The Federal Reserve, as expected, raised its policy rate by 50-basis-points yesterday to a 0.75%-to-1.0% range, signaling to the market that the central bank is resolved to fight inflation. But there’s a long road ahead and the Fed remains well behind the curve as inflation continues to run hot.

The key question: Will the central bank catch a break as inflation begins to peak?

The question has been asked and answered in recent history: No. Consumer inflation at the headline level, for example, surged 8.5% for the year through March, a world above the Fed’s 0.75%-to-1.0% target rate range.

Fed chairman Jerome Powell said in yesterday’s press conference:

“Inflation is much too high, and we understand the hardship it is causing, and we’re moving expeditiously to bring it back down.”

Given the wide gap between current inflation and the current policy rate, even after yesterday’s half-point increase, the current profile still points to an extended run of relatively sharp and rapid hikes in the months ahead.

The key variables that could soften the expected path for rate hikes: incoming inflation data and economic growth. If and when there are convincing signs that US inflation is peaking would take some of the pressure off the Fed to hike more aggressively for longer. Ditto for signs that the economy is slowing to the point that recession risk is materially rising. For the moment, the evidence is thin for expecting that inflation will soon ease in a meaningful degree or that a US recession is imminent. In turn, a hawkish path for the Fed remains intact for the near term.

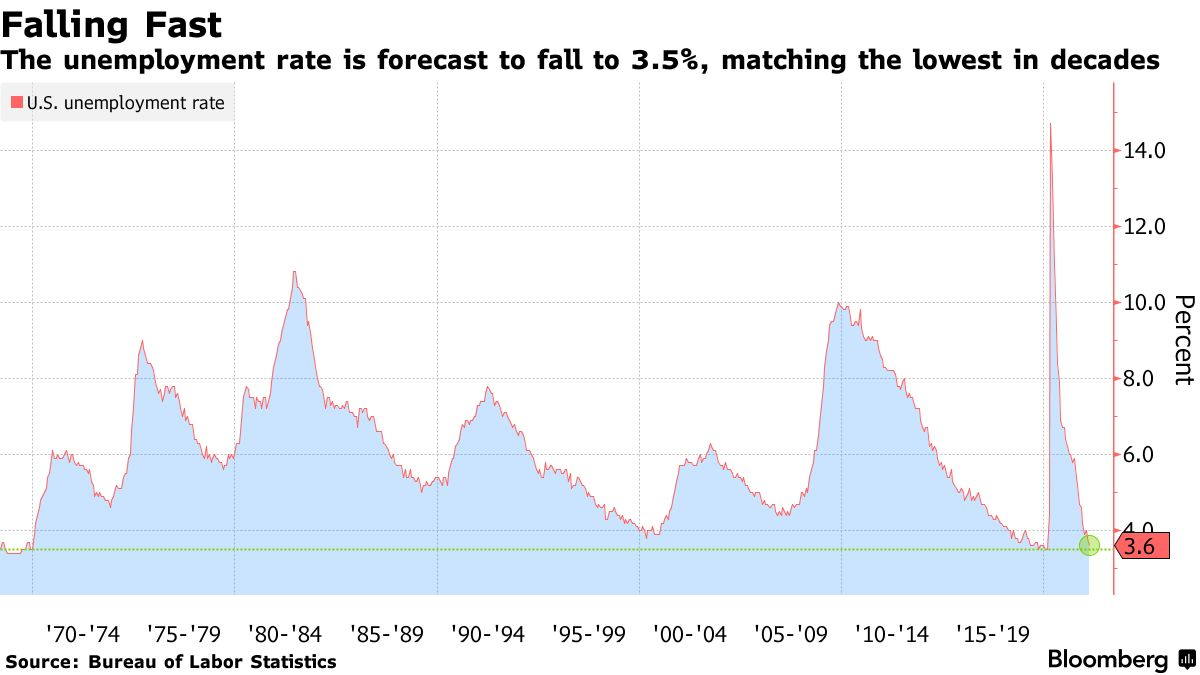

Consider the jobless rate, which continues to print at multi-decade lows. The US employment rate is expected to slip to 3.5% in April, according to some estimates for Friday’s payrolls report from the Labor Dept. The persistently strong demand for workers, combined with a labor shortage, is keeping unemployment unusually low. In turn, a low jobless rate is fueling wage growth, which is supporting higher inflation.

Gad Levanon, chief economist at the Burning Glass Institute, a labor market research shop, predicts:

“We’re going to be at historically very low unemployment rates very soon. I don’t see what will reverse it unless we hit a recession.”

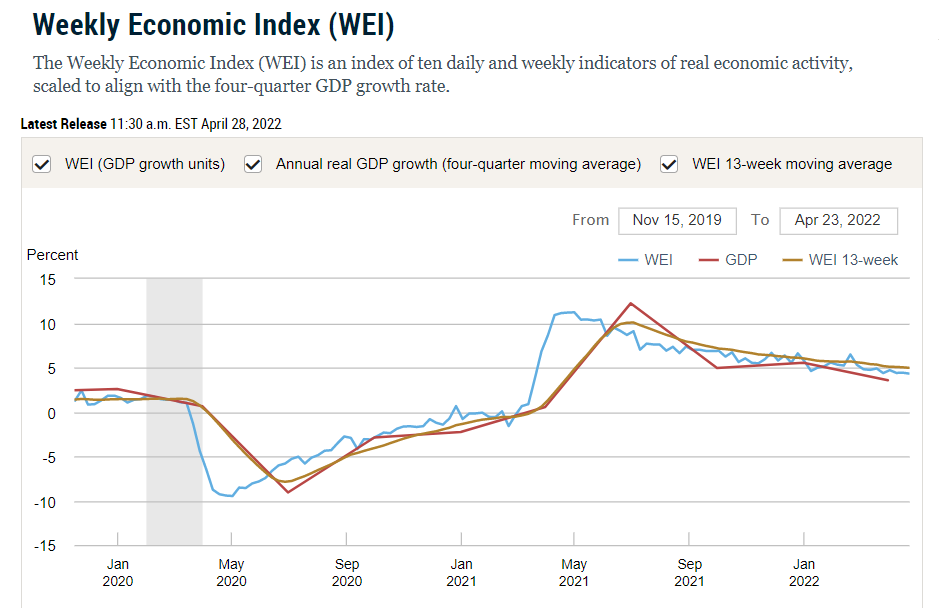

Although US economic growth is decelerating, the odds remain low that a recession is near, in part due to a strong labor market. The NY Fed’s Weekly Economic Index, a real-time, multi-factor measure of economic activity, still reflects solid, albeit slowing growth through Apr. 23.

Meanwhile, the surprisingly weak first-quarter GDP report isn’t expected to signal the start of a recession. Economists generally are penciling in a rebound in growth for Q2. The Atlanta Fed’s GDPNow model is also pointing to a return to growth for the April-through-June period, based on the May 4 estimate.

A survey-based proxy of US GDP for April also indicates moderate growth at the moment.

“Alongside the acceleration in manufacturing growth recorded by the S&P Global PMI in April, the sustained solid performance of the service sector points to GDP growth returning in the second quarter,”

Says Chris Williamson, chief business economist at S&P Global.

In other words, the odds aren’t high at present for a material softening in US inflation pressure or a significant rise in recession risk for the immediate future. As a result, the Fed will remain under pressure to aggressively raise interest rates for the foreseeable future.

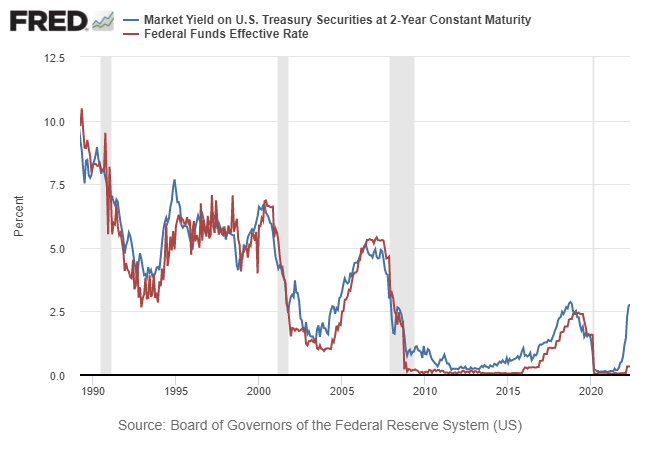

Market sentiment continues to predict no less. One of many examples: the policy-sensitive 2-year Treasury yield, which in previous decades has tracked the Fed funds rate, is currently 2.66% (May 4) — far above the current 0.75%-to-1.0% Fed funds target range. The current premium on the 2-year rate over the Fed funds rate is unusually wide and implies that the central bank needs to accelerate rate hikes.

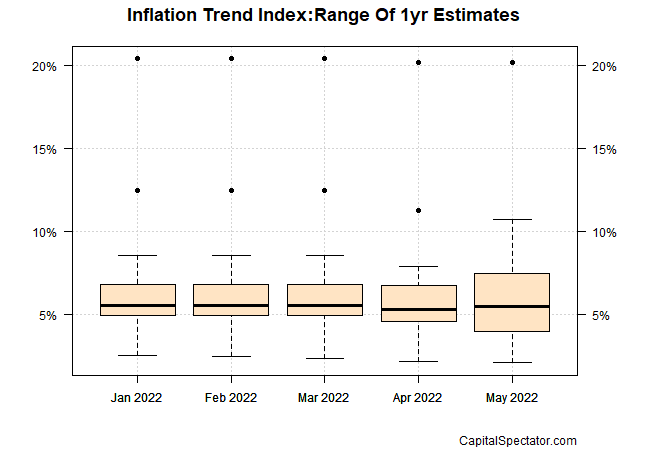

Meanwhile, the Capital Spectator’s Inflation Trend Index (ITI) continues to indicate that pricing pressure will hold more or less steady at elevated levels through May. Although a number of economists predict that inflation will soon start to show signs of peaking, a material downturn doesn’t look imminent.

Rick Rieder, chief investment officer of global fixed income at BlackRock, sees softer inflation numbers approaching. He predicts that:

“The high rates of inflation are anticipated to ‘moderate’ during the next several months.”

The timing, however, remains highly uncertain and numbers published to date don’t offer high confidence that this peaking has started or is about to obvious is the next round of inflation data.