Pentair plc (NYSE:PNR) is scheduled to report second-quarter 2017 results before the market opens on Jul 25.

Last quarter, the company delivered a positive earnings surprise of 6.56%. Pentair has surpassed the Zacks Consensus Estimate in each of the trailing four quarters, generating an average positive surprise of 5.29%.

Let’s see how things are shaping up prior to this announcement.

Factors to Consider

Pentair expects the second-quarter 2017 adjusted EPS guidance in the range of 97–99 cents. The company projects second-quarter revenues to be approximately $1.24 billion, which would be down approximately 5% on a reported- and core-basis compared to second-quarter 2016 revenues. Strengthening of the U.S. dollar, material and other cost inflation and lower oil prices remain headwinds for its second quarter performance.

In the Electrical & Fastening Solutions business, Pentair is looking at additional price increases to help mitigate the cost inflation. After a challenging second half of 2016, the company’s Electrical segment’s order trends remain solid. It anticipates the business to improve in the quarter to be reported.

The company also continues to record sound growth in the biogas business, which further showed signs of strengthening earlier this year on the back of the Union Engineering acquisition. In addition, Pentair’s Aquatic & Environmental Systems business is poised to grow on industry strength, constant dealer wins and strategic product innovations.

Earnings Whispers

Our proven model does not conclusively show that Pentair is likely to beat estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. This is not the case here, as you will see below:

Zacks ESP: Earnings ESP for Pentair is 0.00%. This is because the Most Accurate estimate and the Zacks Consensus Estimate are both pegged at $1.00. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Pentair currently has a Zacks Rank #2 (Buy) which increases the predictive power of ESP. However, the company’s ESP of 0.00% makes surprise prediction difficult.

Conversely, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

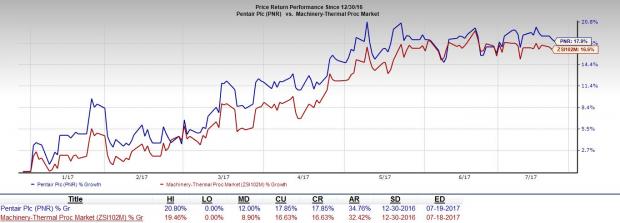

Share Price Performance

Year to date, the company’s shares yielded a return of 17.9%, outperforming 16.6% growth recorded by the Zacks categorized Machinery-Thermal Products industry.

Stocks That Warrant a Look

Here are some other stocks you may want to consider, as according to our model they also have the right combination of elements to post an earnings beat this quarter.

Belden Inc. (NYSE:BDC) , with an Earnings ESP of +0.83% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

AptarGroup, Inc. (NYSE:ATR) , with an Earnings ESP of +1.04% and a Zacks Rank #2.

Avery Dennison Corporation (NYSE:AVY) , with an Earnings ESP of +1.68% and a Zacks Rank #2.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Belden Inc (BDC): Free Stock Analysis Report

AptarGroup, Inc. (ATR): Free Stock Analysis Report

Avery Dennison Corporation (AVY): Free Stock Analysis Report

Pentair PLC. (PNR): Free Stock Analysis Report

Original post