On January 13, Google (GOOG) made a big splash into the home automation market by scooping up privately held Nest Labs for $3.2 billion.

The very next day, Nestor Inc. (NEST) – a Rhode Island-based company that traded over-the-counter for less than one penny – watched its stock soar 1,900%.

What gives? Investors confused the two companies, of course.

Not just a few investors, either. For two days in a row, close to two million shares of Nestor traded hands.

(And we wonder why Wall Street calls us the “dumb money!”)

It’s not even the only case of mistaken identity that we’ve seen recently.

Back in October 2013 – when social media darling, Twitter (TWTR), announced its highly anticipated IPO filing – investors bid up Tweeter Home Electronics Group (THEGQ) by 1,800%. (Its ticker symbol at the time was TWTRQ.)

Naturally, both penny stocks have since come crashing back down to Earth, handing thousands of investors big losses and a big dollop of embarrassment.

Forget the mix-ups, though. I’m not here to belabor the point that you should look twice before you hit the “Buy” button. That goes without saying.

Instead, I want to drive home how extremely sensitive penny stocks are to news – and, more importantly, why that’s a reality we can exploit for serious short-term profits…

Ever See a Stock Double Overnight?

Despite the misconception that all penny stocks are frauds, there are real companies – with actual businesses, sales and profits – that trade as penny stocks. Thousands of them, in fact.

Of the almost 19,000 stocks traded on all U.S. exchanges, roughly 6,000 are penny stocks, trading for less than $1 per share. And among those penny stocks, more than 2,000 are profitable, which is as real as it gets.

So what do you think happens when one of those penny stocks announces legitimate news? Well, shares often double (or more) overnight. And they don’t come crashing back down, either.

Want proof? Look no further than cloud-based videogame provider, TransGaming (TNG.V), which happens to be an active recommendation in our premium newsletter, WSD Insider.

On January 6, the company was trading for $0.19 per share, at a market cap roughly equal to its annual sales.

Then, on January 7, management announced its GameTree TV platform would be offered on smart televisions made by the $170-billion market cap Samsung, the world’s largest consumer electronics company.

Sure enough, the stock rocketed 105% higher on the news… in a single day.

Lest you think I’m merely cherry-picking an example, think again. Price doubles for penny stocks occur with incredible regularity.

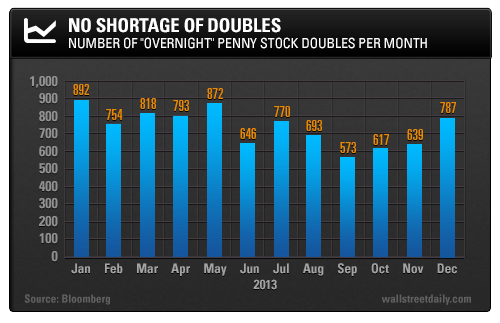

During any given month, there are upwards of 890 overnight doubles, which works out to an average of about 30 per day.

In fact, based on our analysis, it’s not uncommon for the number of overnight doubles to average as high as 40 per day – like they did in 2012.

Of course, with over 6,000 penny stocks trading on U.S. exchanges, the trick becomes distinguishing the good penny stocks from the mediocre (or the downright rotten).

It can be done, though. Our experience with TransGaming serves as the latest proof. Be sure to tune in tomorrow to find out how. That’s when I plan to share my 10 Golden Rules for Investing in Penny Stocks.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Penny Stock Accidentally Blasts 1,900% Higher

Published 01/20/2014, 06:16 AM

Updated 05/14/2017, 06:45 AM

Penny Stock Accidentally Blasts 1,900% Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.