For a company that specializes in bikes that don't move, Peloton is certainly speeding along. The home-exercise company is launching a roadshow for what could be one of the biggest IPOs of the year, according to Bloomberg, this week - and its data reflects strong growth for Peloton as it looks to achieve a valuation reportedly as high as $10 billion.

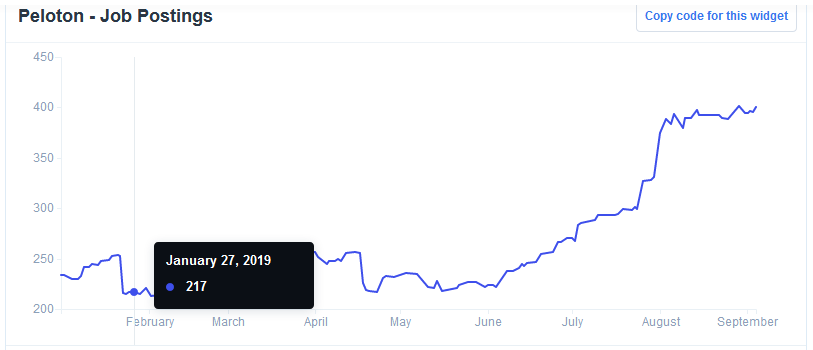

Peloton just keeps growing and growing as it continues to add more showrooms (and, customers) and job postings are up more than 70% so far in 2019.

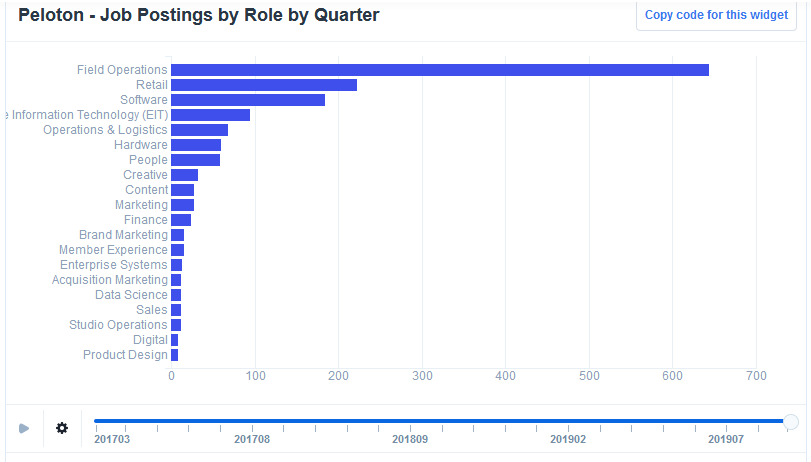

Peloton has been taking a greater focus on quality control - and providing customers with elite service, from their order to their delivery, to their riding experience. The move is in reaction to customer complaints about Peloton delivery and assembly experiences, and hiring data suggests Peloton is looking to bring in-house delivery and installation roles. Our data reflects a rapid spike in "Field Specialist" and "Brand Ambassador" roles that, in effect, put staffers before Peloton customers at a very critical time - as they are receiving their order.

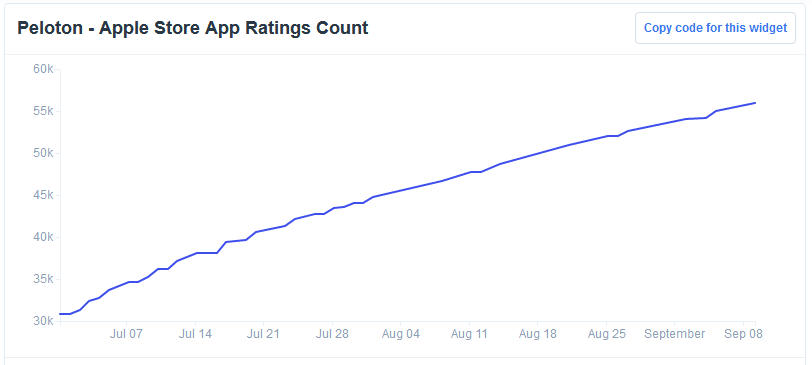

Still - in spite of the short-term snafu - people are engaged with Peloton and users seem to love the product. We can track engagement, from the chart above, which measures Apple App Store Rating Count over time - like, when your phone promotes an opportunity to rate an app from one-to-five stars, which some of us do. For Peloton, it has been steadily increasing in the second half of 2019, as it adds showrooms and customers - nearly doubling from 30,000 on June 30 to more than 56,000 at last count.

If there is anything, at all, that could derail the company's momentum, it is the fact that Peloton is up against other high-tech competitors in the fitness space that are also launching operations in new markets to support scale, as American fitness trends hit high gear in the app economy.

About the Data:

Thinknum tracks companies using information they post online - jobs, social and web traffic, product sales and app ratings - and creates data sets that measure factors like hiring, revenue and foot traffic. Data sets may not be fully comprehensive (they only account for what is available on the web), but they can be used to gauge performance factors like staffing and sales.