It has been about a month since the last earnings report for People's United Financial, Inc. (NASDAQ:PBCT) . Shares have lost about 5.7% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

People's United Beats on Q2 Earnings, Revenues Rise

People's United’s second-quarter 2017 operating earnings of $0.24 per share beat the Zacks Consensus Estimate by $0.01. The reported figure was up 4% year over year.

Results reflected higher revenues and lower provisions. Growth in loans and deposits were the tailwinds. However, rise in expenses and decline in profitability ratios were the undermining factors.

Net income came in at $69.3 million or $0.19 per share compared with $68.5 million or $0.23 per share in the prior-year quarter.

Revenues & Expenses Rise

Net revenue, on a fully taxable basis, was up 13% year over year to $376.8 million in the quarter.

Net interest income, on a fully taxable basis, totaled $285.2 million, up 15.1% year over year. Further, net interest margin improved 9 basis points (bps) year over year to 2.90%.

Non-interest income climbed 7.3% year over year to $91.6 million. The rise was primarily attributable to higher investment management fees, commercial banking lending fees, operating lease income and insurance revenues.

Non-interest expenses increased 21% on a year-over-year basis to $257.3 million. Rise in compensation and benefits, professional and outside services, regulatory assessments and other non-interest expenses were the main factors responsible for the significant increase in expenses.

As of Jun 30, 2017, total loans were $31.6 billion, up 6.4% from the prior quarter. Further, total deposits increased approximately 4.3% to $31.8 billion from the prior quarter.

Credit Quality: A Mixed Bag

As of Jun 30, 2017, non-performing assets were $198.1 million, up 8.8% year over year. Ratio of non-performing loans to total originated loans increased 4 bps from the prior-year quarter to 0.60%.

However, net loan charge-offs decreased 4% year over year to $4.9 million and provision for loan losses was $7.8 million, down 25.7% year over year.

Capital Position Strengthens, Profitability Ratios Decline

Capital ratios of People’s United displayed improvement. As of Jun 30, 2017, total risk-based capital ratio climbed to 12.6% from 11.5% in the year-ago quarter. Further, tangible equity ratio was 7.5%, up from 7.2% in the year-ago quarter.

The company’s profitability ratios deteriorated. Return on average tangible stockholders’ equity was 8.7%, down from 10.1% in the prior-year quarter. Return on average assets of 0.65% was down from 0.70% in the year-ago quarter.

2017 Outlook (including the Suffolk Bancorp acquisition and excluding LEAF acquisition)

Management projects loan portfolio to grow in the range of 11–13%. Deposits are expected to grow 12–14%.

Net interest income is projected to grow in the range of 12–14%. This is based on the expectation of NIM to be in the range of 2.9–3%. Further, the company expects non-interest income to rise 5–7%.

Management expects expenses (excluding merger-related expenses) to be in the range of $930-$940 million.

The company expects to maintain excellent credit quality with provisions in the range of $25–$30 million.

The company expects Tier 1 leverage ratio to be between 8% and 8.5%. Common equity tier 1 ratio is estimated to be 9.5–9.7%.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed an upward trend in fresh estimates. There has been one revision higher for the current quarter in the past month. While looking back an additional 30 days, we can see even more upward momentum. There have been four upward revisions in the last two months.

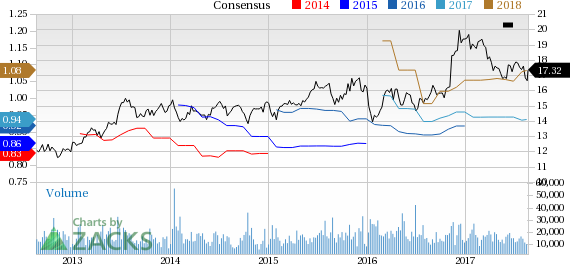

People's United Financial, Inc. Price and Consensus

VGM Scores

At this time, People's United's stock has a poor Growth Score of F, however its Momentum is doing a bit better with a D. Following the exact same course, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of F. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate investors will probably be better served looking elsewhere.

Outlook

While estimates have been broadly trending upward for the stock, the magnitude of these revisions has been net zero. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

People's United Financial, Inc. (PBCT): Free Stock Analysis Report

Original post

Zacks Investment Research