USD/JPY" title="USD/JPY" height="242" width="474">

USD/JPY" title="USD/JPY" height="242" width="474">

The USD/JPY has surprised me over the past week. Despite the US economy witnessing a QE taper, GDP expansion over 3.2% and Consumer Confidence scoring a 5-month high, the USD/JPY continued to lower.

With the latest Japanese Consumer Price Index (Inflation) data confirming that Abenomics may finally be making progress, I am looking for this pair’s recent bullish run to come to a halt and for this period of selling to continue.

The JPY was a surprise upward mover last week, with the Bank of Japan (BoJ) refraining from adding any further QE to their economy in January. At first, this raised a few eyebrows, because further QE was expected. However, Thursday’s inflation release revealed that Japanese inflation increased to 1.3% last year, over half way to the BoJ’s 2% target. This suggests to me that future QE from the BoJ will be put off for the foreseeable future, allowing the JPY to continue to strengthen.

The JPY is also benefiting from concerns emerging regarding Chinese economic growth. China has come under heavy fire recently, following their manufacturing PMI’s unexpectedly contracting, alongside their banks being criticised for issuing subprime loans. Over the weekend, China’s manufacturing gauge scored a 6-month low reading and It would not surprise me if the JPY continues to receive backing, while China is under the microscope.

The USD suffered losses on Monday, following their Manufacturing ISMscoringfar below the 56.5 expectations. Bearing in mind that manufacturing is an essential contributor to the US labour market, there are fears that Friday’s NFP could be weakened by the surprise slowdown in manufacturing.

Equally, there is anxiety that October’s famous US debt ceiling fiasco could be revisited this month, following US Treasury Secretary, Jack Lew revealing that the US could still default on their debts, if congress do not agree to raise its borrowing limit. Right now, it appears that another government shutdown is very unlikely, however any threat of the US defaulting on their loans, will plummet the value of the USD.

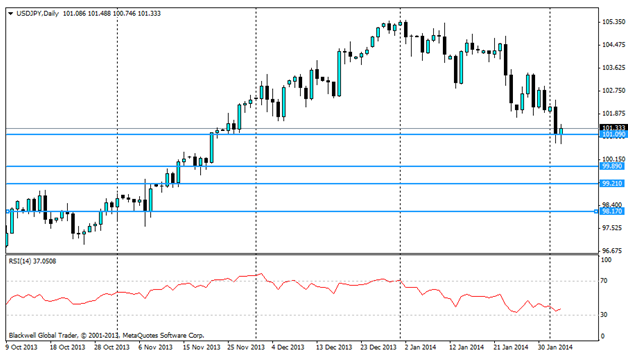

Regarding my technical observations for this pair, the USD/JPY Is currently edging towards the 101.900 support level. If the USD unexpectedly weakens, or the JPY strengthens, then I can see future support levels at 99.890, 99.210 and 98.170. I understand that the latter support level is nearly 300 pips away. However, if Monday’s poor manufacturing ISM’s are detrimental to Friday’s NFP result, then sudden bearish movement is not completely unachievable.

Overall, Japan’s latest inflation release was a major sign that Abenomics may finally be making progress. With inflation levels now on track to achieving the BoJ’s target, further easing may be put on hold. This will strengthen the JPY. In reference to the USD, if this debt ceiling scenario does erupt again, then I can envisage the greenback suffering similar losses to what they witnessed in October.