PepsiCo, Inc. (NYSE:PEP) reported better-than-expected second quarter 2016 results with earnings beating the Zacks Consensus Estimate while sales missing expectations narrowly.

Despite the global macro challenges, Pepsi has been doing well due to its significant innovation, revenue management strategies, improved productivity and better market execution.

Moreover, this Purchase, NY-based food/beverage giant raised its full year earnings growth target. Shares rose around 1.8% in pre-market trading.

Earnings Beat

Pepsi’s second-quarter core earnings per share (EPS) of $1.35 beat the Zacks Consensus Estimate of $1.28 by 5.5%.

Earnings rose 2% year over year despite currency headwinds eroding sales.

Currency hurt earnings by 3.5%. In constant currency terms, adjusted earnings grew 6% on strong margins and a decent sales growth.

Since the fourth quarter of 2015, Pepsi is no longer consolidating the results of its Venezuelan operations in its financial statements. The Venezuela deconsolidation hurt EPS by 3%.

Notably, core earnings exclude restructuring and impairment charges and also commodity mark-to-market net impact. Including this item, reported earnings came in at $1.38 per share, up 4% year over year.

Sales Discussion

Total sales declined 3.3% year over year to $15.40 billion. Foreign exchange (Fx) hurt revenue growth by 4% while Venezuela deconsolidation had a 2.5% negative impact on sales. Revenues marginally missed the Zacks Consensus Estimate of $15.41 billion by 0.1%.

Excluding the impact of Fx and Venezuela deconsolidation, revenues increased 3.3% on an organic basis. However, organic sales growth was slightly softer than the 3.5% rise recorded in the previous quarter.

While North America snacks segment volumes remained strong, it declined for the beverages in North America and Latin America.

Pepsi witnessed an effective net pricing gain of 2%, same as the past quarter. The inflation-based pricing benefits in Venezuela are no longer available as Pepsi does not include the results of its Venezuelan subsidiaries since the past couple of quarters.

Volumes grew 2%, same as the previous quarter. While organic snacks/food improved from the last quarter, growing 2.5%, beverage volumes were softer than last quarter, rising 2%.

Organic volumes grew 2% in the Frito-Lay segment, higher than 1% last quarter. Organic volumes grew 3% in Quaker Foods, another American snacks business, while it was a decline of 2% in the previous quarter. Organic snacks volumes rose 2% in the Latin America segment and 4% in Asia, Middle East and North Africa (AMENA), both softer than the last quarter. Organic snacks volume rose 3% in the Europe Sub-Saharan Africa (ESSA) segment softer than 1% in the last quarter.

Organic beverage volumes rose 4% in ESSA, better than last quarter. It declined 2% in Latin America, worse than last quarter. In AMENA, beverage volumes remained stable at 5%. Beverage volumes declined 1% in the North Americas Beverages segment, softer than an increase of 1% in the previous quarter.

Cross-category competition and growing health and wellness consciousness among consumers have been hurting the demand for carbonated beverages of Pepsi as well as other soft drink companies including The Coca-Cola Company (NYSE:KO) and Dr Pepper Snapple Group, Inc. (NYSE:DPS) . Consumers have become cautious about the high sugar content of these drinks and the related obesity concerns. Diet drinks are also under pressure due to an increasing consumer concern regarding the use of artificial sweeteners.

Margins Rise

Core gross margins improved 75 basis points (bps) backed by higher pricing, effective revenue management strategies and productivity gains. Lower costs of key raw materials have also benefited margins.

Core constant currency operating profit rose 4% to $2.91 billion despite the negative impact of Venezuela deconsolidation. Core operating margins rose 80 bps as higher gross margin gains and cost reductions offset higher marketing costs. Advertising and marketing expenses, as a percentage of sales, rose 50 bps in the second quarter.

The core effective tax rate was 26.0%, same as the year-ago.

2016 EPS Growth Outlook Slightly Up

While Pepsi maintained its previously issued sales guidance for 2016, it slightly raised its earnings growth guidance.

Pepsi expects core constant currency earnings per share (excluding Venezuela deconsolidation) to increase 9%, higher than 8% expected previously. Currency and Venezuela deconsolidation are likely to impact earnings per share by 4% and 2%, respectively.

Including the headwinds from Venezuela deconsolidation and currency volatility, earnings are expected to increase 3% to $4.71 per share, higher than $4.66 previously.

Excluding headwinds from currency and structural changes, organic revenues are expected to rise 4%, excluding the impact of an extra week this year. Currency is projected to hurt revenues by 4%, while the 53rd week is expected to add 1% to sales growth.

Commodity inflation is expected in the low single-digit range (including the transaction-related Fx impact). Productivity savings are anticipated to be approximately $1 billion.

Also, management plans to return $7 billion to shareholders through dividends and share repurchases.

Zacks Rank

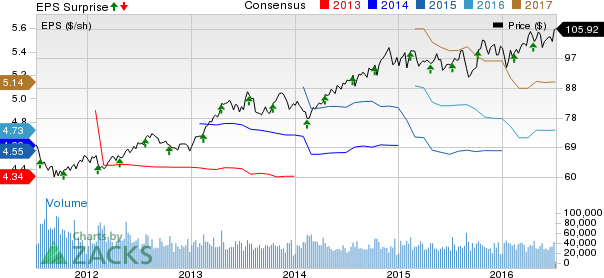

Pepsi carries a Zacks Rank #2 (Buy). Another beverage stocks worth considering is Primo Water Corp. (NASDAQ:PRMW) , which enjoys the same rank as Pepsi.

COCA COLA CO (KO): Free Stock Analysis Report

DR PEPPER SNAPL (DPS): Free Stock Analysis Report

PEPSICO INC (PEP): Free Stock Analysis Report

PRIMO WATER CP (PRMW): Free Stock Analysis Report

Original post

Zacks Investment Research