Following Tuesday’s falls we saw somewhat of a bounce backyesterday although the positivity was not enough to wipe out the earlier losses. Policy makers in Europe were quick to calm markets with one member of the ECB suggesting that the central bank may buy Spanish debt through its SMP programme like it did with Italian paper. This bolstered Italian and Spanish equities in particular and while they also saw their bond yields come lower but, once again, they remain at significantly elevated levels (5.5% and 5.85% respectively).

The closely watched bond auctions had their impact usurped by the comments suggesting central bank support for Spanish assets although both auctions were disappointing. The yields on Italian 1 year money doubled to 2.84% from the previous auction in Italy while Germany’s auction was “technically uncovered” i.e. not enough buyers were found for their debt.

This is fortunately not to do with any doubts over the stability or health of the German financial system and more to do with the pricing. Investors were unwilling to pump money into a 10 year bond paying a yield of only 1.7% while the risk of the Eurozone remains.

Italy is active in the auction markets once again today and once again will be closely followed.

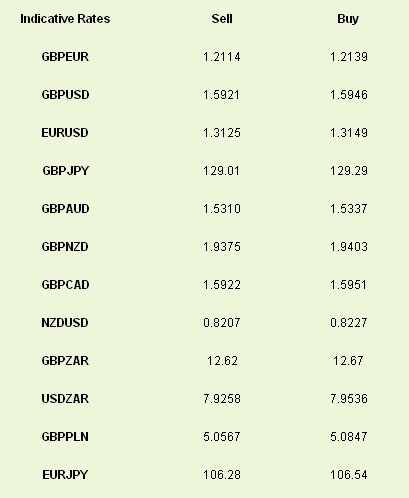

The euro has not been a significant mover on these flows however with crosses against the single currency remaining range-bound since we returned from the long weekend. The main losers yesterday were the typical ‘haven’ currencies of JPY and USD but the euro does remain vulnerable in the short term and, as we said yesterday, is only 30bps away from recent highs in GBPEUR terms.

The impact of the Indonesian earthquake was slight yesterday. Traders, upon seeing the magnitude of the event, had been fearful that we may have been in for a similar day as the day of last year’s quake off the Japanese coast. Thankfully these fears proved to be ill-founded and the market, and human, cost seems to be little.

We finally get some economic news today following a couple of sessions fuelled by price action as opposed to fundamental data. The most closely watched number will the US initial jobless claims figure due at 13.30 which is expected to show a continuing trend of deterioration in the number of people claiming unemployment benefits stateside. This will directly link into the market’s mind-set as to whether further asset purchases are likely in the future. The market is looking for 355k.

We also have details of the UK trade balance at 09.30 and Eurozone industrial production due at 10.00.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Periphery Bonds Bounce Back

Published 04/12/2012, 06:54 AM

Updated 07/09/2023, 06:31 AM

Periphery Bonds Bounce Back

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.