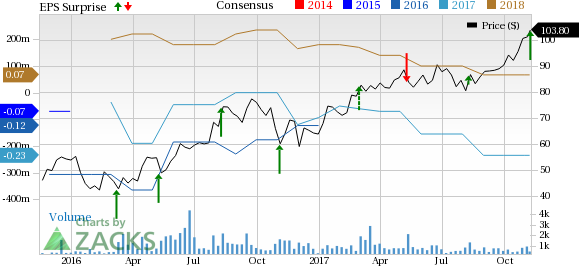

Penumbra, Inc. (NYSE:PEN) reported third-quarter 2017 earnings per share of a penny, comparing favorably with a loss of 4 cents in the year-ago quarter. The figure is also better than the Zacks Consensus Estimate of a loss of 7 cents.

Revenues in the reported quarter rose 24.9% year over year (up 24.1% at constant exchange rate or CER) to $83.9 million, exceeding the Zacks Consensus Estimate of $79 million.

On a geographic basis, third-quarter revenues in the United States (representing 66.3% of total sales) grossed $55.7 million, up 25.4% from the year-ago quarter (same at CER). Meanwhile, international sales (33.7% of total sales) advanced 23.9% year over year (up 21.5% at CER) to $28.3 million.

Going by product category, revenues from neuro products grew 23.4% (up 22.5% at CER) to $58.7 million in the quarter under review. Revenues from peripheral vascular product business rose to $25.2 million in the third quarter, reflecting an increase of 28.4% (up 27.8% at CER) year over year.

Operational Update

Penumbra’s third-quarter gross margin was 65.3%, reflecting a 147-basis point (bps) expansion year over year. Gross profit rose 27.8%.

Research and development expenses totaled $8.1 million, up 25.2%, while sales, general and administrative expenses amounted to $45.9 million, up 21.8% year over year. Operating profit in the reported quarter came in at $0.7 million, comparing favorably with the operating loss of $1.3 million in the prior-year quarter.

Financial Update

Penumbra exited the third quarter of 2017 with cash and cash equivalents of $65.6 million as compared with $76.6 million at the end of the second quarter.

Our Take

Penumbra exited third-quarter 2017 with better-than-expected results. The year-over-year comparison of earnings was favorable. Moreover, the company witnessed strong growth across all geographies and product lines. The company is focusing on product innovation through research and development.

Penumbra is an active player in the fast-growing interventional therapies space. In fact, the company’s products primarily cater to the unmet clinical needs in two major markets — neuro and peripheral vascular.

Zacks Rank & Key Picks

Penumbra has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader medical sector are PetMed Express, Inc. (NASDAQ:PETS) , Luminex Corporation (NASDAQ:LMNX) and Intuitive Surgical, Inc. (NASDAQ:ISRG) . Notably, PetMed and Luminex sport a Zacks Rank #1 (Strong Buy), while Intuitive Surgical carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed reported earnings per share of 43 cents in the second quarter of fiscal 2018, up 79.2% from the year-ago quarter’s 24 cents. Also, gross margin expanded 548 bps year over year to 35.2% in the reported quarter.

Luminex reported adjusted earnings per share of 19 cents in the third quarter of 2017, up 216.7% year over year. Revenues increased almost 4.1% year over year to $74.1 million.

Intuitive Surgical posted adjusted earnings of $2.77 per share in the third quarter of 2017, up 34.5% year over year. Revenues rose 18% year over year to $806.1 million.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

Penumbra, Inc. (PEN): Free Stock Analysis Report

Original post

Zacks Investment Research