I can’t remember a time when I’ve been more out of love with charting and trading. As I stand here right now, what I want to do is go prepare a nice dinner for my family. I am wholly unaccustomed to actually not liking what I do for a living. I have lived my life striving to occupy myself only with gainful employment which I find exciting, interesting, and fulfilling. I pity those who work just to put food on the table but hate their jobs. But lately I’ve been getting a taste of that myself.

I don’t mean to burden you with my own psyche, but I’m not going to censor myself for my readers. For me, this market sucks. It’s as simple as that. There is always going to be a cadre of traders that smirks and says how ridiculous that is, and how they’re making money day in and day out. Well, good for you. It’s your market, then. And it’s been your market for quite some time. I don’t have much of a knack for the market we’re in right now, and it’s particularly soul-crushing when almost every day provides some kind of hope that things are going to turn around only to mysteriously launch to new lifetime highs.

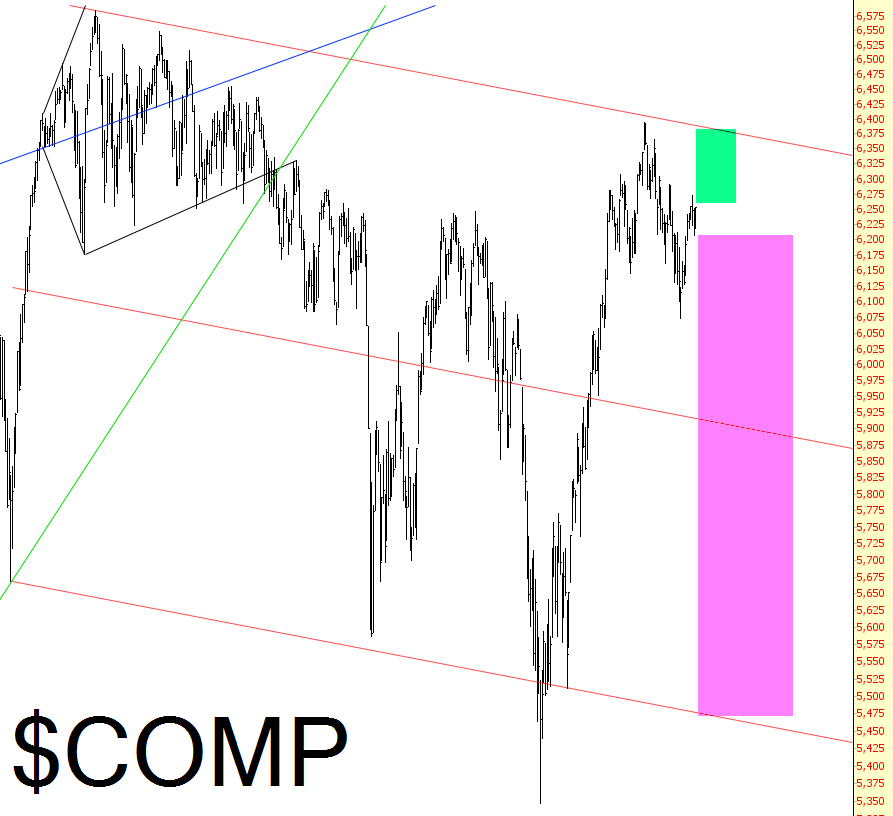

Take the last couple of trading days, for instance. I’ve marked in green the point when the opening bell rings. That’s the “event”: an opening bell. Not an announcement. Not a report. But the opening bell.

Of course, with the jobs report coming out tomorrow, my ever-increasingly-cynical self predicts the following:

(1) If the jobs report is WEAK, then the market will embrace the fact that interest rate hikes will be delayed, which will be BULLISH;

(2) If the jobs report is STRONG, then the market will embrace the fact that the economy is strong, which will be BULLISH.

So, heads, you win, tails, I lose. It would be the final coup de grace for the week.

“Why not just buy then, Tim?” I’ve answered this before. I have enough “long” exposure in my life, thank you very much, and the best looking charts (even to this day) are short setups, so I’ll leave the buying of Facebook Inc (NASDAQ:FB), Amazon.com Inc (NASDAQ:AMZN), and Alphabet Inc (NASDAQ:GOOGL) to you good people, per my video last night.

The Dow Jones Composite drop job is substantial (magenta) whereas the breakout-to-bullish-uptrend is shown in green. Perhaps the lows for the year are, in fact, already in. Clearly a push above the channel would extinguish the few remaining bears out there, including me.

In spite of a failed OPEC meeting, crude oil continues to maintain its strength. It doesn’t matter how many satellite photos ZeroHedge is going to show us about how there’s a oil tanker for every man, woman, and child on the planet sitting off a port city somewhere; oil has roared higher since February 11th, and nothing about this chart is breaking.

So that’s your depress-o-rama for tonight. I’ll see you here Friday when we can all witness every index push to lifetime highs and the bulls giggle all the way to the bank again. See ya.