The US is still knee-deep in the first wave of COVID-19. So, gold should be still knee-deep in a wave of bullishness.

"Really not good." This is how Dr Anthony Fauci, the leading US expert in infectious diseases and the member of the White House Coronavirus Task Force, described the current state of the epidemic in America.

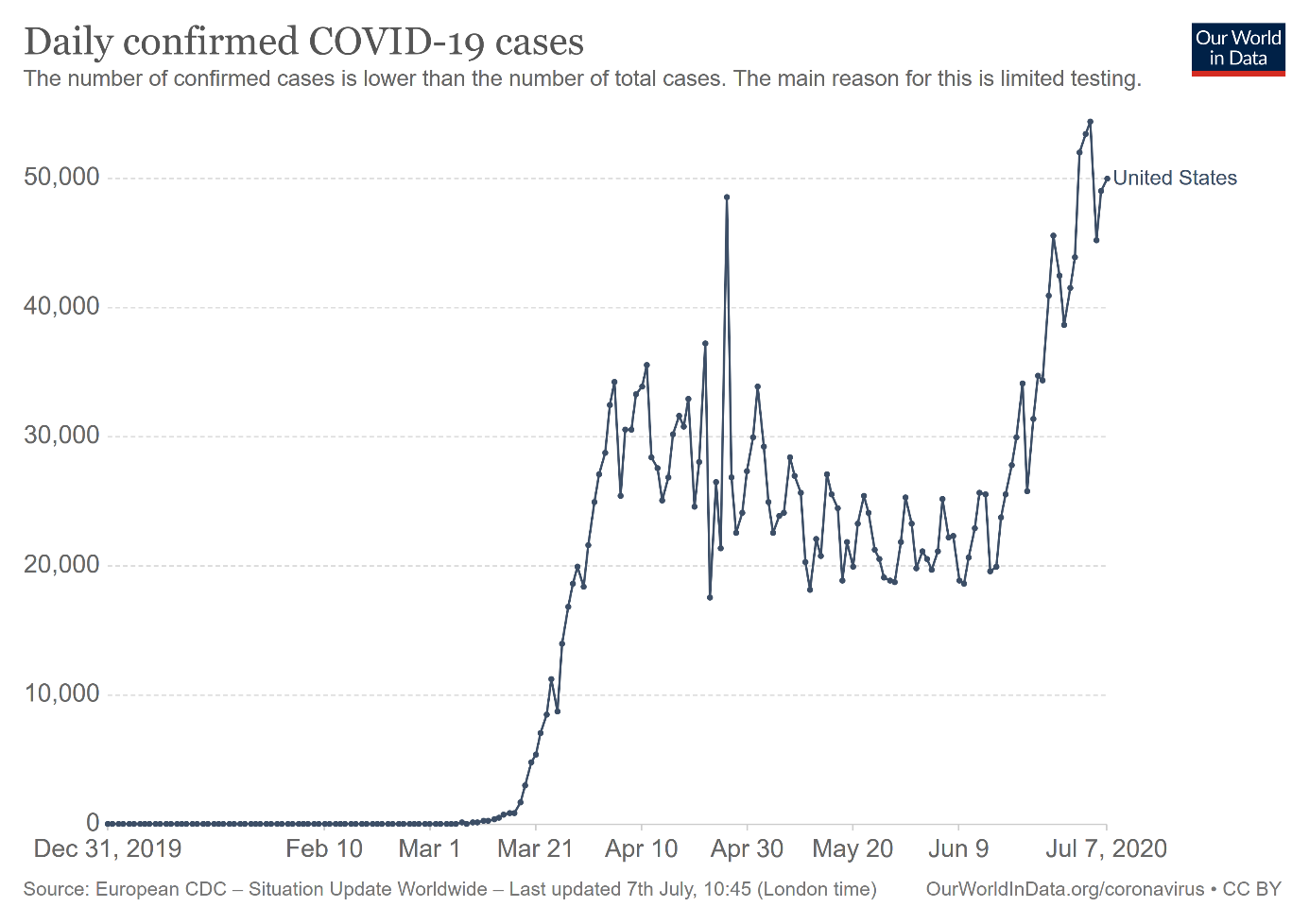

Fauci is right. Take a look at the chart below. The number of new daily confirmed cases of COVID-19 has surged recently, surpassing the April peak and jumping above 50,000. Since the beginning of the pandemic, almost 3 million Americans have become infected and more than 130,000 have died in the US as a result.

The surge in coronavirus cases across the United States has made people worry again. Raphael Bostic, Atlanta Fed President, said on Tuesday:

"We are hearing it more and more as we get more data. People are getting nervous again. Business leaders are getting worried. Consumers are getting worried. And there is a real sense this might go on longer than we have planned for."

Indeed, more and more states and countries are rolling back the re-opening of their economies, or even re-imposing lockdowns. For example, Melbourne, Australia's second biggest city, ordered its residents to stay in their homes for six weeks due to a resurgence in infections. In the US, New York expanded its travel quarantine for visitors from three more states, while Florida's greater Miami area rolled back reopening.

However, the White House is pushing the country to fully reopen, as President Trump said on Tuesday that the US is "not closing, we'll never close". Given the resurgence in new cases, such calls are controversial. Another full lockdown is, of course, absurd, and the incidence of deaths from COVID-19 is declining, but this is because the new infections are mainly occurring in younger people. But if coronavirus spreads wider, the daily number of deaths may rise again.

Implications For Gold

What does it all mean for the gold market? The longer the outbreak of COVID-19 lasts and threatens to undermine the economy, the longer safe-haven demand for gold will remain in place. Moreover, until the health crisis is fully resolved, economic activity will be subdued, while both the Fed and the Treasury will stick to ultra-easy monetary and fiscal policy. After all, a resurgence in coronavirus cases makes Americans more cautious, hampering consumer spending and GDP growth.

It will also make the disconnect between the real economy and financial markets even larger. Importantly, some US government stimulus programs will expire at the end of July, so either economic growth will slow, or there will be a fresh round of fiscal and monetary stimulus. Given the upcoming presidential elections, a new round of support is likely, which should raise worries about the level of the fiscal deficit, federal debt and inflation, all of which supports gold.

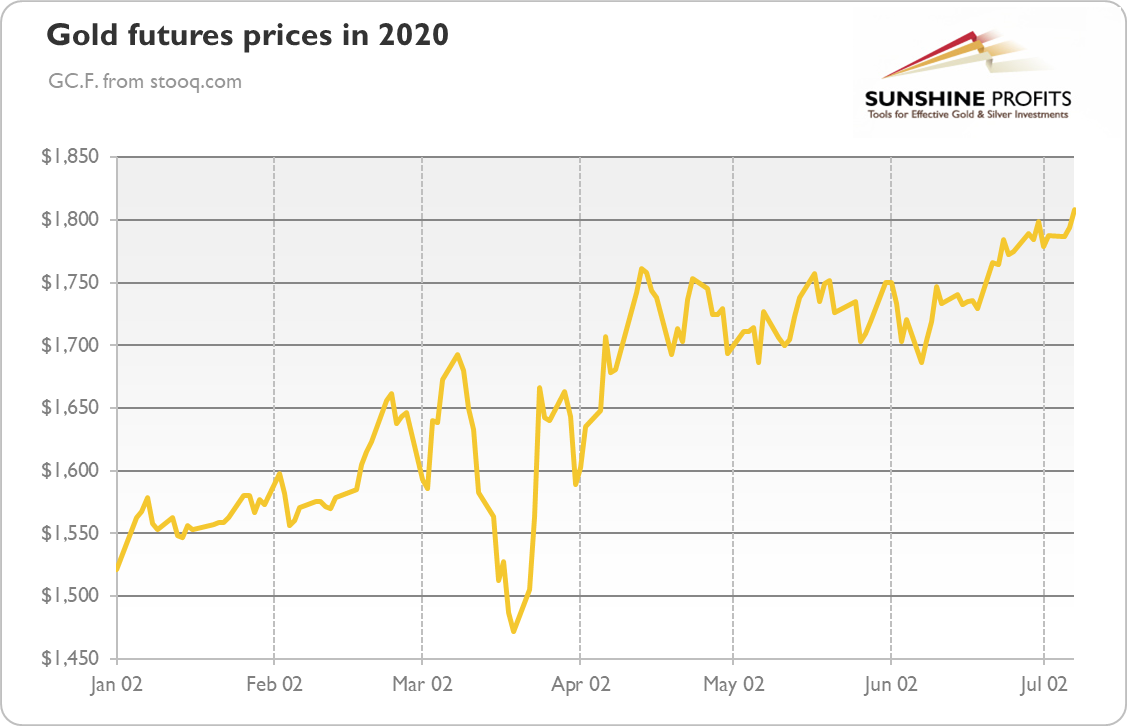

Not surprisingly, gold has been gaining steadily. The price jumped above $1,800 yesterday.

Of course, it remains to be seen whether the price will stay above $1,800 for long. But even if it retraces some gains in the near future, in the current macroeconomic environment, a longer march higher is a matter of time.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.