The Mexican peso is ground zero in the latest round of the tariff fight and yet other assets have fallen harder. We explain why and look at implications that most are missing. Nonfarm payrolls are due on Friday.

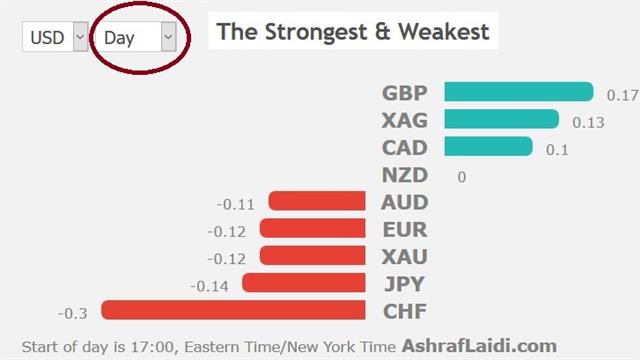

GBP is the highest performer on weakening odds of Boris Johnson becoming next PM after the Brexit Party lost yesterday's bi-electrions in Peterborough. Here's what Ashraf said about GBP and Johnson 2 weeks ago. U.S. and Canada jobs are due next.

The most-notable aspect about the Mexican peso is how little it has fallen since Trump first threatened tariffs. On Thursday, he ramped up warnings saying “not nearly enough” had been offered to stop them.

Peso dynamics suggest how minimal the expectations of Trump following through on tariffs on Monday. MXN is down only 2.65% against the US dollar since Trump's surprise threat on May 30. That's a relatively small move in the emerging market space and even when you consider that the US dollar has lost ground broadly in that same time frame, it's still surprisingly small when you consider that on the night Trump was elected it fell 12% and now it's facing escalating tariffs and a tight deadline.

One interpretation would be that tariffs remain a low-probability event or won't last long. But that doesn't explain why the broad market is expressing a larger measure of concern. Oil is down 12% since the announcement. Treasury yields are down 33 basis points at the front-end and more than a full rate cut has been priced in over the past week alone.

The market is thinking this isn't a Mexico-only problem. The message is that Trump is increasingly willing to turn to tariffs. On Thursday he said “the higher tariffs go, the higher the number of companies that will move back to the USA.”

Could markets be coming to terms with the idea that Trump really believes in tariffs and that they benefit the US? That sentiment is being extended to China and European autos and to any other potential dispute that might come up in Presidency. He really is Tariff Man.

He said Thursday that he will decide on more Chinese tariffs in two weeks and half his administration is going to try to talk him out of it but we have to assume a better-than-50% chance he does it. In the short-term, if a deal is done to avert tariffs on Mexico, watch for how he frames it. If he comes out afterwards and says 'tariffs work and that's why we got a deal' then the entire exercise starts to look like a PR campaign for tariffs – an effort to boost support for the tariff war to come.

First, the market will be looking to Friday's non-farm payrolls report. The economist consensus is +180K but the market is undoubtedly braced for something worse after ADP data showed the worst jobs growth in nine years. Anything better than 140K will be a sigh of relief for markets. At the same time, watch out if it's above 220K because a number that strong may rattle belief in a rate cut.