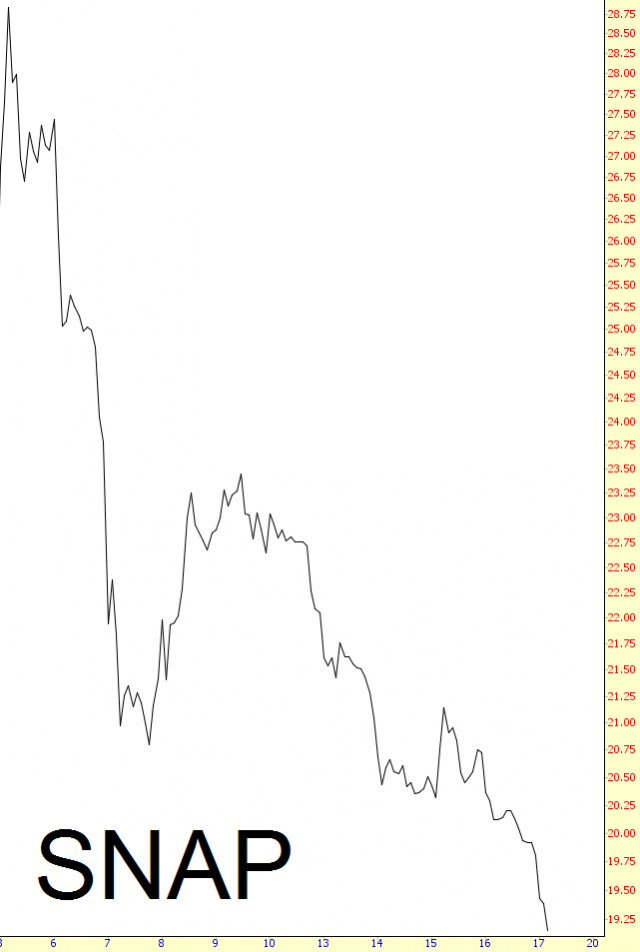

Since I’ve been having an unexpectedly grand old time being a SNAP Inc (NYSE:SNAP) permabear, I thought I’d share some thoughts this Friday evening about the nature of a financial instrument which basically does nothing but go down.

As you might expect, it’s essentially an upside-down version of why stocks reaching lifetime highs tend to simply keep going on to more new highs. For stocks like SNAP, the situation is this:

(1) Everyone who has ever bought the company in the public markets is in a losing position;

(2) As the stock continues to drop in value, the pain for those holding on to the stock continues to increase. Since a wide variety of people, with an equally wide variety of tolerance to financial pain, exist among the shareholders, you’re going to have a steady stream of sellers shouting “Uncle!” and dumping their shares to stop the pain;

(3) As this selling continues to exacerbate the weakness, it feeds on itself;

(4) Only until some exogenous event jolts the stock higher, infusing hope into the beleaguered owners, the stock will just keep obeying gravity. Such an “event’ might be a strong buy recommendation from a respected analyst, a surprise product announcement, or an exceptionally good earnings report. In SNAP’s brief history as a public enterprise, none of these things have happened yet, so it’s basically been one uninterrupted poo festival.

I chickened out Friday and took my profits (again) on SNAP, since a stock with so little history could definitely shock to the upside, but I continue to feel that there’s no meaningful floor to this instrument yet, and for all we know, it could be a single-digit stock before this year is over.