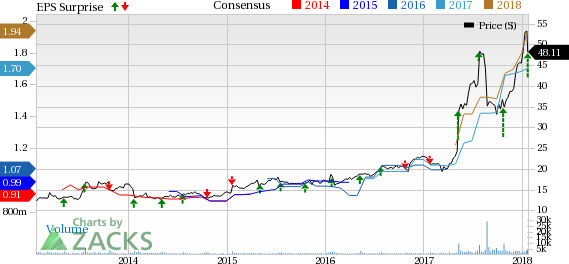

PetMed Express, Inc. (NASDAQ:PETS) announced earnings per share (EPS) of 44 cents for the third quarter of fiscal 2018, up 83.3% from the year-ago quarter’s 24 cents. Also, the bottom line surpassed the Zacks Consensus Estimate by 33.3%. This year-over-year rise in earnings was driven by an increase in sales and improved margins.

Net sales in the reported quarter rose 13.7% year over year to $60.1 million, outpacing the Zacks Consensus Estimate by 5.4%.

Per this leading pet pharmacy in Americas, the upside in sales was a result of increased new orders and reorders during the quarter.

In the reported quarter, reorder sales increased 13.4% to $50.9 million on a year-over-year basis while new order sales rose 15.5% to $9.2 million.

Average order value was approximately $86 in the quarter compared with $81 in the year-ago quarter. We note that the variation in average order value is mainly driven by a shift of sales to higher priced items.

Per the company, the seasonality in its business is mainly because of the proportion of flea, tick and heartworm medications in the product mix. Spring and summer are considered peak seasons while fall and winter represent off-seasons.

During the quarter under review, PetMed acquired 106,000 new customers, up from 99,000 a year ago. Roughly, 84% of all orders was generated from its website (compared with 83% in the prior-year quarter).

Gross margin expanded 502 basis points (bps) year over year to 31.9% in the quarter under review. General and administrative expenses were up 8.5% year over year to $5.8 million. Also, advertising expenses rose 30.2% to $4.1 million. This led to a 16.6% increase in adjusted operating expenses (without depreciation expense), which amounted to $9.9 million. Nevertheless, adjusted operating margin in the quarter expanded 462 bps to 19.9% from the year-ago quarter.

PetMed exited the fiscal third quarter with cash and cash equivalents of $80.9 million compared with $68.4 million at the end of second-quarter fiscal 2017. The company also announced a 25% hike in quarterly dividend to 25 cents per share, payable to shareholders of record as of Feb 5, 2018.

Our Take

PetMed successfully delivered yet another quarter of solid results. In the fiscal third quarter, the company once again topped on both revenues and earnings. We are also encouraged to note the stellar growth in reorder and new order sales in the quarter.

The company is also striving to implement several strategies to revitalize its top line. These include an increased focus on advertising efficiency to boost new order sales as well as shifting sales to higher margin items while also expanding its product offerings.

PetMed currently offers a wide range of products catering to dogs, cats and horses besides working on upgrading its existing portfolio.

Zacks Rank & Other Key Picks

PetMed sports a Zacks Rank #1 (Strong Buy). A few other top-ranked stocks in the broader medical sector are Amedisys, Inc. (NASDAQ:AMED) , Bio-Rad Laboratories, Inc. (NYSE:BIO) and Intuitive Surgical, Inc. (NASDAQ:ISRG) .

Amedisys has a long-term expected earnings growth rate of 18.5%. The stock carries a Zacks Rank #2 (Buy).

Bio-Rad Laboratories has a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here. The company has a long-term expected earnings growth rate of 25%.

Intuitive Surgical has a long-term expected earnings growth rate of 9.6%. The stock has a Zacks Rank of 2.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Bio-Rad Laboratories, Inc. (BIO): Free Stock Analysis Report

Amedisys Inc (AMED): Free Stock Analysis Report

Original post