Investing.com’s stocks of the week

We spoke last week of a feeling of the markets returning to a 2011 stance; peripheral bond yields moving higher and global assets pitching lower on fears from the Eurozone. If last week gave us a feeling, yesterday was an exact facsimile.

The European reaction to the poor US jobs number was understandably negative however, the issue was compelled by growth fears for the periphery following the Spanish government’s admission that another EUR10bn of savings i.e. further austerity would be needed but few details of where the money would be coming from. The straw that broke the camel’s back however was the Spanish Minister for the Economy and Competition Luis de Guindos refusing to rule out the possibility that Spain would ask for a bailout. Then all hell broke loose…

The fear of contagion and the acknowledgement that should Spain ask for a bailout Italy will be left swinging in the wind saw equities tumble, in particular banking shares, and yields spike back to the levels seen before the ECB’s LTRO lending operations which had been heralded as a saviour. Unfortunately the patient is stirring and the latest injection of painkillers have worn off; further pain will likely be on its way.

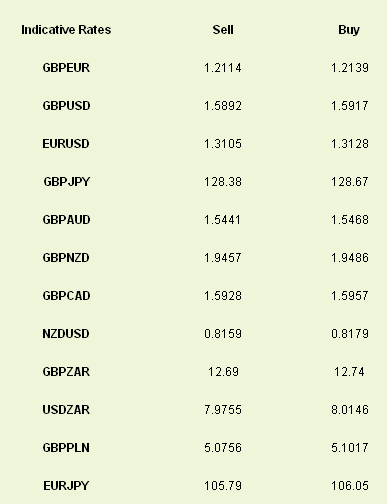

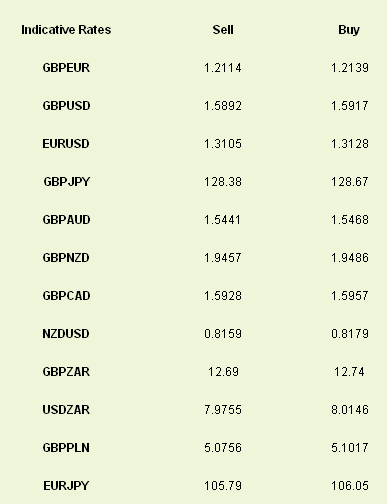

One asset that stayed relatively unbowed despite this was the euro. GBP/EUR remained around the 1.21 level through the session whilst EUR/USD, despite spending a good part of the day below 1.31 has now recovered.

Luckily enough the data calendar is once again quiet during the European session, allowing the market to focus on scheduled German and Italian bond auctions. Italy are looking to get rid of 3 month and 1 year debts while Germany is flogging 10 year money. These, plus Spanish industrial production due at 08.00 will govern the market movement after an Asian session that chased European losses lower.

The chatter will now move from, when will the Federal Reserve increase its asset purchases to, when will the ECB decide to inject more cash into the ailing European economy. I think that it is only right that, should we seeing similar headlines from Europe following negative Q1 GDP estimates, then the Bank of England may decide to go for a pre-emptive strike.

Sterling has slipped higher overnight following the British Retail Consortium’s measure of retail sales showing growth of 1.3%. The good weather in March is being touted as the main reason but obviously is not a recipe for sustainable gains. GBP/EUR is only 30pips from the highs of September 2010 as a result.

The European reaction to the poor US jobs number was understandably negative however, the issue was compelled by growth fears for the periphery following the Spanish government’s admission that another EUR10bn of savings i.e. further austerity would be needed but few details of where the money would be coming from. The straw that broke the camel’s back however was the Spanish Minister for the Economy and Competition Luis de Guindos refusing to rule out the possibility that Spain would ask for a bailout. Then all hell broke loose…

The fear of contagion and the acknowledgement that should Spain ask for a bailout Italy will be left swinging in the wind saw equities tumble, in particular banking shares, and yields spike back to the levels seen before the ECB’s LTRO lending operations which had been heralded as a saviour. Unfortunately the patient is stirring and the latest injection of painkillers have worn off; further pain will likely be on its way.

One asset that stayed relatively unbowed despite this was the euro. GBP/EUR remained around the 1.21 level through the session whilst EUR/USD, despite spending a good part of the day below 1.31 has now recovered.

Luckily enough the data calendar is once again quiet during the European session, allowing the market to focus on scheduled German and Italian bond auctions. Italy are looking to get rid of 3 month and 1 year debts while Germany is flogging 10 year money. These, plus Spanish industrial production due at 08.00 will govern the market movement after an Asian session that chased European losses lower.

The chatter will now move from, when will the Federal Reserve increase its asset purchases to, when will the ECB decide to inject more cash into the ailing European economy. I think that it is only right that, should we seeing similar headlines from Europe following negative Q1 GDP estimates, then the Bank of England may decide to go for a pre-emptive strike.

Sterling has slipped higher overnight following the British Retail Consortium’s measure of retail sales showing growth of 1.3%. The good weather in March is being touted as the main reason but obviously is not a recipe for sustainable gains. GBP/EUR is only 30pips from the highs of September 2010 as a result.