Pentair plc (NYSE:PNR) reported second-quarter 2017 adjusted earnings of $1.00 per share, up 13.6% from the year-ago quarter. Earnings came in line with the Zacks Consensus Estimate. The figure also came ahead of management’s guidance range of 97–99 cents.

Including one-time items, the company reported earnings of 37 cents per share, down 49% from 73 cents recorded in the year-ago quarter.

Net sales decreased 3% year over year to $1.265 billion. The figure marginally missed the Zacks Consensus Estimate of $1.269 billion. Excluding the unfavorable impact of currency translation, core sales declined 3%.

Cost of sales declined 4.6% to $782 million in the quarter from $819.4 million recorded in the year-ago quarter. Gross profit in the reported quarter was $483.2 million, up 0.3% from $481.8 million recorded in the prior-year quarter. Gross margin expanded 120 basis points (bps) year over year to 38.2% in the quarter.

Selling, general and administrative expenses dropped 3.2% year over year to $241.7 million. Research and development expenses remained flat year over year at $28.7 million. Adjusted operating income went up 6% to $255 million from $241 million recorded in the year-ago quarter. Operating margin advanced 170 bps to 20.2%.

Segmental Performance

Sales from the Water Quality Systems segment edged down 1% year over year to $753.7 million. Operating earnings increased 4.8% to $161 million.

The Electrical segment reported revenues of $513.2 million, down 5% from the year-earlier quarter. Segment operating earnings were up 1% year over year to $112.8 million.

Financial Update

Pentair had cash and cash equivalents of $177.8 million at the end of second-quarter 2017 compared with $238.5 million at the end of 2016. The company recorded cash from operations of $210.9 million for the six-month period ended Jun 30, 2017, compared with $320.9 million recorded in the comparable period last year.

Free cash flow usage was $177 million for the six-month period ended Jun 30, 2017, compared with $264.5 million in the prior-year period. Pentair paid dividends of 34.5 cents per share in second-quarter 2017. In Dec 2016, Pentair approved a 3% hike in the annual cash dividend rate for 2017 to $1.38.

During the second quarter, Pentair successfully completed the previously announced sale of its Valves & Controls business, and with the proceeds reduced its debt by approximately $3 billion.

Pentair previously announced that its board of directors had unanimously approved a plan to separate into it two publicly-traded companies. Significant work is underway on all activities leading to the separation of its Water and Electrical businesses. The separation is expected to occur through a tax-free spin-off of Electrical segment by Pentair to its shareholders in second-quarter 2018.

Guidance

Pentair updated its full-year 2017 adjusted EPS guidance to $3.50 on the back of revenues of $4.9 billion. It also guided third-quarter 2017 adjusted EPS guidance range of 91–93 cents. The company expects third quarter revenue to be approximately $1.22 billion, up approximately 1% on a reported and core basis compared to third-quarter 2016 revenue. Pentair is targeting to deliver full-year free cash flow of 100% of adjusted net income.

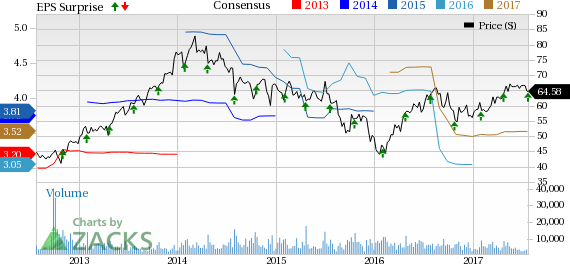

Share Price Performance

Pentair has outperformed the industry with respect to price performance year to date. The stock gained 15.2%, while the industry recorded growth of 14.8% over the same time frame.

Zacks Rank and Other Key Picks

Pentair currently carries a Zacks Rank #2 (Buy).

Other top-ranked companies in the same sector are AGCO Corporation (NYSE:AGCO) , Apogee Enterprises, Inc. (NASDAQ:APOG) and Cimpress N.V. (NASDAQ:CMPR) , all three sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AGCO has expected long-term growth rate of 12.41%.

Apogee has expected long-term growth rate of 12.50%.

Cimpress has expected long-term growth rate of 17.50%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Apogee Enterprises, Inc. (APOG): Free Stock Analysis Report

AGCO Corporation (AGCO): Free Stock Analysis Report

Pentair PLC. (PNR): Free Stock Analysis Report

Cimpress N.V (CMPR): Free Stock Analysis Report

Original post

Zacks Investment Research