Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

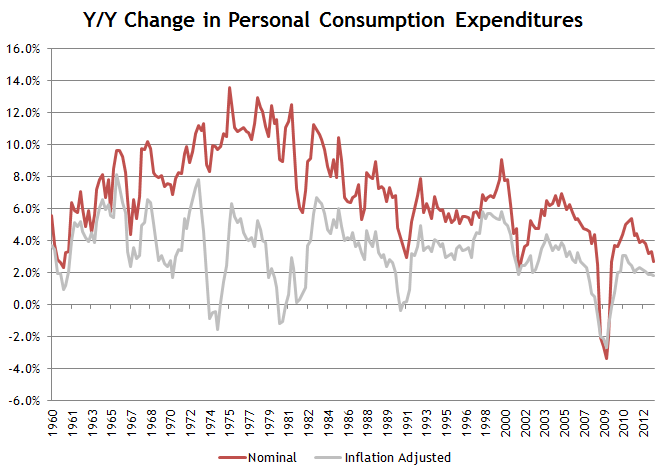

Last week’s personal income data released by the BEA showed that personal consumption expenditures grew year over year at the slowest pace this cycle on both a nominal and inflation adjusted basis. The nominal (not inflation-adjusted) data is particularly troublesome because the increase was the slowest growth outside of a recession going back to 1959.

The main reason for the weak nominal growth is due to weak inflation. To an economist that’s not that big of a deal since “real” consumption growth is what drives general welfare. But to a securities analyst focused on equities, the lack of inflation could pose a headwind for earnings growth. Earnings and revenue are nominal, not inflation-adjusted numbers. If top-line consumption is only growing 2.5% then 10% earnings growth, which is what analysts are currently forecasting, is going to be hard to come by.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Original post