Despite the price of gold erasing its 2014 gains, one gold expert is predicting an event that will permanently change the market for this commodity… peak gold.

The CEO of Goldcorp (NYSE:GG), Chuck Jeannes, recently told The Wall Street Journal that either this year or next gold production will reach a height that will never be seen again.

That’s quite a statement!

But is Jeannes just trying to prop up gold prices, or are there hard facts backing up his claim?

Let’s examine the situation.

Looking at the Data

Gold production has steadily been on the rise since the late 1970s. Last year, according to figures from the U.S. Geological Survey, gold production came in at 2,270 metric tons.

But it looks like that trend is about to change dramatically.

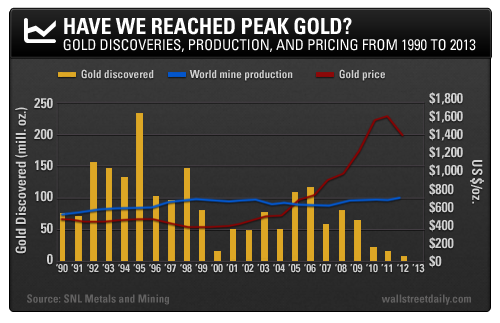

A recent study by SNL Metals and Mining Research said that over the past 24 years, gold production came in at 1.84 billion ounces.

However, only 1.66 billion ounces of the precious metal was found during that period, which included 217 major discoveries of more than two million ounces.

More ominously, the trend line of major discoveries is pointing downward – as you can see in this chart from the report.

The report goes on to say that during the 1990s, there were 1.1 billion ounces of gold found in 124 large deposits.

But since the turn of the century, only 605 million ounces were discovered in just 93 large deposits. And many of these discoveries involve lower-grade ores.

Another Factor at Play

The report highlights another worrisome trend… the time needed to bring a discovery into production.

This time frame used to average only eight years between 1985 and 1995.

But starting in 1996, the length of time necessary to bring a discovery into production lengthened. SNL states that, for the 57 new major mines put into production between 1996 and 2005, the time averaged 11 years.

And things have gotten even worse recently. For the 111 new mines put into production between 2006 and 2013, the time lengthens out to 18 years before mines yield a noticeable output.

Plus the trend is still going higher!

SNL forecasts that, for the 63 projects currently in the pipeline between now and 2019, the time to bring them to fruition will be 19.5 years.

The longer time frames are due not only to lower-quality discoveries, but also more governmental and environmental restrictions placed on mining projects.

These restraining factors can be seen in current gold discoveries – only a third have either started producing or booked as reserves.

The Outlook

Gold prices are still about 50% higher than before the Federal Reserve embarked on its quantitative easing stimulus program.

But the bottom line here is that the Goldcorp CEO does have some hard facts backing up his “peak gold” claim. And unlike with “peak oil,” there seems to be no gusher (U.S. shale) of new supply coming online anytime soon.

And “the chase” continues,