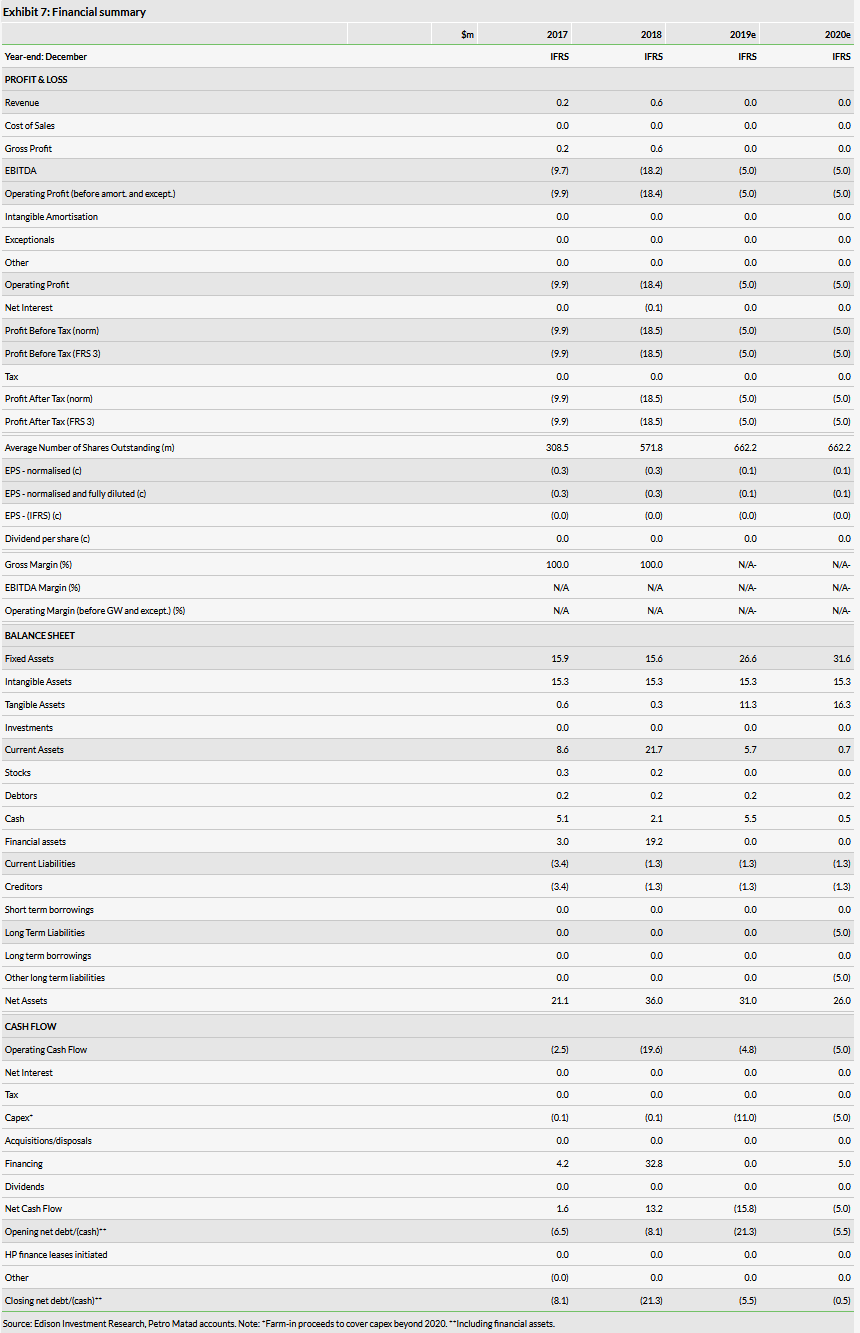

Financials

Petro Matad closed FY18 with $2.1m in cash and $19.2m in financial assets, enough to cover its four-well 2019/20 exploration and appraisal campaign. It ended H119 with $16.1m in net cash. Additional funding would be required to commit to an exploration programme and to support group G&A beyond 2020. We assume a short-term debt facility for the initial two years of development (2021–22).

We have updated our capex assumption of $15m for the 2019/20 well programme to $16m to account for Red Deer costs of $4m. The remaining wells are estimated at $3m for Heron, $3m for Gazelle, $4m for Velociraptor and $2m for geological studies. These costs include contingency but exclude overheads and PSC costs.

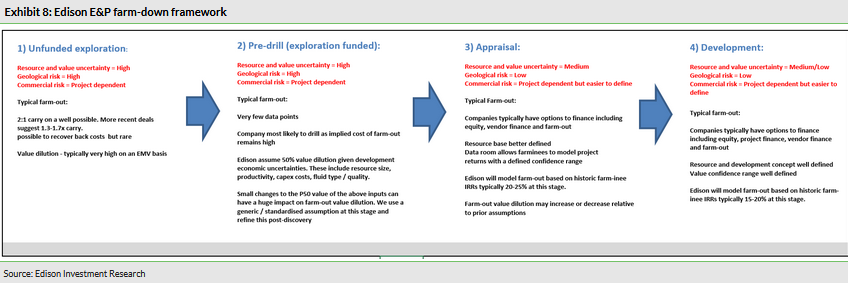

Appendix A

We use a farm-down framework when valuing E&P assets that are not self-funded through to first oil. In general, the extent of value dilution we assume through farm-down decreases as asset certainty and risks decrease, as shown in Exhibit 8. Given the current uncertainty with regard to unrisked resource size, productivity, oil quality and costs, we use a generic assumption of 50% value dilution (stage 2 of our framework) for Petro Matad, which we intend to refine post-drill.