Key Takeaways

- Bitcoin’s social sentiment slipped into the negative territory in late May, which could be a positive sign.

- But on-chain metrics reveal that BTC faces a major resistance wall ahead.

- Due to the ambiguous outlook, the area between $9,200 and $10,050 is a reasonable no-trade zone.

Investors are losing faith in Bitcoin as its price remains stagnant, but a counter-sentiment approach suggests that the uptrend could be preparing to resume.

The Crowd Turns Bearish

The high levels of uncertainty in the market can be seen across the board.

Not only is the Crypto Fear and Greed Index sensing “fear” among market participants, but the chatter around Bitcoin on Twitter has also grown pessimistic.

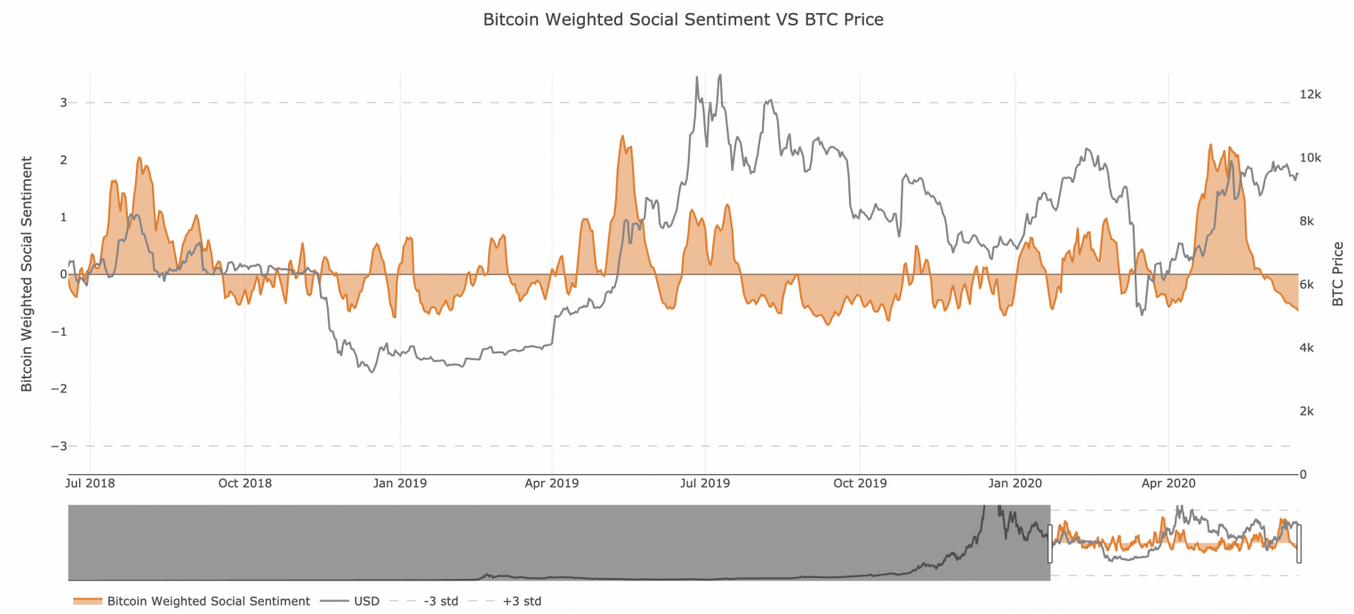

Santiment’s social sentiment index reveals that the social activity around the flagship cryptocurrency has slipped into the negative territory in late May. As investors appear to shift their focus towards small-cap cryptocurrencies, Bitcoin’s social sentiment is currently at a low of -0.64.

The behavior analytics platform maintains that despite the state of commotion among market participants, the wisdom of the crowd is usually inaccurate. Thus, a buying opportunity may be developing.

“We like to see when the crowd has turned negative, as this has historically been the territory when bottoms begin to emerge,” affirmed Santiment.

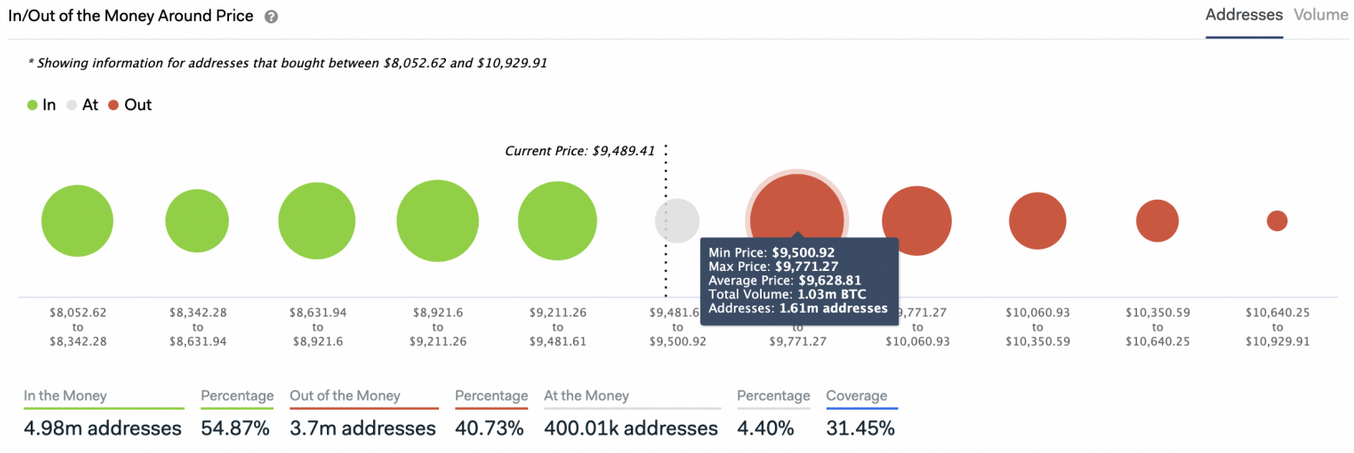

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model shows that Bitcoin sits underneath a massive resistance wall that it must overcome to advance higher.

Based on this on-chain metric, approximately 1.6 million addresses bought more than 1 million BTC between $9,500 and $9,770. This significant supply barrier could absorb any upside pressure.

But if buy orders begin to pile up and the pioneer cryptocurrency slices through this area of resistance, it would likely surge to retest the infamous $10,000 level.

On the flip side, the IOMAP cohorts reveal that if the current support level that sits between $9,400 and $9,000 fails to hold, the next significant barrier to watch out for sits around $8,000.

Here, over 900,000 addresses purchased 500,000 BTC.

Bitcoin Sits In No-Trade Zone

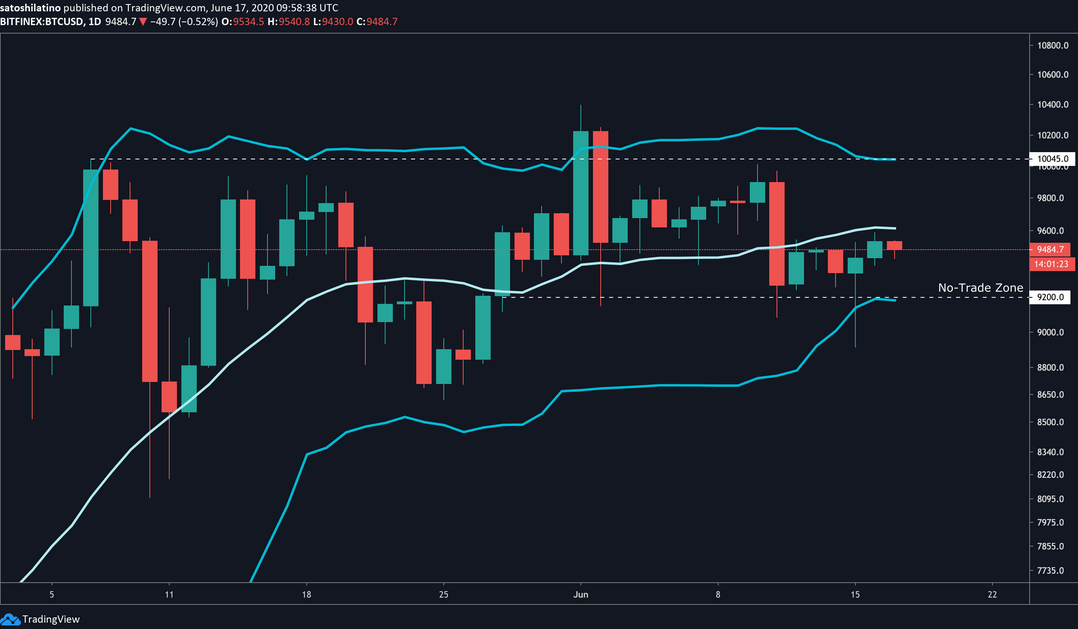

From a technical perspective, the bellwether cryptocurrency appears to be consolidating within a narrow trading range. Its price action has been mostly contained between the $9,200 support level, and the $10,050 resistance over the past month.

Throughout this stagnation phase, the Bollinger bands were forced to squeeze BTC’s 1-day chart.

Squeezes are indicative of periods of low volatility and are typically succeeded by wild price movements. The longer the squeeze, the higher the probability of a strong breakout.

Since this technical index does not provide a clear path for Bitcoin’s direction, the area between the lower and upper band is a reasonable no-trade zone. An increase in volume that allows a daily candlestick to close below or above this critical zone will determine where BTC is headed next.

It’s just a matter of time before support or resistance breaks to provide a clear signal of the direction of Bitcoin’s trend.

However, the high levels of demand among institutional investors add credence to this optimistic outlook.

The Chicago Mercantile Exchange (CME) Group reported a volume increase of its Bitcoin futures options of over 25x in the last two months. The rapid growth in demand indicates that investors could be using Bitcoin as a hedge against the ongoing global economic uncertainty, according to Tim McCourt, Managing Director at CME.

Regardless, it’s crucial to understand the supply barriers previously mentioned and wait for confirmation before entering any trade. As the cryptocurrency market appears to be entering a new bullish cycle, having cash ready to deploy is a must.