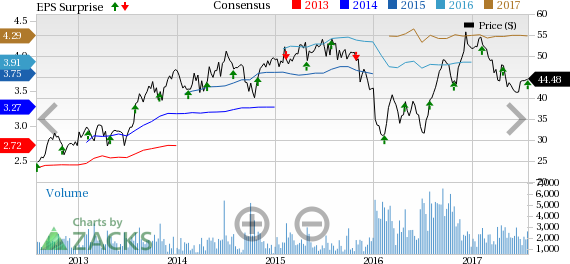

Penske Automotive Group Inc. (NYSE:PAG) recorded adjusted earnings of $1.27 per share in the second quarter of 2017, surpassing the Zacks Consensus Estimate of $1.20. Earnings per share at $1.23, inclusive of the impact of foreign exchange, posted the highest figure in the company’s history.

Net income rallied 12.5% to $106.9 million in the quarter from $95 million a year ago.

Revenues rose 2.5% year over year to $5.38 billion, thereby beating the Zacks Consensus Estimate of $5.33 billion. Excluding foreign exchange, revenues increased 6.6%, driven by the 4.2% rise in total retail automotive sales to 130,127 units. Same-store retail revenues declined 5.6% to 112,796 units.

Gross profit inched up 1.9% to $817.3 million from $771.3 million in second-quarter 2016. Operating income grew 4.8% to $172 million from $164.1 million in the year-ago quarter.

Penske Automotive Group, Inc. Price, Consensus and EPS Surprise

Segment Performance

The company operates under three reportable segments – Retail Automotive, Retail Commercial Trucks and Commercial Vehicles Australia/Power Systems and Other.

Revenues from Retail Automotive nudged up to $5.1 billion from the year-ago figure of $4.8 billion.

Revenues from Retail Commercial Trucks decreased to $228.5 million from $309.5 million recorded in the year-ago quarter.

Revenues from Commercial Vehicles Australia/Power Systems and Other increased to $114.2 million from $107.8 million in the year-ago quarter.

Financial Position

Penske Automotive had cash and cash equivalents of $20.7 million as of Jun 30, 2017, down from $24 million as of Dec 31, 2016. Long-term debt was $2 billion as of June 30, 2017, up from $1.8 billion as of Dec 31, 2016.

Dividend

On Jul 26, the company’s board members approved of a dividend of 32 cents per common share, payable on Sep 1, to shareholders of record on Aug 10.

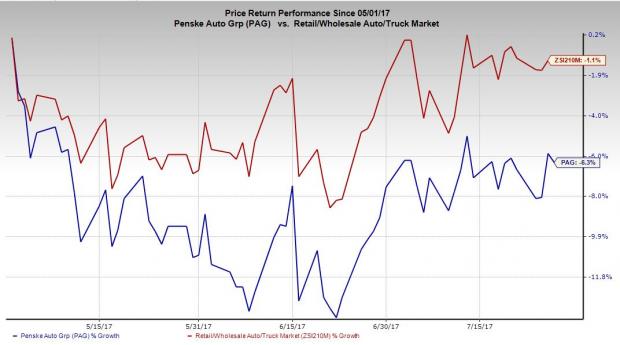

Price Performance

Penske Automotive shares have lost 6.3% in the last three months, significantly underperforming the 1.1% decline of the industry it belongs to.

Zacks Rank & Key Picks

Penske Automotive currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the auto space are Allison Transmission Holdings (NYSE:ALSN) , Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) and Daimler AG (OTC:DDAIF) , all stocks sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Allison Transmission has expected long-term growth rate of 11%.

Volkswagen has expected growth rate of around 17.3% over the long term.

Daimler has expected long-term growth rate of 2.8%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Penske Automotive Group, Inc. (PAG): Free Stock Analysis Report

Daimler AG (DDAIF): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Allison Transmission Holdings, Inc. (ALSN): Free Stock Analysis Report

Original post